Should You Be Adding Princeton Bancorp (NASDAQ:BPRN) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Princeton Bancorp (NASDAQ:BPRN), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Princeton Bancorp

How Quickly Is Princeton Bancorp Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Princeton Bancorp has managed to grow EPS by 30% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

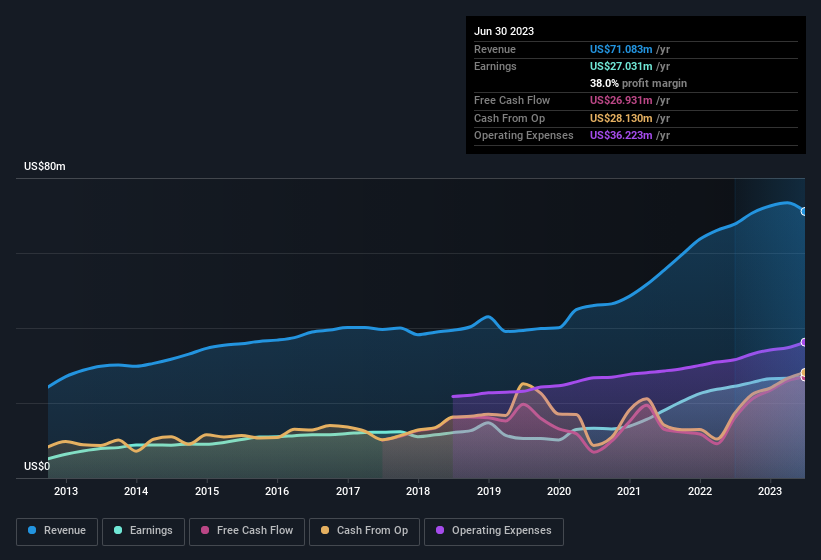

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that Princeton Bancorp's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While we note Princeton Bancorp achieved similar EBIT margins to last year, revenue grew by a solid 5.0% to US$71m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Princeton Bancorp's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Princeton Bancorp Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Even though some insiders sold down their holdings, their actions speak louder than words with US$445k more invested than sold by people who know they company best. You could argue that level of buying implies genuine confidence in the business. It is also worth noting that it was Independent Director Martin Tuchman who made the biggest single purchase, worth US$380k, paying US$31.65 per share.

Along with the insider buying, another encouraging sign for Princeton Bancorp is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at US$44m. That's a lot of money, and no small incentive to work hard. As a percentage, this totals to 25% of the shares on issue for the business, an appreciable amount considering the market cap.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Ed Dietzler, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to Princeton Bancorp, with market caps between US$100m and US$400m, is around US$1.6m.

Princeton Bancorp offered total compensation worth US$1.3m to its CEO in the year to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Princeton Bancorp Worth Keeping An Eye On?

For growth investors, Princeton Bancorp's raw rate of earnings growth is a beacon in the night. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. Even so, be aware that Princeton Bancorp is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Princeton Bancorp, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.