Should You Be Adding Tricon Residential (TSE:TCN) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Tricon Residential (TSE:TCN), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Tricon Residential

Tricon Residential's Improving Profits

In the last three years Tricon Residential's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Tricon Residential's EPS shot up from US$2.07 to US$2.84; a result that's bound to keep shareholders happy. That's a impressive gain of 37%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of Tricon Residential's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that Tricon Residential is growing revenues, and EBIT margins improved by 12.2 percentage points to 50%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

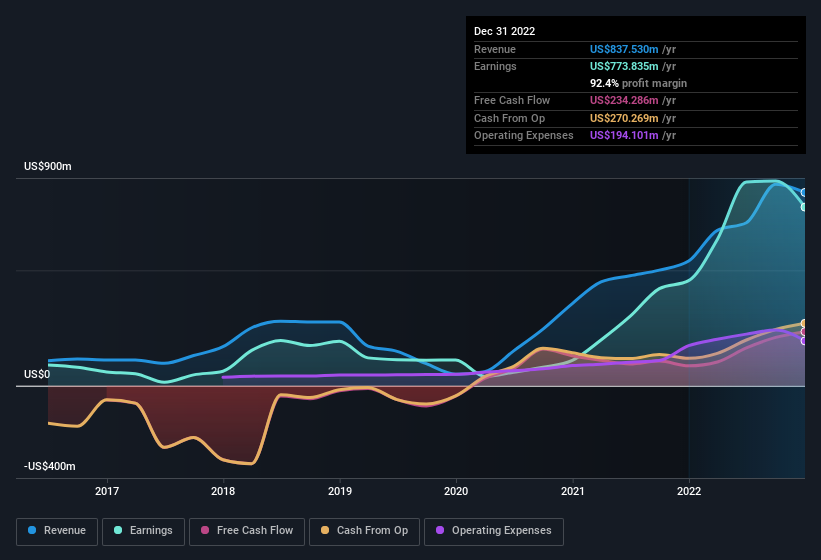

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Tricon Residential's future profits.

Are Tricon Residential Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's pleasing to note that insiders spent US$1.6m buying Tricon Residential shares, over the last year, without reporting any share sales whatsoever. Knowing this, Tricon Residential will have have all eyes on them in anticipation for the what could happen in the near future. We also note that it was the Co-Founder & Non Independent Director, Geoffrey Matus, who made the biggest single acquisition, paying CA$575k for shares at about CA$11.50 each.

Along with the insider buying, another encouraging sign for Tricon Residential is that insiders, as a group, have a considerable shareholding. With a whopping US$82m worth of shares as a group, insiders have plenty riding on the company's success. This would indicate that the goals of shareholders and management are one and the same.

Should You Add Tricon Residential To Your Watchlist?

You can't deny that Tricon Residential has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. Don't forget that there may still be risks. For instance, we've identified 4 warning signs for Tricon Residential (2 are a bit unpleasant) you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Tricon Residential isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here