Addus HomeCare Reports Record Annual Revenues Surpassing $1 Billion in 2023

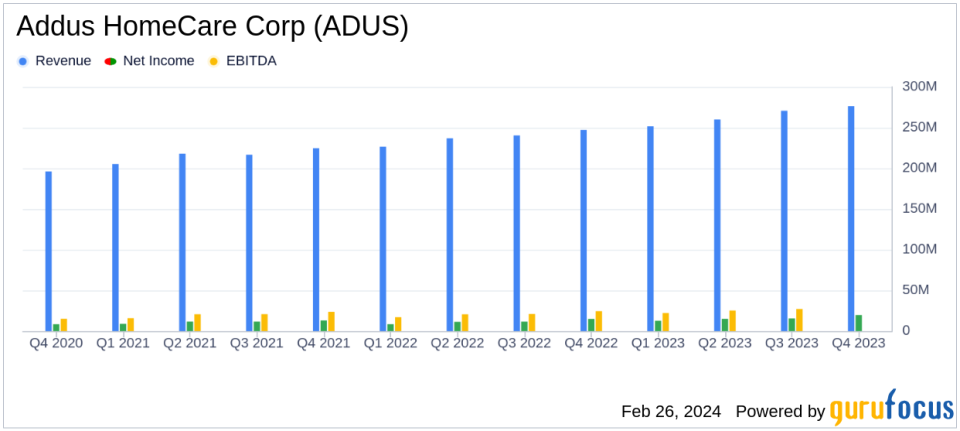

Net Service Revenues: $276.4 million for Q4 2023, an 11.9% increase year-over-year; $1.06 billion for the full year, up 11.3%.

Net Income: $19.6 million for Q4 2023, up from $14.8 million in Q4 2022; $62.5 million for the full year, compared to $46.0 million in 2022.

Adjusted EBITDA: Increased 21.3% to $34.3 million for Q4 2023; $121.0 million for 2023, a 19.3% increase.

Diluted EPS: $1.20 for Q4 2023, compared to $0.91 for the same period last year; $3.83 for the full year, up from $2.84 in 2022.

Cash and Liquidity: $64.8 million in cash and $335.6 million in available credit as of December 31, 2023.

On February 26, 2024, Addus HomeCare Corp (NASDAQ:ADUS) announced its financial results for the fourth quarter and year ended December 31, 2023, revealing significant growth in revenue and net income. The company's 8-K filing details an 11.9% increase in net service revenues for the fourth quarter, reaching $276.4 million, and an 11.3% increase for the full year, surpassing $1.0 billion for the first time. Net income for the fourth quarter stood at $19.6 million, up from $14.8 million in the same period of the previous year, while full-year net income rose to $62.5 million from $46.0 million in 2022.

Addus HomeCare Corp, a provider of in-home personal care services, operates through segments including Personal Care, Hospice, and Home Health. The Personal Care segment, which is the primary revenue driver, experienced an 11.2% organic growth rate on a same-store basis for the quarter and a record annual growth rate of 12.1%. The Hospice segment contributed 19.8% of the fourth-quarter revenue, benefiting from a 3.1% rate increase effective October 1, 2023.

Chairman and CEO Dirk Allison commented on the company's performance, highlighting the strong demand for home-based care and the successful integration of Tennessee Quality Care, which expanded Addus's service capabilities. Allison also noted the company's focus on enhancing personal care services and exploring growth in value-based contracting models.

Our fourth quarter financial and operating performance marked a strong finish to another record year for Addus. Revenue was up 11.9% and adjusted EBITDA was 21.3% higher for the fourth quarter of 2023 compared with the same period last year. Propelled by the strong momentum in our business throughout 2023, we surpassed $1.0 billion in annual revenues for the first time, said Dirk Allison.

The company's financial stability is further underscored by its cash position of $64.8 million and a manageable debt level, with bank debt standing at $126.4 million. Addus also reported a net cash provided by operating activities of $30.0 million for the fourth quarter and $112.2 million for the full year.

Looking ahead, Allison expressed optimism for 2024, citing the company's financial flexibility to invest in growth initiatives, including acquisitions and development opportunities. He emphasized the importance of Addus's value proposition, which offers high-quality and cost-effective care in the home setting, and the company's commitment to enhancing caregiver support and service delivery.

For value investors and potential GuruFocus.com members, Addus HomeCare Corp's strong financial performance, coupled with its strategic growth initiatives and robust demand for its services, presents a compelling investment narrative within the Healthcare Providers & Services industry.

For more detailed financial information and the full earnings report, please refer to the official 8-K filing.

Explore the complete 8-K earnings release (here) from Addus HomeCare Corp for further details.

This article first appeared on GuruFocus.