Adhesives & Sealants Market by Adhesive Formulating Technology, Sealant Resin Type, Application and Region - Global Forecast to 2026

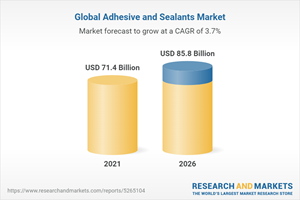

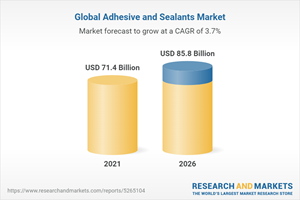

Global Adhesive and Sealants Market

Dublin, April 22, 2022 (GLOBE NEWSWIRE) -- The "Global Adhesives & Sealants Market by Adhesive Formulating Technology (Water-based, Solvent-based, Hot-melt, Reactive), Sealant Resin Type (Silicone, Polyurethane, Plastisol, Emulsion, Polysulfide, Butyl), Application, Region - Forecast to 2026" report has been added to ResearchAndMarkets.com's offering.

The adhesives & sealants market is projected to grow from USD 71.4 billion in 2021 to USD 85.8 billion by 2026, at a CAGR of 3.7% between 2021 and 2026.

The major drivers for the market are increased demand for adhesives in the medical industry, increasing demand for adhesives & sealants from the building & construction industry, and growth in the appliances industry.

The reactive & other formulating technologies segment is projected to register the fastest growth during the forecast period because they exhibit high bond strength and long-term durability under severe environmental conditions. They have a better performance advantage than hot-melt or solvent-borne technologies.

Paper & packaging segment is projected to be the largest application of adhesives

Paper & Packaging is the largest application segment, in terms of both volume and value, in 2020. This is because of the increased use of adhesives in a wide variety of paper bonding applications ranging from corrugated box construction and the lamination of printed sheets to packaging material used for all types of consumer products and the production of large industrial tubes and cores used by manufacturers of roll goods and other materials. The increased demand for flexible packaging will play an important role in driving the adhesives market.

Automotive & transportation is the fastest-growing application of the sealants market

Automotive & transportation application is the fastest-growing segment, in terms of volume, between 2021 and 2026. Growing transportation industry is driving the sealants market. Sealants are replacing mechanical gaskets owing to their resistance to corrosion and chemicals. The popular sealants used for automobiles include polyvinyl, polyurethanes, silicones, and other elastomeric rubbers. The increasing use of plastics, composites, and fibers in automobile manufacturing has aided the growth of the sealants market, as plastics cannot be welded.

Asia Pacific is the fastest market for adhesives & sealants during the forecast period

Asia Pacific is projected to be the largest and the fastest-growing market for adhesives & sealants during the forecast period. Asia Pacific is an emerging market in terms of demand for adhesives & sealants. China and India have been the driving forces behind the rapid development of the market in Asia Pacific, as well as globally. The growth in these countries is attributed to high economic growth and heavy investments in the packaging and automotive & transportation sectors.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.1.1 Market Dynamics

5.1.2 Drivers

5.1.2.1 Increased Demand for Adhesives in Medical Industry

5.1.2.2 High Demand for Adhesives & Sealants from Building & Construction Industry

5.1.2.3 Growth in Appliance Industry

5.1.3 Restraints

5.1.3.1 Environmental Regulations in North America and Europe

5.1.4 Opportunities

5.1.4.1 Increased Industrial Activity due to Globalization

5.1.4.2 Greater Opportunities in Asia-Pacific and the Middle East

5.1.4.3 Rising Requirement for Non-Hazardous and Sustainable Adhesives

5.1.4.4 Development of Hybrid Resins to Manufacture High-Performance Adhesives & Sealants

5.1.5 Challenges

5.1.5.1 Shifting Rules and Changing Standards

5.2 Porter's Five Forces Analysis

5.2.1 Threat of New Entrants

5.2.2 Threat of Substitutes

5.2.3 Bargaining Power of Buyers

5.2.4 Bargaining Power of Suppliers

5.2.5 Intensity of Competitive Rivalry

5.3 Macroeconomic Indicators

5.4 COVID-19 Impact

5.5 Impact of COVID-19 on End-Use Industries

5.6 Value Chain Analysis

5.7 Pricing Analysis

5.8 Adhesives & Sealants Ecosystem

5.9 Impact of Trends and Technology Disruption on Manufacturers of Adhesives & Sealants: Yc and Ycc Shift

5.10 Export-Import Trade Statistics

5.11 Regulations

5.12 Patent Analysis

5.13 Case Study Analysis

5.14 Technology Analysis

6 Adhesives Market, by Formulating Technology

6.1 Introduction

6.2 Water-Based

6.2.1 Expected to Lead Adhesives Market

6.2.2 Pva Emulsion Adhesives

6.2.3 Pae Emulsion Adhesives

6.2.4 Vae Emulsion Adhesives

6.2.5 Others

6.2.5.1 Polyurethane Dispersion Adhesives

6.2.5.2 Water-Based Rubber Adhesives

6.3 Solvent-Based

6.3.1 Stringent Government Regulations to Hamper Use of Solvent-Based Adhesives

6.3.2 Styrene-Butadiene Styrene Rubber (Sbsr) Adhesives

6.3.3 Chloroprene Rubber (Cr) Adhesives

6.3.4 Polyvinyl Acetate (Pva) Adhesives

6.3.5 Polyamide Adhesives

6.3.6 Others

6.4 Hot-Melt

6.4.1 Growing Use due to Fast Setting Speed and Relatively Lower Cost

6.4.2 Eva Adhesives

6.4.3 Styrenic Block Copolymer (Sbc)

6.4.4 Copolyamides (Copas)

6.4.4.1 Properties

6.4.4.2 Applications

6.4.5 Amorphous Poly Alpha Olefins (Apaos)

6.4.5.1 Properties

6.4.5.2 Applications

6.4.6 Others

6.4.6.1 Copolyester (Copes) Adhesives

6.4.6.1.1 Main Features & Characteristics

6.4.6.1.2 Applications

6.4.7 Polyurethanes

6.4.7.1 Properties

6.4.7.2 Applications

6.4.7.3 Metallocene Polyethylene & Metallocene Polypropylene

6.4.7.3.1 Main Features & Characteristics

6.4.7.3.2 Applications

6.5 Reactive & Others

7 Adhesives Market, by Application

7.1 Introduction

7.2 Paper & Packaging

7.2.1 High Demand for Flexible Packaging Impacts Market

7.3 Building & Construction

7.3.1 Development of Smart Cities and Mega Projects to Boost Market Growth

7.4 Woodworking

7.4.1 Furniture Industry to See Increased Demand for Adhesives

7.5 Automotive & Transportation

7.5.1 Advancements in Electric Vehicles to Increase Demand for Adhesives in Automotive Industry

7.6 Consumer & Diy

7.6.1 Growing Awareness About Advantages of Adhesives to Propel Demand

7.7 Leather & Footwear

7.7.1 High Footwear Production in Asia to Boost Demand for Adhesives

7.8 Assembly

7.8.1 Wide Use of Adhesives in Manufacturing Sector to Boost Market

7.9 Electronics

7.9.1 New Trends and Technological Innovations to Fuel Market

7.10 Medical

7.10.1 Growing Use of Silicone Adhesives to Drive Market

7.11 Others

8 Sealants Market, by Resin Type

8.1 Introduction

8.2 Silicone

8.2.1 Offers Better Flexibility and Longer Lifespan

8.3 Polyurethane

8.3.1 High Demand in Automotive Application to Drive Market

8.4 Plastisol

8.4.1 Sound Deadening and Vibration Reduction Properties to Fuel Demand

8.5 Emulsion

8.5.1 Growing Use by Construction Sector to Propel Market

8.6 Polysulfide

8.6.1 Competitive Sealants Hamper Market Growth

8.7 Butyl

8.7.1 Widespread Use due to Higher Stability Against Oxidation

8.8 Others

9 Sealants Market, by Application

9.1 Introduction

9.2 Building & Construction

9.2.1 Investments in New Construction and Infrastructure to Positively Impact Market

9.3 Automotive & Transportation

9.3.1 Growing Transportation Industry to Drive Market

9.4 Consumer

9.4.1 Rising Demand for Sealants for Household Use

9.5 Others

10 Adhesives & Sealants Market, by Region

11 Competitive Landscape

11.1 Overview

11.1.1 Overview of Strategies Adopted by Key Adhesives & Sealants Players

11.2 Company Evaluation Quadrant Matrix: Definitions and Methodology, 2020

11.2.1 Star

11.2.2 Emerging Leaders

11.2.3 Pervasive

11.2.4 Emerging Companies

11.3 Strength of Product Portfolio

11.4 Sme Matrix, 2020

11.4.1 Responsive Companies

11.4.2 Progressive Companies

11.4.3 Starting Blocks

11.4.4 Dynamic Companies

11.5 Competitive Scenario

11.5.1 Market Evaluation Matrix

11.6 Market Share Analysis

11.7 Revenue Analysis

11.7.1 3M

11.7.2 Henkel Ag

11.7.3 H.B. Fuller

11.7.4 Sika Ag

11.7.5 Arkema (Bostik)

11.8 Market Ranking Analysis

11.8.1 Competitive Situation and Trends

12 Company Profiles

12.1 Major Players

12.1.1 Henkel Ag

12.1.2 H.B. Fuller

12.1.3 Sika Ag

12.1.4 Arkema (Bostik)

12.1.5 3M

12.1.6 Huntsman Corporation

12.1.7 Illinois Tool Works Inc.

12.1.8 Avery Dennison Corporation

12.1.9 Dow Inc.

12.1.10 Wacker Chemie Ag

12.2 Other Companies

12.2.1 Rpm International Inc.

12.2.2 Akzonobel N.V.

12.2.3 Ppg Industries

12.2.4 Parker Hannifin Corp (Parker Lord)

12.2.5 Adhesives Research Inc.

12.2.6 Delo Industrie Klebstoffe GmbH & Co. KGaA

12.2.7 Dymax Corporation

12.2.8 Mapei Corporation

12.2.9 Meridian Adhesives Group

12.2.10 Master Bond Inc.

12.2.11 Soudal Group

12.2.12 Pidilite Industries

12.2.13 Jowat Se

12.2.14 Franklin International

12.3 Other Companies

13 Adjacent & Related Markets

14 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/wlwyln

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900