ADMA Biologics Inc Reports Robust Revenue Growth and Positive Adjusted Net Income for FY 2023

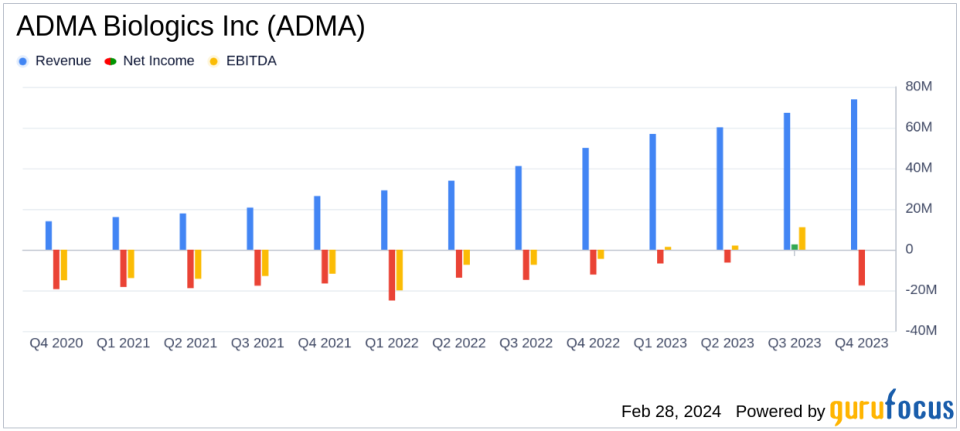

Revenue Growth: ADMA Biologics Inc (NASDAQ:ADMA) reported a 68% increase in total revenues for FY 2023, reaching $258.2 million.

Adjusted EBITDA: The company achieved $40.3 million in adjusted EBITDA for FY 2023, a significant improvement from a loss of $27.6 million in FY 2022.

Adjusted Net Income: ADMA recorded an adjusted net income of $0.7 million for FY 2023, marking a positive shift from an adjusted net loss of $59.2 million in the previous year.

Future Revenue Guidance: Revenue guidance for FY 2024 and FY 2025 has been increased to over $330 million and $380 million, respectively.

Net Income and EBITDA Projections: Net income guidance for FY 2024 is set to exceed $65 million, with adjusted EBITDA guidance rising to over $90 million.

On February 28, 2024, ADMA Biologics Inc (NASDAQ:ADMA) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, known for its specialty plasma-derived biologics, showcased a remarkable year-over-year revenue increase and a positive shift towards profitability.

Company Overview

ADMA Biologics Inc is a biopharmaceutical company focused on the manufacturing, marketing, and development of specialty plasma-derived biologics for the treatment of immunodeficient patients at risk for infection and others at risk for certain infectious diseases. The company's products are designed for immune-compromised individuals who suffer from an underlying immune deficiency disorder or who may be immune-suppressed for medical reasons.

Financial Highlights and Challenges

The company's financial achievements in FY 2023 were underscored by a 68% increase in total revenues, which amounted to $258.2 million, compared to $154.1 million in FY 2022. This growth is primarily attributed to increased sales of ADMA's immunoglobulin products. Adjusted EBITDA also saw a significant turnaround, with the company reporting $40.3 million for FY 2023, compared to an adjusted EBITDA loss of $27.6 million for the previous year.

Despite these achievements, ADMA reported a net loss of $28.2 million for FY 2023, which, while still a loss, is a considerable improvement from the net loss of $65.9 million in FY 2022. The company's adjusted net income for FY 2023 was $0.7 million, taking into account non-recurring costs related to IT systems disruption and loss on extinguishment of debt. These challenges highlight the importance of managing operational costs and the impact of non-operational expenses on the company's bottom line.

Future Outlook and Commentary

Adam Grossman, President and CEO of ADMA, commented on the company's performance, stating:

"We are pleased with our 2023 performance, which marked first-time positive adjusted net income on a full year basis. This is a testament to the exponential revenue growth of our commercial specialty biologics product portfolio and effective fiscal and operational management."

Looking ahead, ADMA has increased its revenue guidance for FY 2024 and FY 2025, with expectations to surpass $330 million and $380 million, respectively. The company also anticipates significant net income and adjusted EBITDA growth in the coming years, with a focus on manufacturing innovations and the advancement of its preclinical S. pneumonia pipeline program.

Key Financial Metrics

Important metrics from ADMA's financial statements include:

Working Capital: As of December 31, 2023, ADMA had working capital of approximately $207.2 million.

Inventory: The company reported $172.9 million in inventory, which is a critical component for its product supply chain.

Cash Position: ADMA had $51.4 million in cash and cash equivalents, providing liquidity for ongoing operations.

These metrics are crucial for understanding the company's operational efficiency, liquidity, and ability to sustain its growth trajectory.

Analysis of Performance

ADMA's performance in FY 2023 indicates a company on the rise, with significant revenue growth and a positive adjusted net income. The management's focus on expanding the utilization of its products and improving operational efficiency has begun to yield tangible financial results. The company's strategic initiatives, including its innovative growth opportunities and pipeline development, are expected to further enhance its market position and financial performance in the biotechnology industry.

For a detailed reconciliation of GAAP to non-GAAP financial measures, please refer to the financial tables included in the 8-K filing.

Investors and stakeholders are encouraged to join the conference call scheduled for today at 4:30 p.m. ET for further discussion on the company's financial results and outlook.

Explore the complete 8-K earnings release (here) from ADMA Biologics Inc for further details.

This article first appeared on GuruFocus.