ADP Reports Solid Growth in Q2 Fiscal 2024, Earnings and Revenue Climb

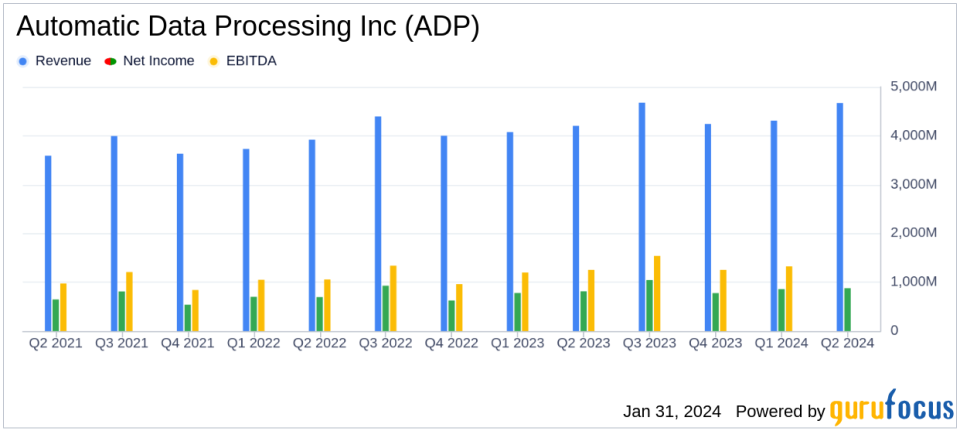

Revenue Growth: ADP's revenues rose by 6% year-over-year to $4.7 billion, with organic constant currency growth also at 6%.

Net Earnings and EPS: Net earnings increased by 8% to $878 million, with diluted earnings per share (EPS) up by 9% to $2.13.

Adjusted EBIT and Margin: Adjusted EBIT grew by 7% to $1.1 billion, and adjusted EBIT margin expanded by 20 basis points to 24.6%.

Employer Services: Employer Services segment revenue increased by 8%, and U.S. pays per control grew by 2%.

PEO Services: PEO Services segment saw a revenue increase of 3%, with average worksite employees paid by PEO Services rising by 2% to approximately 725,000.

Client Funds Interest: Interest on funds held for clients increased by 20% to $225 million, despite a 2% decrease in average client funds balances.

On January 31, 2024, Automatic Data Processing Inc (NASDAQ:ADP), a leading provider of payroll and human capital management solutions, released its 8-K filing, detailing the financial results for the second quarter of fiscal year 2024. ADP, established in 1949, serves over 1 million clients, offering a range of services from payroll to human capital management solutions, insurance, and retirement services to businesses of all sizes.

Financial Performance Highlights

ADP's performance in the second quarter reflects a robust growth trajectory, with revenues increasing to $4.7 billion, a 6% rise compared to the same period last year. This growth is attributed to a solid performance in the Employer Services segment, which saw an 8% increase in revenue. The PEO Services segment also contributed positively, with a 3% revenue increase and a 2% rise in the average number of worksite employees paid.

Net earnings for the quarter stood at $878 million, marking an 8% increase from the previous year. The adjusted net earnings, which exclude certain non-GAAP adjustments, mirrored this growth at $881 million. Diluted EPS and adjusted diluted EPS both increased by 9% to $2.13, reflecting the company's profitability and efficiency in generating earnings.

Operational and Segment Performance

The Employer Services segment's margin saw a significant increase of 170 basis points, while the PEO Services segment experienced a slight margin decrease of 50 basis points. Interest on funds held for clients, a key metric for ADP's investment strategy, increased by 20% to $225 million, despite a slight decrease in average client funds balances. The average interest yield on client funds saw a substantial increase of 50 basis points to 2.8%.

ADP's President and CEO, Maria Black, commented on the results, stating,

Our momentum to start the year continued into our second quarter with strong revenue and earnings growth. We are focused on providing exceptional HCM products and outstanding service, and these efforts continued to drive client satisfaction to new heights."

Chief Financial Officer Don McGuire added,

Following another quarter of record bookings and strong retention, we are well-positioned for steady growth over the remainder of the year. And, as always, we remain committed to improving profitability while continuing to invest consistently to position ourselves to deliver long-term sustainable growth for our shareholders."

Looking Ahead

ADP updated its fiscal 2024 outlook, projecting a revenue growth of 6% to 7%, with adjusted EBIT margin expansion of 60 to 70 basis points. The adjusted effective tax rate is expected to be around 23%, with diluted EPS growth forecasted at 10% to 12%. The Employer Services segment is anticipated to grow by 7% to 8%, with a margin increase of 150 to 160 basis points. PEO Services revenue is expected to grow by 3% to 4%, although the segment margin may decrease by 80 to 100 basis points.

The company's financial stability is further evidenced by its consolidated balance sheet, which shows a healthy cash and cash equivalents balance of $1.6 billion as of December 31, 2023. The cash flow statement indicates strong cash flows from operating activities at $1.4 billion for the six months ended December 31, 2023.

Automatic Data Processing Inc's Q2 fiscal 2024 results demonstrate the company's ability to maintain growth and profitability in a competitive business services industry. With a focus on innovation and client satisfaction, ADP is well-positioned to continue its trajectory of steady growth and shareholder value creation.

For more detailed information, investors and interested parties can access the full earnings report and listen to the webcast of the financial analysts' conference call on ADP's investor relations website.

Explore the complete 8-K earnings release (here) from Automatic Data Processing Inc for further details.

This article first appeared on GuruFocus.