ADP Stock Gains 16% in Six Months: What You Should Know

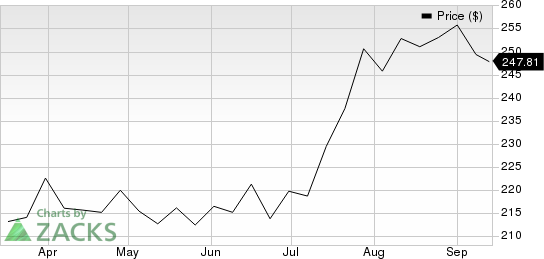

Automatic Data Processing, Inc. ADP shares have had an impressive run over the past six months.

The stock has rallied 16% compared with the 14.6% rise of the industry it belongs to and the 14.8% increase of the Zacks S&P 500 composite.

Automatic Data Processing, Inc. Price

Automatic Data Processing, Inc. price | Automatic Data Processing, Inc. Quote

What’s Behind the Rally

ADP has an impressive earnings surprise history. Earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering an average beat of 3.1%. The consensus mark for fiscal 2024 earnings has moved 1.9% north in the past 60 days.

The company benefits from a strong business model, high recurring revenues, good margins, robust client retention and low capital expenditure. It has a strong cash-generating ability that allows it to pursue growth in areas that exhibit true potential.

ADP has been able to accelerate DataCloud penetration and increase investment in inside sales, mid-market migrations and service alignment initiatives through its ongoing transformation initiatives. Through these initiatives, the company continues to innovate, improve operations, expand margins and enhance innovation abilities.

ADP maintains its strong position as a human capital management (HCM) technology and services provider. The company is focused on delivering a complete suite of cloud-based HCM and HR Outsourcing solutions. It is expanding its international HCM and HRO businesses with established local, in-country software solutions and cloud-based multi-country solutions.

Zacks Rank and Other Stocks to Consider

ADP currently carries a Zacks Rank #2 (Buy).

Here are some other top-ranked stocks from the broader Business Service sector.

Verisk Analytics VRSK beat the Zacks Consensus Estimate in three of the four previous quarters and matched on one instance, with an average of 9.9%. The consensus mark for 2023 revenues is pegged at $2.66 billion, which indicates a decrease of 8.2% from the year-ago figure. Earnings are pegged at $5.71 for 2023, which is 14% above the year-ago figure. VRSK currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Broadridge BR currently carries a Zacks Rank #2. It beat the Zacks Consensus Estimate in two of the trailing four quarters, missed once and matched on one instance, the average being 0.5%. The Zacks Consensus Estimate for fiscal 2024 revenues and earnings indicates a rise of 7.2% and 8.8%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report