ADP Stock Rises 9% in Three Months: What You Should Know

Automatic Data Processing, Inc. ADP shares have had an impressive run over the past three months. The stock has rallied 9.3% compared with the 6.7% rise of the industry it belongs to and the 3.2% decline of the Zacks S&P 500 composite.

Factors in Favor

ADP has an impressive earnings surprise history. Earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering an average beat of 3.1%.

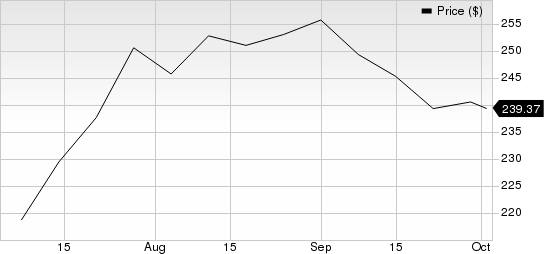

Automatic Data Processing, Inc. Price

Automatic Data Processing, Inc. price | Automatic Data Processing, Inc. Quote

ADP has been able to accelerate DataCloud penetration and increase investment in inside sales, mid-market migrations and service alignment initiatives through its ongoing transformation initiatives. Through these initiatives, the company continues to innovate, improve operations, expand margins and enhance innovation abilities.

ADP maintains its strong position as a human capital management (HCM) technology and services provider. The company is focused on delivering a complete suite of cloud-based HCM and HR Outsourcing solutions. It is expanding its international HCM and HRO businesses with established local, in-country software solutions and cloud-based multi-country solutions.

ADP continues to pursue acquisitions that strategically fit its overall business mix and are easy to integrate over the long term. The recent acquisition of Sora enhanced the company’s ability to streamline HR processes through automation, combining Sora's user-friendly platform with its own HCM solutions for improved efficiency and employee experiences.

Zacks Rank and Other Stocks to Consider

ADP currently carries a Zacks Rank #2 (Buy).

The following top-ranked stocks from the Business Services sector are also worth consideration:

Verisk Analytics VRSK beat the Zacks Consensus Estimate in three of the four previous quarters and matched on one instance, with an average surprise of 9.9%. The consensus mark for 2023 revenues is pegged at $2.66 billion, which reflects a decrease of 8.2% from the year-ago figure. Earnings are pegged at $5.71 per share for 2023, which is 14% above the year-ago figure. VRSK currently has a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Broadridge BR currently carries a Zacks Rank of 2. It beat the Zacks Consensus Estimate in two of the trailing four quarters, missed once and matched on one instance, the average surprise being 0.5%. The consensus estimate for fiscal 2024 revenues and earnings indicates a rise of 7.2% and 8.8% year over year, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report