ADTRAN (ADTN) Boosts User Base With Solid Mosaic One Traction

ADTRAN, Inc. ADTN has revealed that it added 300 Mosaic One customers in the past 18 months to strengthen its position as a leading provider of end-to-end fiber broadband solutions and cloud-based software-as-a-service (SaaS) networks. The healthy addition to the subscriber base within a short period speaks volume of the cloud-based network optimization platform that manages broadband access and connected home solutions to proactively solve service issues and boost subscriber experience.

Leveraging three intelligent applications, namely Mosaic One Promote, Mosaic One Care and Mosaic One Operate, the avant-garde platform offers service optimization with the widest gigabit broadband coverage. It monetizes networks by facilitating service providers to unlock new revenue streams and enhance competitiveness to deliver an improved broadband experience.

Mosaic One enables alternative network providers, utilities and regional service providers to capitalize on subscriber intelligence and cloud-delivered SaaS capabilities. This, in turn, connects network events and insights to give a clearer understanding of subscribers’ usage behavior and devices.

Collating and analyzing data from the broadband network gateway and the in-home network, Mosaic One simplifies network operations and helps troubleshoot issues. Integrating a rich set of data visualization and optimization tools, it utilizes an open, multi-vendor architecture to streamline complex processes. This vendor and technology-agnostic solution provides advanced tools to assess bandwidth capacity and identify the drawbacks within the network through automation for higher revenue generation.

The three Mosaic One applications have been specifically designed to focus on customer success, marketing and operations teams. Mosaic One Promote targets subscribers on the basis of their device usage behavior, spurs average revenue per unit and detects churn suspects with high flight risk scores. It minimizes revenue leakage by quickly identifying customers that are mis-provisioned and communicates accurate data to billing for revenue recovery.

Further, the platform automates campaigns across multiple channels, including SMS and email, to accelerate marketing efforts for intelligent subscriber insights. Mosaic One Care reduces expensive truck rolls and promptly resolves customer issues with end-to-end visibility from the access network into the home. Mosaic One Operate effectively monitors and corrects access network alarms to prevent subscriber service issues. This helps in enhancing network uptime supported by plug and play provisioning.

ADTRAN continues to benefit from solid demand trends of its network solutions, driven by the accelerated expansion of fiber-to-the-home networks, upgrades to in-home Wi-Fi connectivity and the adoption of cloud-based automation tools. The company’s end-to-end solutions simplify the deployment of fiber-based broadband services and provide a better customer experience.

It is focused on being a top global supplier of access infrastructure and related value-added solutions from the Cloud Edge to the Subscriber Edge through a broad portfolio of flexible hardware and software network solutions. These products enable a seamless transition to the fully converged, scalable, highly automated, cloud-controlled voice, data, Internet and video networks of the future.

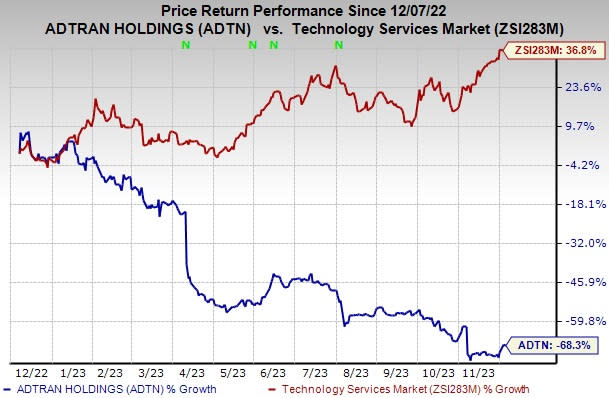

The stock has lost 68.3% in the past year against the industry’s growth of 36.8%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

ADTRAN currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Comtech Telecommunications Corp. CMTL, presently carrying a Zacks Rank #2 (Buy), is a solid pick. Headquartered in Melville, NY, the company is a leading global provider of next-generation 911 emergency systems and secure wireless communications technologies to commercial and government customers.

Comtech’s key satellite earth station modems incorporate forward error correction and bandwidth compression technologies, which enable its customers to optimize their satellite networks by either reducing their satellite transponder lease costs or increasing data.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architectures and enhance their cloud experiences. Arista has a long-term earnings growth expectation of 20.4% and delivered an earnings surprise of 12%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

AudioCodes Ltd. AUDC currently carries a Zacks Rank #2. It has a long-term earnings growth expectation of 24.8% and delivered an earnings surprise of 14%, on average, in the trailing four quarters.

Headquartered in Lod, Israel, AudioCodes offers advanced communications software, products, and productivity solutions for the digital workplace. It provides a broad range of innovative products, solutions and services that are used by large multi-national enterprises and leading tier-1 operators around the world.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ADTRAN Holdings, Inc. (ADTN) : Free Stock Analysis Report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report