ADTRAN's (ADTN) Preliminary Q3 Results Show a Top-Line Decline

ADTRAN, Inc. ADTN recently issued preliminary third-quarter 2023 results. These initial unaudited financial metrics provide valuable insight into the company’s business operations and market trends for the September quarter.

During the quarter, ADTRAN witnessed solid customer addition in the U.S. and European markets, backed by its comprehensive product portfolio. Despite these gains, the company’s net sales were adversely affected by foreign exchange fluctuations owing to its international footprint. A stronger U.S. dollar particularly impacted sales generated outside the United States.

For the third quarter, the company expects revenues to be $272.3 million. The preliminary figure is lower than the company’s guidance range of $275-305 million. Against the backdrop of a volatile economic environment, cautious capital spending from customers and inventory adjustments had an impact on the top line.

The conservative capital spending behavior of consumers resulted in a GAAP operating loss of $82.1 million with a negative operating margin of 30.2% during the quarter. For the third quarter, ADTRAN had earlier estimated the non-GAAP operating margin within the range of -5% to 0% of revenues. Per the preliminary results, the third quarter tally for non-GAAP operating margin is expected at -1.9% or an operating loss of $5,111 million. This figure aligns with the higher end of the company's expectations, supported by improved operational efficiency and a higher non-GAAP gross margin.

To successfully navigate through the current uncertain situation, ADTRAN is taking initiatives to better align its operating model. Management remains optimistic about the company's ability to capitalize on a potential return to normalize spending behavior owing to its broad portfolio and diverse market presence.

ADTRAN continues to benefit from solid demand trends of its network solutions, driven by the accelerated expansion of fiber-to-the-home networks, upgrades to in-home Wi-Fi connectivity and the adoption of cloud-based automation tools. The company’s end-to-end solutions simplify the deployment of fiber-based broadband services and provide a better customer experience.

It is focused on being a top global supplier of access infrastructure and related value-added solutions from the Cloud Edge to the Subscriber Edge through a broad portfolio of flexible hardware and software network solutions. These products enable a seamless transition to the fully converged, scalable, highly automated, cloud-controlled voice, data, Internet and video networks of the future.

ADTRAN expects solid traction in its domestic markets for ultra-broadband and fiber-to-the-home solutions, along with Software-Defined access and Ethernet passive optical network solutions. The company also anticipates a pickup in capital spending in Tier-1, Tier-2 and regional service provider market segments. Its global leadership in software-defined access is likely to ensure a steady stream of revenues as it helps clients reduce costs and accelerate service delivery and deployment.

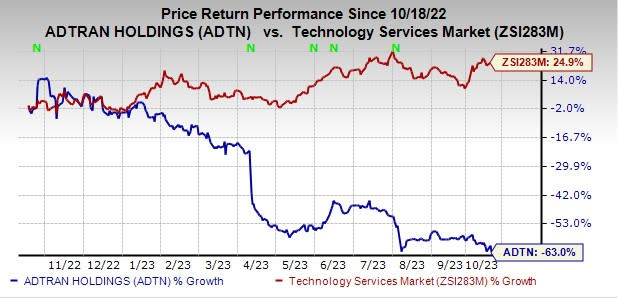

The stock has lost 63% in the past year against the industry’s growth of 24.9%.

Image Source: Zacks Investment Research

ADTRAN carries a Zacks Rank #3 (Hold).

Stocks to Consider

Ubiquiti Inc. UI, carrying a Zacks Rank #2 (Buy), is a key pick in the broader industry. Headquartered in New York, it offers a comprehensive portfolio of networking products and solutions for service providers and enterprises at disruptive prices. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ubiquiti boasts a proprietary network communication platform that is well-equipped to meet end-market customer needs. In addition, it is committed to reducing operational costs by using a self-sustaining mechanism for rapid product support and dissemination of information by leveraging the strength of the Ubiquiti Community.

NVIDIA Corporation NVDA, currently sporting a Zacks Rank #1, delivered an earnings surprise of 9.79%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 29.19%.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit or GPU. Over the years, the company’s focus has evolved from PC graphics to artificial intelligence-based solutions that now support high-performance computing, gaming and virtual reality platforms.

Arista Networks, Inc. ANET, presently carrying a Zacks Rank #2, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has delivered an earnings surprise of 12.8%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products and is well-positioned for healthy growth in the data-driven cloud networking business with proactive platforms and predictive operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ADTRAN Holdings, Inc. (ADTN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report