Advance Auto (AAP) to Report Q4 Earnings: What's in Store?

Advance Auto Parts AAP is slated to release fourth-quarter 2023 results on Feb 28, before market open. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share (EPS) and revenues is pegged at 24 cents and $2.47 billion, respectively.

For the fourth quarter, the consensus estimate for AAP’s EPS has moved down 11 cents in the past 90 days. The bottom-line estimate implies a deterioration of 91.7% from the year-ago reported number. The Zacks Consensus Estimate for its quarterly revenues indicates a year-over-year decline of 0.20%.

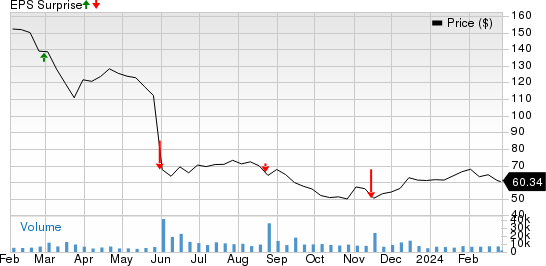

AAP's earnings surpassed estimates in one of the trailing four quarters and missed in the other three, delivering an average negative surprise of 56.86%. This is depicted in the graph below.

Advance Auto Parts, Inc. Price and EPS Surprise

Advance Auto Parts, Inc. price-eps-surprise | Advance Auto Parts, Inc. Quote

Q3 Highlights

Advance Auto incurred an adjusted loss of 82 cents per share in third-quarter 2023 against an adjusted earnings of $1.92 in the year-ago quarter. The reported figure was in contrast to the Zacks Consensus Estimate of earnings of $1.42 per share. Advance Auto generated net revenues of $2.72 billion, outpacing the Zacks Consensus Estimate of $2.68 billion and increasing 2.9% year over year. Comparable store sales increased 1.2%.

Factors to Shape Q4 Results

Advance Auto's strategic plan to restore profitability, encompassing the divestment of Worldpac and CarQuest Canadian business, substantial cost reductions and strategic reinvestment in core operations is likely to have boosted the result of the to-be-reported quarter. Its efforts to expand and optimize footprints by opening new stores, widening online presence and entering into strategic collaborations are expected to have resulted in higher sales and profits in the to-be-reported quarter. It opened 12 new locations in the last reported quarter. It planned to open a total of 55-65 new stores in 2023. Moreover, the acquisition of DieHard brand from Transformco has boosted the company’s top-line growth. Higher sales are likely to have benefited the company’s top line in the to-be-reported quarter.

AAP’s margins are under pressure due to elevated product costs. The company witnessed $80 million in higher product costs in the last reported quarter. Wage inflation and increased volume, contributing to heightened supply chain expenses add to the woes. The company grapples with inflationary costs, particularly in labor, within its new distribution centers in California and Toronto. Several one-time costs are likely to have adversely affected margins in the to-be-reported quarter.

The trimmed 2023 guidance casts pessimism on the upcoming results. In the third quarter of 2023, Advance Auto narrowed its 2023 net sales to $11.25-$11.30 billion compared with the previous range of $11.25-$11.35 billion. Comparable store sales are expected in the range of negative 0.5% to 0%. The operating income margin is envisioned in the range of 1.8-2%, down from 4-4.3% guided earlier.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Advance Auto for the quarter to be reported, as it does not have the right combination of the two key ingredients. A combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Earnings ESP: AAP has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate is in line with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: It currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Key Releases From the Same Space

O’Reilly Automotive, Inc. ORLY reported fourth-quarter 2023 earnings on Feb 7. Its adjusted EPS of $9.26 beat the Zacks Consensus Estimate of $9.07. The bottom line increased from $8.37 reported in the prior-year quarter. The automotive parts retailer registered quarterly revenues of $3,832 million, which marginally missed the Zacks Consensus Estimate of $3,838 million. The top line, however, increased 5.2% year over year. During the quarter, comps grew 3.4%. The company opened 47 new stores in the United States and Mexico. The total store count was 6,157 as of Dec 31, 2023.

ORLY had cash and cash equivalents of $279.1 million at the end of the reported quarter, up from $108.6 million recorded as of 2022-end. Its long-term debt was $5.57 billion, higher than $4.37 billion as of Dec 31, 2022.

AutoNation, Inc. AN reported fourth-quarter 2023 adjusted earnings of $5.02 per share, which decreased 21.2% year over year but topped the Zacks Consensus Estimate of $4.85. The earnings beat can be primarily attributed to higher-than-expected new vehicle and parts and service business revenues. In the reported quarter, revenues amounted to $6.8 billion, surpassing the Zacks Consensus Estimate of $6.65 billion. The company had recorded revenues of $6.7 billion in the fourth quarter of 2022.

AutoNation’s cash and cash equivalents were $60.8 million as of Dec 31, 2023, declining from $72.6 million recorded as of Dec 31, 2022. The company’s liquidity was $1.5 billion, including $61 million in cash and nearly $1.46 billion available under its revolving credit facility.

Lithia Motors LAD reported adjusted earnings of $8.24 per share for fourth-quarter 2023, which declined from the prior-year quarter’s $9.05. The bottom line, however, surpassed the Zacks Consensus Estimate of $8.11 per share. Total revenues jumped 10% year over year to $7.74 billion. The top line outpaced the Zacks Consensus Estimate of $7.67 billion.

Lithia had cash/cash equivalents/restricted cash of $941.1 million as of Dec 31, 2023, up from $246.7 million as of Dec 31, 2022. Long-term debt was $5.5 billion as of Dec 31, 2023, up from $5.1 billion as of Dec 31, 2022.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

O'Reilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

AutoNation, Inc. (AN) : Free Stock Analysis Report

Advance Auto Parts, Inc. (AAP) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report