Advance Auto Parts Inc (AAP) Faces Headwinds as Q4 and Full Year 2023 Earnings Reveal Challenges

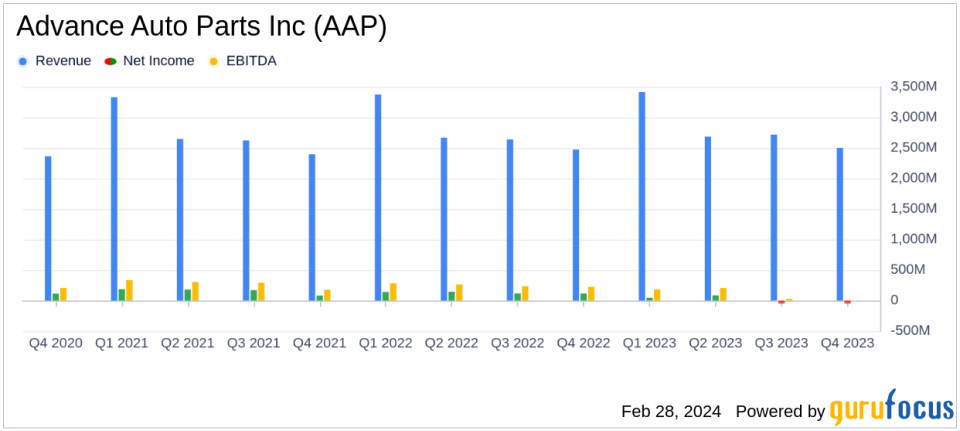

Net Sales: Q4 net sales slightly decreased by 0.4% year-over-year, with a full-year increase of 1.2%.

Gross Profit: Q4 gross profit fell by 11.9%, with a full-year gross margin decrease of 414 basis points.

Operating Income: Operating loss in Q4, with full-year operating income plummeting to 1.0% of net sales.

Earnings Per Share (EPS): Diluted loss per share of $0.59 in Q4, and a significant drop in full-year EPS to $0.50 from $7.65.

Free Cash Flow: Free cash flow for the full year sharply decreased to $43.7 million from the previous year's $312.5 million.

Store Count: Net increase in store and branch count, with 61 openings and 40 closures/consolidations.

On February 28, 2024, Advance Auto Parts Inc (NYSE:AAP), a leading provider of aftermarket automotive parts in North America, released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year ended December 30, 2023. The company, which operates 4,786 stores and 321 Worldpac branches, faced a challenging year with net sales for the fourth quarter slightly decreasing by 0.4% compared to the prior year, and a 1.2% increase for the full year. Comparable store sales saw a decrease of 1.4% in Q4 and a 0.3% decrease for the full year.

Advance Auto Parts Inc (NYSE:AAP) reported a significant decrease in gross profit by 11.9% in Q4, with a full-year gross margin decrease of 414 basis points, primarily due to inventory-related items and elevated supply chain costs. The company's operating income also took a hit, with a Q4 operating loss and a full-year operating income of only 1.0% of net sales, a stark contrast to the 6.0% in the previous year.

The company's diluted earnings per share (EPS) reflected these challenges, with a Q4 diluted loss per share of $0.59 and a full-year EPS of $0.50, a significant drop from the previous year's $7.65. Net cash provided by operating activities for the full year was $0.3 billion, a decrease from the prior year's $0.7 billion, primarily due to lower net income and working capital changes. Free cash flow also saw a sharp decrease to $43.7 million for the full year 2023, compared with $312.5 million for the prior year.

Amidst these financial challenges, Advance Auto Parts Inc (NYSE:AAP) has taken steps to stabilize and improve its business. President and CEO Shane O'Kelly emphasized the urgency to return to profitable growth, citing the full year results as below expectations. The company has streamlined leadership, made key executive appointments, and launched cost reduction initiatives, including a $150 million annualized reduction in SG&A expenses and an additional $50 million reduction in indirect spend.

Looking forward, Advance Auto Parts Inc (NYSE:AAP) is focusing on customer service, investing in frontline staff, and strengthening its competitive position. The company provided guidance for 2024, projecting net sales between $11.3 billion and $11.4 billion, with a comparable store sales increase of up to 1.0%. The anticipated operating income margin is between 3.2% and 3.5%, with diluted EPS ranging from $3.75 to $4.25. Capital expenditures are expected to be between $200 million and $250 million, with a minimum free cash flow of $250 million.

Despite the setbacks, Advance Auto Parts Inc (NYSE:AAP) remains committed to its operational improvement plans and is taking decisive actions to turn around the company's performance. The company's efforts to improve productivity and reduce expenses are aimed at laying a solid foundation for long-term success.

Investors and stakeholders are keeping a close watch on Advance Auto Parts Inc (NYSE:AAP) as it navigates through these operational and financial challenges, with the hope that the company's strategic initiatives will lead to a more robust financial performance in the future.

Explore the complete 8-K earnings release (here) from Advance Auto Parts Inc for further details.

This article first appeared on GuruFocus.