Advance Auto Parts (NYSE:AAP) Posts Q4 Sales In Line With Estimates, Stock Soars

Auto parts and accessories retailer Advance Auto Parts (NYSE:AAP) reported results in line with analysts' expectations in Q4 FY2023, with revenue flat year on year at $2.46 billion. On the other hand, the company's full-year revenue guidance of $11.35 billion at the midpoint came in slightly below analysts' estimates. It made a GAAP loss of $0.59 per share, down from its profit of $2.88 per share in the same quarter last year.

Is now the time to buy Advance Auto Parts? Find out by accessing our full research report, it's free.

Advance Auto Parts (AAP) Q4 FY2023 Highlights:

Revenue: $2.46 billion vs analyst estimates of $2.46 billion (small beat)

EPS: -$0.59 vs analyst estimates of $0.19 (-$0.78 miss)

Management's revenue guidance for the upcoming financial year 2024 is $11.35 billion at the midpoint, missing analyst estimates by 0.9% and implying 0.6% growth (vs 1.2% in FY2023)

Management's EPS guidance for the upcoming financial year 2024 is $4.00 per share at the midpoint, well above analyst estimates of $3.49

Free Cash Flow of $200.5 million, up 34.8% from the same quarter last year

Gross Margin (GAAP): 38.6%, down from 44.1% in the same quarter last year

Same-Store Sales were down 1.4% year on year (slight miss vs expectations of down 1.1% year on year)

Store Locations: 5,107 at quarter end, increasing by 21 over the last 12 months

Market Capitalization: $3.83 billion

“As we closed out 2023, we continued to act with a sense of urgency to stabilize the business and position the company to return to profitable growth,” said Shane O'Kelly, president and chief executive officer.

Founded in Virginia in 1932, Advance Auto Parts (NYSE:AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

Auto Parts Retailer

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

Sales Growth

Advance Auto Parts is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

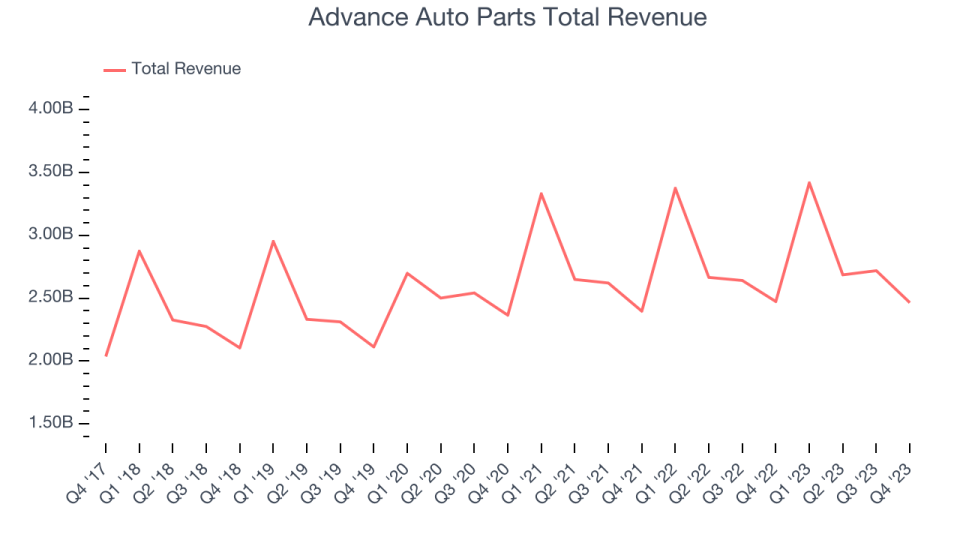

As you can see below, the company's annualized revenue growth rate of 3.8% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak as its store footprint remained relatively unchanged, implying that growth was driven by more sales at existing, established stores.

This quarter, Advance Auto Parts reported a rather uninspiring 0.4% year-on-year revenue decline to $2.46 billion in revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 1.6% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

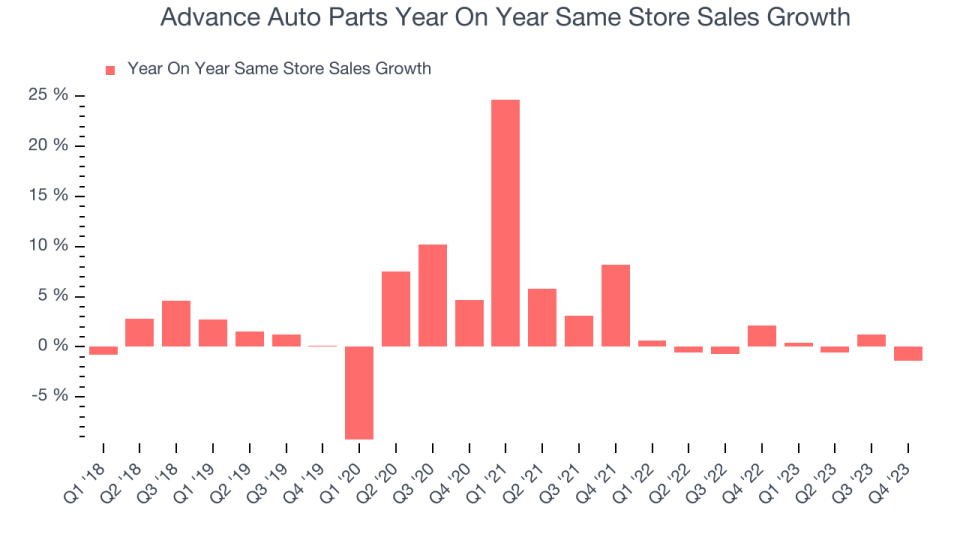

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Advance Auto Parts's demand within its existing stores has barely increased over the last eight quarters. On average, the company's same-store sales growth has been flat.

In the latest quarter, Advance Auto Parts's same-store sales fell 1.4% year on year. This decline was a reversal from the 2.1% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Advance Auto Parts's Q4 Results

We were impressed by Advance Auto Parts's optimistic full-year earnings forecast, which blew past analysts' expectations. Additionally, the company said it "recently launched an initiative to eliminate costs related to our indirect spend by an additional $50 million on an annualized basis". Finally, Advance Auto Parts is undergoing an "ongoing operational and strategic review of the business, including the separate sales processes for Worldpac and our Canadian business." The stock is up 9.3% after reporting and currently trades at $70.65 per share.

So should you invest in Advance Auto Parts right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.