Advanced Drainage Systems Inc (WMS) Reports Mixed Fiscal 2024 Q3 Results

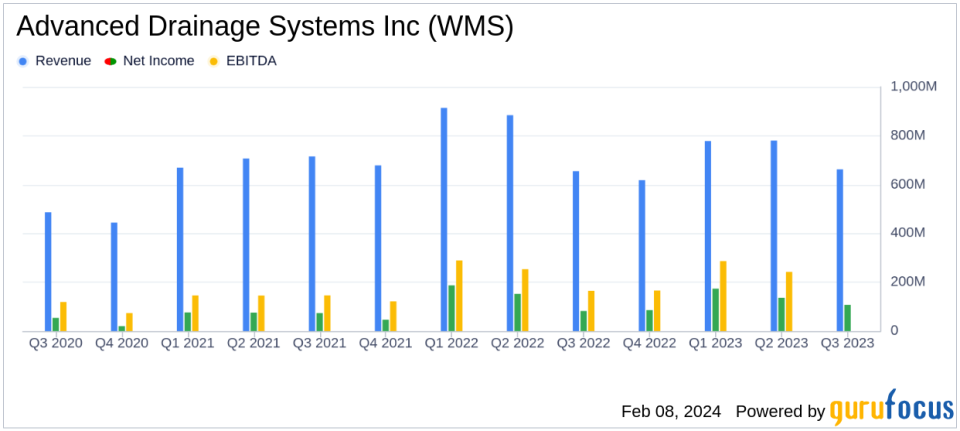

Net Sales: Q3 net sales rose 1.1% to $662.4 million, but year-to-date sales fell 9.5% to $2,220.6 million.

Net Income: Q3 net income surged 28.5% to $106.9 million, with a slight year-to-date decrease of 1.7%.

Earnings Per Share (EPS): Q3 EPS increased by 35.4% to $1.34, and year-to-date EPS grew by 4.4%.

Adjusted EBITDA: Achieved a 20.3% increase in Q3 and remained flat year-to-date at $731.8 million.

Free Cash Flow: Improved by 5.7% to $563.9 million for the year-to-date period.

On February 8, 2024, Advanced Drainage Systems Inc (NYSE:WMS) released its 8-K filing, detailing the financial results for the third quarter of fiscal year 2024, which ended on December 31, 2023. The company, a leader in water management solutions, reported a modest increase in net sales for the quarter, while year-to-date figures showed a decrease compared to the previous year.

Advanced Drainage Systems Inc operates primarily in the construction industry, designing, manufacturing, and marketing thermoplastic corrugated pipes and related water management products across the Americas and Europe. The company's main revenue comes from its Pipe segment, serving various markets including agriculture, residential, and infrastructure.

Financial Highlights and Challenges

The third quarter saw net sales increase to $662.4 million, a 1.1% rise, with net income jumping 28.5% to $106.9 million. This performance was driven by stronger demand in infrastructure, residential, and agriculture markets. However, the company faced challenges such as higher interest rates, credit tightening, and economic uncertainty, which could pose risks moving forward.

Despite these challenges, Advanced Drainage Systems Inc achieved a record Adjusted EBITDA margin of 30.8% during the quarter, a significant improvement from the previous year. This is particularly important for a company in the construction sector, where efficient cost management and operational efficiency are key to maintaining profitability.

Key Financial Metrics

Key financial metrics from the Income Statement, Balance Sheet, and Cash Flow Statement highlight the company's performance:

"In the third quarter, we saw net sales return to growth... Our business model continues to demonstrate resilience, as evidenced by the record Adjusted EBITDA margin of 30.8% achieved during the third quarter, a 490-basis points improvement from the prior year." - Scott Barbour, President and CEO of ADS.

The company's financial achievements, such as the increase in net income per diluted share to $1.34 and the rise in Adjusted EBITDA, underscore its ability to navigate a complex economic landscape effectively. The increase in free cash flow to $563.9 million also indicates a strong capacity to generate cash after capital expenditures, which is crucial for ongoing investments and shareholder returns.

Analysis of Company Performance

Advanced Drainage Systems Inc's performance in the third quarter reflects a robust business model capable of adapting to market conditions. The company's strategic focus on product innovation and partnerships, such as the launch of the ECOPOD-NX and the collaboration with Rainwater Management Solutions, positions it well for future growth. However, the outlook for the non-residential market remains uncertain, and the company plans to continue its focus on delivering exceptional service and pursuing profitable growth.

For a more detailed analysis of Advanced Drainage Systems Inc's financial performance and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Stay informed on the latest financial news and analysis by visiting GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from Advanced Drainage Systems Inc for further details.

This article first appeared on GuruFocus.