Advanced Energy (AEIS) Q3 Earnings Beat, Revenues Fall Y/Y

Advanced Energy Industries AEIS reported third-quarter 2023 non-GAAP earnings of $1.28 per share, beating the Zacks Consensus Estimate by 10.34%. However, the bottom-line figure declined 39.6% on a year-over-year basis.

Revenues of $410 million lagged the Zacks Consensus Estimate by 2.81% and dropped 20.6% year over year and 1% sequentially.

The backlog was $514 million at the end of the reported quarter. Advanced Energy expects a backlog between $400 million and $500 million at the end of the current quarter.

The company’s expansion is noteworthy. Year to date, AEIS has launched 19 new products across its markets. During the reported quarter, Advanced Energy launched five new products into the Industrial and medical market, including the iHP-Liquid, a fully-sealed liquid-cooled power supply designed to operate in harsh manufacturing environments.

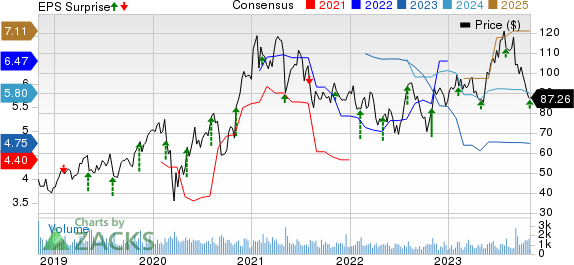

Advanced Energy Industries, Inc. Price, Consensus and EPS Surprise

Advanced Energy Industries, Inc. price-consensus-eps-surprise-chart | Advanced Energy Industries, Inc. Quote

End Market in Detail

Semiconductor Equipment: Revenues (45.1% of the total revenues) generated from the market fell 30.6% year over year to $185 million. The figure topped the Zacks Consensus Estimate by 1.06%.

Sequentially, revenues increased 7%. AEIS witnessed increased demand for RF products used in etch and deposition applications and strong performance in high-voltage products primarily used in ion implanters.

In partnership with key clients for eVerest and eVoS, orders have been secured, and these platforms are set to drive revenue expansion.

Industrial & Medical: Revenues (28.1% of the total revenues) from the market fell 3.6% year over year to $115.2 million and lagged the Zacks Consensus Estimate by 9.53%.

Soft market conditions hurt top-line growth.

Advanced Energy secured notable design wins in robotics, factory automation and thin film manufacturing applications in the reported quarter.

Data Center Computing: Revenues (16.7% of the total revenues) from the market were $68.3 million, down 22% year over year. However, the figure beat the consensus mark by 3.18%.

Sequentially, revenues jumped 16%. Top-line growth in the market was driven by significant design wins for AI applications in the hyperscale market.

Telecom & Networking: Revenues (10.1% of the total revenues) generated from the market were $41.4 million, down 2.6% year over year. The figure missed the Zacks Consensus Estimate by 11.02%.

Operating Results

In the third quarter, the non-GAAP gross margin was 36.1%, down 132 basis points (bps) on a year-over-year basis.

Sequentially, the gross margin expanded by 50 bps that benefited from improved mix and lower material costs.

Non-GAAP operating expenses were $97.3 million, down 2.5% year over year. As a percentage of revenues, the figure jumped 440 bps year over year to 23.7% in the reported quarter.

The non-GAAP operating margin was 12.4%, contracting 570 bps on a year-over-year basis but expanding 50 bps sequentially.

Balance Sheet & Cash Flow

As of Sep 30, 2023, cash and cash equivalents were $985.9 million compared with $455.2 million as of Jun 30, 2023.

Debt principal payments of $5 million were made in the reported quarter.

In the third quarter, Advanced Energy completed a private offering of $575 million aggregate principal amount of 2.50% Convertible Senior Notes due 2028.

For the third quarter, cash flow from operations was $72.7 million, higher than $23.6 million in the second quarter.

Advanced Energy made dividend payments of $3.8 million in the reported quarter. AEIS spent $40 million to repurchase 370,000 shares of its common stock.

Guidance

For fourth-quarter 2023, Advanced Energy expects non-GAAP earnings of $1.15 per share (+/- 20 cents). The Zacks Consensus Estimate is pegged at $1.26 per share, down 2.3% over the past 30 days.

Advanced Energy anticipates revenues of $405 million (+/- $15 million). The Zacks Consensus Estimate for the same is pegged at $437.17 million, suggesting a year-over-year decline of 10.92%.

Zacks Rank & Stocks to Consider

Currently, Advanced Energy has a Zacks Rank #4 (Sell).

Here are some better-ranked stocks worth considering in the broader sector.

GoDaddy GDDY, Ballard Power System BLDP and Itron ITRI are some better-ranked stocks that investors can consider in the broader sector. While GDDY and ITRI carry a Zacks Rank #1 (Strong Buy), BLDP carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GoDaddy shares have declined 2.1% year to date. GoDaddy is scheduled to release third-quarter 2023 results on Nov 2.

Itron shares have increased 13.1% year to date. ITRI is set to report its third-quarter 2023 on Nov 2.

Ballard Power System shares have declined 30.5% year to date. BLDP is set to report its third-quarter 2023 results on Nov 7.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Itron, Inc. (ITRI) : Free Stock Analysis Report

Ballard Power Systems, Inc. (BLDP) : Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS) : Free Stock Analysis Report

GoDaddy Inc. (GDDY) : Free Stock Analysis Report