Advanced Energy Industries Inc Reports Mixed 2023 Results Amid Market Corrections

Revenue: $1.66 billion in 2023, a 10% decrease from $1.85 billion in 2022.

GAAP Net Income: $130.7 million in 2023, down from $201.9 million in 2022.

Non-GAAP Net Income: $184.0 million in 2023, compared to $244.8 million in 2022.

Operating Cash Flow: Record $213 million in 2023, indicating strong cash generation capabilities.

Dividends and Share Repurchases: Paid $15.2 million in dividends and repurchased $40.0 million of common stock in 2023.

Guidance: Q1 2024 revenue expected to be $350 million +/- $15 million with GAAP EPS from continuing operations at $0.29 +/- $0.20.

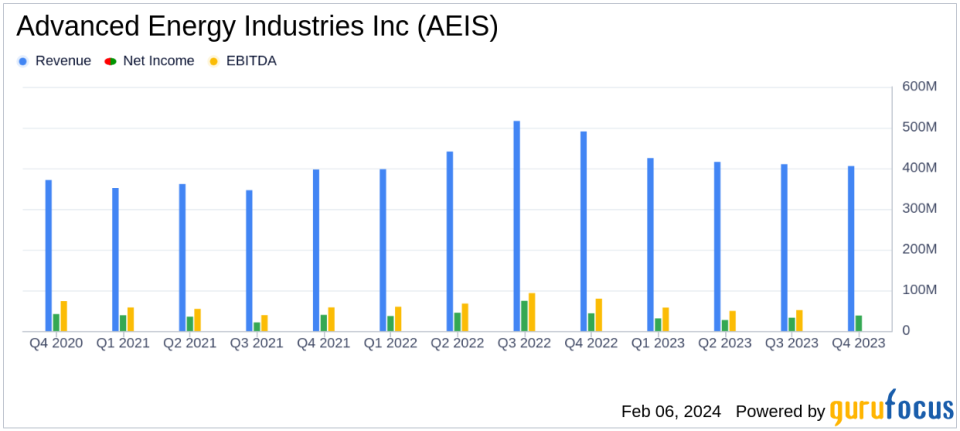

On February 6, 2024, Advanced Energy Industries Inc (NASDAQ:AEIS) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, a global provider of precision power-conversion measurement and control solutions, faced a challenging year with a 10% decrease in annual revenue and a significant drop in GAAP net income. Despite these challenges, AEIS achieved record operating cash flow and saw growth in its Industrial and Medical segments.

Financial Performance Overview

AEIS reported a fourth-quarter revenue of $405.3 million, a slight decrease from the previous quarter and a more notable decline from $490.7 million in the same quarter of the previous year. The company's GAAP net income for the quarter stood at $37.9 million, or $1.01 per diluted share, which included a restructuring and impairment charge and a tax benefit related to a deferred tax asset valuation allowance. Non-GAAP net income for the quarter was $46.7 million, or $1.24 per diluted share.

For the full year 2023, AEIS's revenue was $1.66 billion, reflecting a 10% decrease from the previous year's $1.85 billion. The GAAP net income from continuing operations was $130.7 million, or $3.46 per diluted share, compared to $201.9 million, or $5.35 per diluted share in 2022. The non-GAAP net income was $184.0 million, or $4.88 per diluted share, down from the previous year's $244.8 million, or $6.49 per diluted share.

Strategic Financial Moves and Future Outlook

AEIS's balance sheet remains robust with cash and equivalents at year-end totaling $1.0 billion. The company also completed a private offering of $575 million aggregate principal amount of 2.50% Convertible Senior Notes due 2028. The record cash flow from operations highlights the company's ability to generate cash despite market downturns.

Looking ahead, AEIS provided guidance for the first quarter of 2024, with revenue expected to be around $350 million and GAAP EPS from continuing operations projected to be $0.29, plus or minus $0.20. Non-GAAP EPS is expected to be $0.70, plus or minus $0.20. President and CEO Steve Kelley commented on the outlook, stating:

"While we see a sluggish market environment in the near-term, we expect demand to strengthen as the year progresses. With strong customer interest in our next-generation platforms and a solid design win pipeline, Advanced Energy is well positioned for strong earnings growth as the market recovers."

AEIS's performance in 2023 reflects the resilience of its diversified business model and its ability to navigate market corrections. The company's strategic focus on next-generation platforms and a solid design win pipeline are expected to drive future growth, making it a company to watch for value investors interested in the Industrial Products sector.

For more detailed information, investors are encouraged to review the full 8-K filing and consider the potential opportunities AEIS presents as it navigates through the current market environment.

Explore the complete 8-K earnings release (here) from Advanced Energy Industries Inc for further details.

This article first appeared on GuruFocus.