Advertising Software Stocks Q3 Results: Benchmarking LiveRamp (NYSE:RAMP)

Looking back on advertising software stocks' Q3 earnings, we examine this quarter's best and worst performers, including LiveRamp (NYSE:RAMP) and its peers.

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

The 6 advertising software stocks we track reported a solid Q3; on average, revenues beat analyst consensus estimates by 5.2% while next quarter's revenue guidance was in line with consensus. Stocks have faced challenges as investors prioritize near-term cash flows, but advertising software stocks held their ground better than others, with the share prices up 22% on average since the previous earnings results.

LiveRamp (NYSE:RAMP)

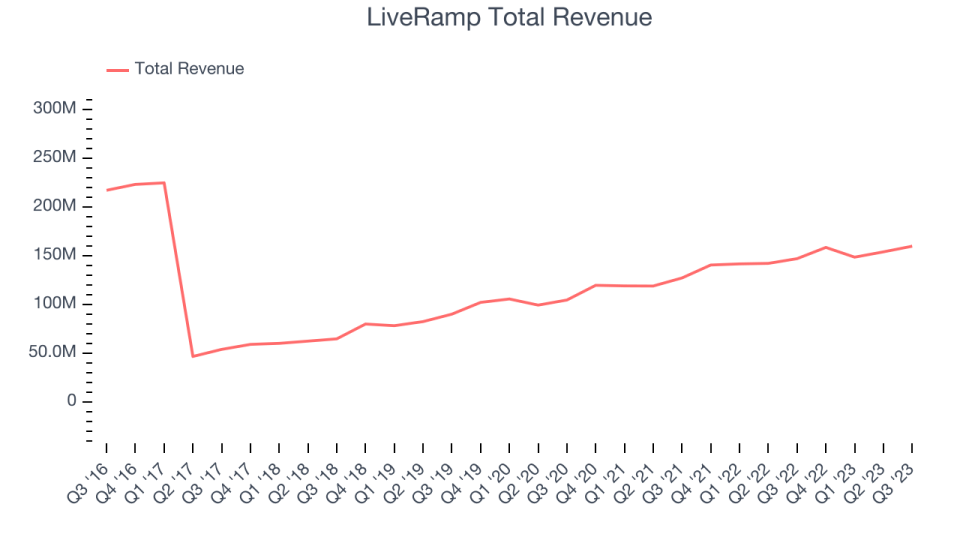

Started in 2011 as a spin-out of RapLeaf, LiveRamp (NYSE:RAMP) is a software-as-a-service provider that helps companies better target their marketing by merging offline and online data about their customers.

LiveRamp reported revenues of $159.9 million, up 8.7% year on year, topping analyst expectations by 4.9%. It was a mixed quarter for the company, with a significant improvement in its gross margin but decelerating customer growth.

LiveRamp scored the highest full-year guidance raise of the whole group. The company added 3 enterprise customers paying more than $1m annually to reach a total of 99. The stock is up 36.6% since the results and currently trades at $40.93.

Is now the time to buy LiveRamp? Access our full analysis of the earnings results here, it's free.

Best Q3: AppLovin (NASDAQ:APP)

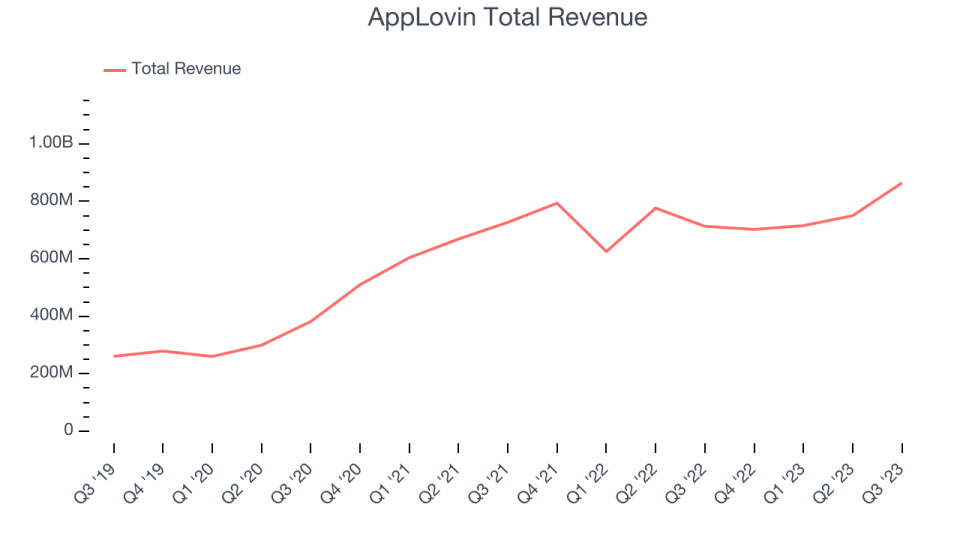

Co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ:APP) is both a mobile game studio and provider of marketing and monetization tools for mobile app developers.

AppLovin reported revenues of $864.3 million, up 21.2% year on year, outperforming analyst expectations by 8.5%. It was a stunning quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' revenue estimates.

AppLovin pulled off the biggest analyst estimates beat among its peers. The stock is up 13.3% since the results and currently trades at $45.51.

Is now the time to buy AppLovin? Access our full analysis of the earnings results here, it's free.

Weakest Q3: The Trade Desk (NASDAQ:TTD)

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ:TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.

The Trade Desk reported revenues of $493.3 million, up 24.9% year on year, exceeding analyst expectations by 1.2%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter.

The Trade Desk had the weakest performance against analyst estimates in the group. The stock is down 7.7% since the results and currently trades at $71.

Read our full analysis of The Trade Desk's results here.

PubMatic (NASDAQ:PUBM)

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $63.68 million, down 1.3% year on year, surpassing analyst expectations by 7.1%. It was a very strong quarter for the company, with optimistic revenue guidance for the next quarter and a solid beat of analysts' revenue estimates.

PubMatic had the slowest revenue growth among its peers. The stock is up 22.1% since the results and currently trades at $14.78.

Read our full, actionable report on PubMatic here, it's free.

DoubleVerify (NYSE:DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE:DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

DoubleVerify reported revenues of $144 million, up 28.3% year on year, surpassing analyst expectations by 3.6%. It was a good quarter for the company, with a decent beat of analysts' revenue estimates.

DoubleVerify delivered the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is up 38.5% since the results and currently trades at $40.12.

Read our full, actionable report on DoubleVerify here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned