ADW Capital Management, LLC Reduces Stake in RCI Hospitality Holdings Inc

ADW Capital Management, LLC (Trades, Portfolio), a New York-based investment firm, recently executed a significant transaction involving RCI Hospitality Holdings Inc. This article provides an in-depth analysis of the transaction, the profiles of both the firm and the traded company, and the potential implications for value investors.

Details of the Transaction

On September 27, 2023, ADW Capital Management, LLC (Trades, Portfolio) reduced its holdings in RCI Hospitality Holdings Inc by 8,000 shares. The transaction was executed at a price of $60.11 per share, impacting the firm's portfolio by -0.12%. Following the transaction, the firm holds a total of 941,000 shares in RCI Hospitality Holdings Inc, representing 14.45% of its portfolio and 9.99% of the traded company's total shares.

Profile of ADW Capital Management, LLC (Trades, Portfolio)

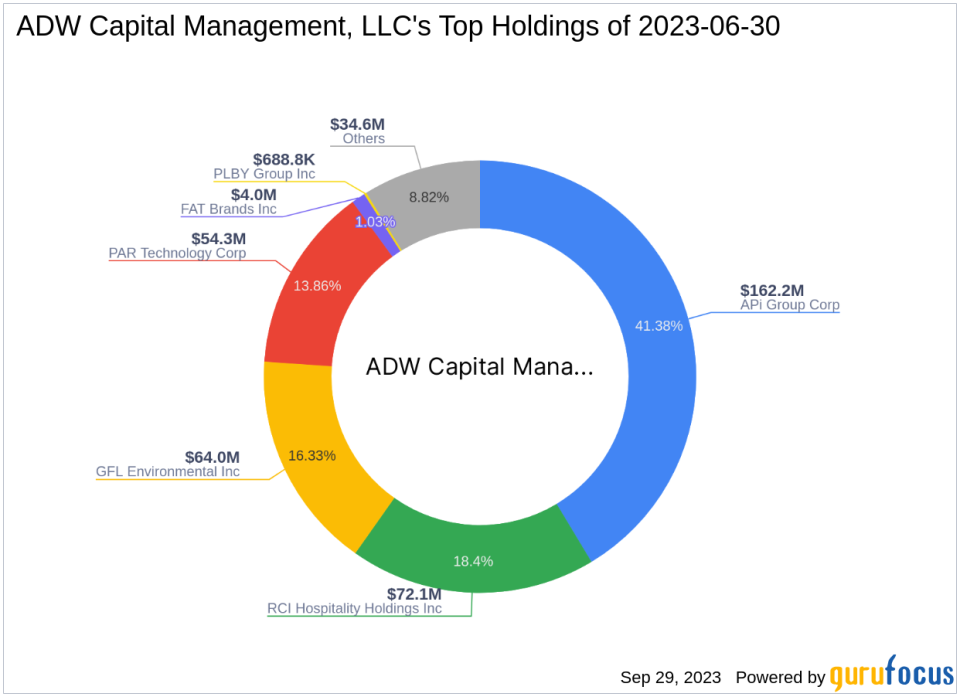

ADW Capital Management, LLC (Trades, Portfolio) is an investment firm based in New York. The firm's investment philosophy is centered around value investing, with a focus on undervalued companies that have the potential for significant growth. As of the date of this article, the firm's equity stands at $392 million. Its top holdings include RCI Hospitality Holdings Inc(NASDAQ:RICK), PAR Technology Corp(NYSE:PAR), APi Group Corp(NYSE:APG), FAT Brands Inc(NASDAQ:FAT), and GFL Environmental Inc(NYSE:GFL). The firm's top sectors are Industrials and Consumer Cyclical.

Overview of RCI Hospitality Holdings Inc

RCI Hospitality Holdings Inc, trading under the symbol RICK, is a US-based company that operates in the restaurant industry. The company owns and operates establishments that offer live adult entertainment, restaurant, and bar operations. It also owns a communication company serving the adult nightclubs industry. The company's operating business segments are Nightclubs, Bombshells, and Others. As of the date of this article, the company's market capitalization stands at $568.672 million. The company's stock price is currently $60.37.

Analysis of RCI Hospitality Holdings Inc's Stock

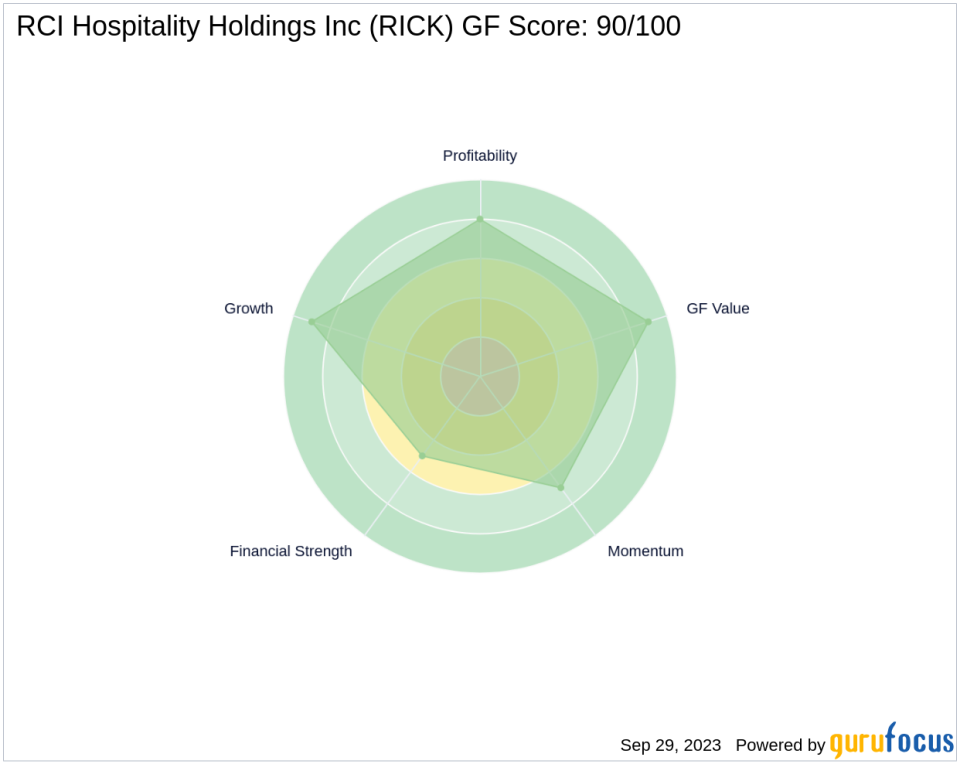

RCI Hospitality Holdings Inc's stock is currently trading at a PE Percentage of 14.91. According to GuruFocus's GF Valuation, the stock is significantly undervalued, with a GF Value of $86.44 and a Price to GF Value ratio of 0.70. Since the transaction, the stock has gained 0.43%. The stock's year-to-date price change ratio stands at -33.21%. The company's GF Score is 90/100, indicating good outperformance potential.

Performance of RCI Hospitality Holdings Inc's Stock

Since its Initial Public Offering (IPO) on October 13, 1995, RCI Hospitality Holdings Inc's stock has gained 589.94%. The company's financial health, as indicated by its balance sheet rank of 5/10, profitability rank of 8/10, growth rank of 9/10, and GF Value rank of 9/10, is commendable. The company's momentum rank is 7/10, indicating a positive trend.

Conclusion

In conclusion, ADW Capital Management, LLC (Trades, Portfolio)'s recent transaction involving RCI Hospitality Holdings Inc is noteworthy for value investors. The transaction has had a slight impact on the firm's portfolio, but the potential for growth in RCI Hospitality Holdings Inc's stock, as indicated by its GF Score and GF Value, is significant. Investors should keep a close eye on the performance of this stock in the coming months.

This article first appeared on GuruFocus.