AECOM (ACM), DB Sterlin JV to Offer Program Management Services

AECOM ACM, along with its joint venture (JV) partner, DB Sterlin, has been selected to provide program management services to the Chicago Department of Water Management (“DWM”).

Under this three-year contract, this JV will be responsible for managing the capital improvement program for DWM’s facilities. As the facilities engage in delivering about 750 million gallons of drinking water to residents daily, the work under this contract will pivot around various DWM assets. The work comprises improvements to the 4,300-mile water distribution system, 12 pumping stations, and two of the world’s largest water purification plants.

Through the use of the latest methods in water main design and rehabilitation, this JV will identify and address critical water system vulnerabilities, mitigate corrosion, and limit impacts on the trees and vegetation. These work processes will support the ongoing delivery of high-quality drinking water and efficient management of waste and stormwater infrastructure as well as the replacement of 400,000 lead service lines across Chicago.

AECOM emanates optimistic views about the new contract as it believes that its partnership with DB Sterlin will strengthen its position in addressing one of the greatest health and equity challenges associated with water delivery in the U.S.

Solid Backlog Level Backs AECOM’s Growth Prospects

AECOM is witnessing robust prospects in all its segments despite the ongoing market uncertainty. Its service offerings in diverse industries across end markets like transportation, facilities, government as well as those in environmental, energy and water businesses have aided it immensely. The diversity and its focus on efficient service delivery have aided its backlog growth.

The company currently has good visibility of strong backlog and pipelines for the upcoming quarters. Its pipeline of opportunities is up in double digits in the Americas design business. Based on clients' strengthening funding backdrop, including benefits from the $1.2 trillion infrastructure bill in the United States, AECOM expects backlog to continue to grow.

At the end of third-quarter fiscal 2023, AECOM’s total backlog increased to $41.63 billion (including 10% growth in the design business) from $41.13 billion in the prior-year quarter. Overall, the company’s performance demonstrates that it has been outgrowing the industry organically and capturing market share.

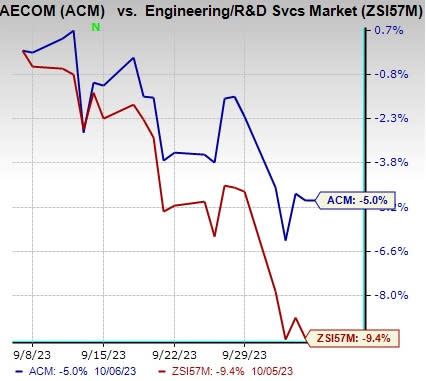

Price Performance

Shares of this Zacks Rank #5 (Strong Sell) company have dwindled to 5% in the past month compared with the Zacks Engineering - R and D Services industry’s 9.4% decline. The downturn is most likely attributable to ongoing macroeconomic risks and the cyclical nature of the business.

Image Source: Zacks Investment Research

Nonetheless, ACM’s ongoing contract wins, which are driven by its digitalization efforts and increased public infrastructure spending, position it well to gain momentum in the upcoming period.

Key Picks

Some better-ranked stocks from the Construction sector are TopBuild Corp. BLD, Sterling Infrastructure, Inc. STRL and Fluor Corporation FLR.

TopBuild currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BLD delivered a trailing four-quarter earnings surprise of 14.1%, on average. Shares of the company have risen 37.7% in the past year. The Zacks Consensus Estimate for BLD’s 2023 sales and earnings per share (EPS) indicates growth of 3.3% and 8.4%, respectively, from the previous year’s reported levels.

Sterling currently sports a Zacks Rank of 1. STRL delivered a trailing four-quarter earnings surprise of 14.9%, on average. Shares of the company have surged 229.9% in the past year.

The Zacks Consensus Estimate for STRL’s 2023 sales and EPS indicates growth of 3.9% and 29.4%, respectively, from the previous year’s reported levels.

Fluor currently sports a Zacks Rank of 1. FLR delivered a trailing four-quarter negative earnings surprise of 5.3%, on average. Shares of the company have gained 23.6% in the past year.

The Zacks Consensus Estimate for FLR’s 2023 sales and EPS indicates growth of 12.6% and 159.8%, respectively, from the previous year’s reported levels

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report