AECOM (ACM) Hikes Dividend by 22%, Boosts Shareholders Value

AECOM’s ACM stock jumped 1.22% in the after-hours trading session on Nov 13, after it announced a hike of 22% in its quarterly cash dividend and raised its share repurchase authorization to $1 billion.

This well-known infrastructure consulting firm raised the quarterly dividend payout to 22 cents per share from 20 cents, consistent with its commitment to annual double-digit increases in the per-share value. The amount will be paid on Jan 19, 2024, to shareholders of record as of Jan 4. Based on the closing price of $80.47 per share on Nov 13, 2023, the stock has a dividend yield of 0.89%.

This move highlights the company’s sound and stable financial position and its commitment to reward shareholders regularly.

ACM’s focus on return-focused capital allocation policy, which emphasizes high-returning investments in organic growth followed by returning substantially all available cash flow to shareholders through share repurchases and dividends, bodes well.

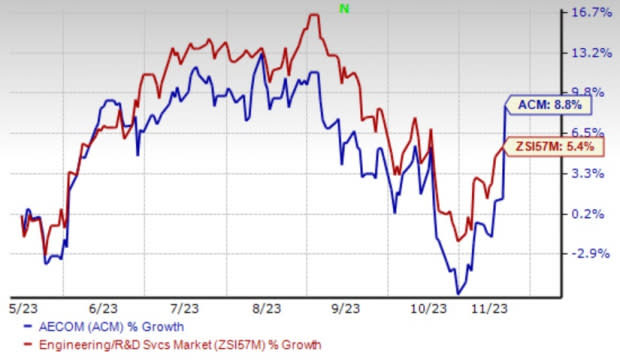

Image Source: Zacks Investment Research

In the past six months, shares of the company have gained 8.8% compared with the Zacks Engineering - R and D Services industry’s 5.4% growth.

Fiscal 2023 at Glance

AECOM’s fourth-quarter fiscal 2023 earnings met surpassed the Zacks Consensus Estimate but increased 13.5% on a year-over-year basis. Revenues topped the consensus estimate and improved 12% from prior year. Adjusted net service revenues, or NSR, moved up 8%. The design business contributed 90% to the total NSR and recorded year-over-year growth of 8%. Adjusted EBITDA also rose 10% year over year.

For fiscal 2024, the company anticipates generating 8-10% organic NSR growth.

Solid Project Execution Aids the Business

AECOM is a leading solutions provider, supporting professional, technical and management solutions for diverse industries across end markets like transportation, facilities, government and environmental, energy and water businesses.

Demand for AECOM’s technical, advisory and program management capabilities is increasing on the back of an improving funding environment, highlighted by the recent passing of the federal infrastructure bill in the United States as well as rising demand for ESG-related services. This underpins the company’s expectation for accelerating revenue growth in fiscal 2023 as well as continued margin, adjusted EBITDA and adjusted EPS growth.

AECOM is witnessing robust prospects across its segments. Its net service revenues or NSR — defined as revenues excluding subcontractor and other direct costs — have been benefiting from strength across core transportation, water and environment markets.

Zacks Rank & Key Picks

AECOM currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Here are some better-ranked stocks that investors may consider from the Zacks Construction sector.

Installed Building Products, Inc. IBP currently sports a Zacks Rank of 1. IBP delivered a trailing four-quarter earnings surprise of 7.3%, on average. Shares of the company have gained 9.8% in the past six months.

The Zacks Consensus Estimate for IBP’s 2023 sales and earnings per share (EPS) indicates growth of 4.3% and 8.6%, respectively, from the previous year’s reported levels.

Acuity Brands, Inc. AYI currently sports a Zacks Rank of 1. AYI delivered a trailing four-quarter earnings surprise of 12%, on average. Shares of the company have gained 10.7% in the past six months.

The Zacks Consensus Estimate for AYI’s fiscal 2024 sales and EPS indicates a decline of 3% and 4.7%, respectively, from the previous year’s reported levels.

Construction Partners, Inc. ROAD currently sports a Zacks Rank of 1. ROAD has a trailing four-quarter earnings surprise of 10.6%, on average. Shares of the company have gained 40.9% in the past six months.

The Zacks Consensus Estimate for ROAD’s fiscal 2024 sales and EPS indicates growth of 14.6% and 47.1%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report

Construction Partners, Inc. (ROAD) : Free Stock Analysis Report