AECOM (ACM) Receives TxDOT Contract to Work as Lead Designer

AECOM ACM is set to perform as Lead Designer for the Lone Star Constructors joint venture. Selected by the Texas Department of Transportation (TxDOT), ACM will manage the design, delivery and maintenance of the I-35 Northeast Expansion (NEX) South Project in Bexar County, TX.

ACM will design and deliver three elevated express lanes along I-35 in each direction. Precisely, it will work on direct connectors at the I-410 South interchange and connection to elevated lanes and direct connectors at the I-410 North interchange, which is currently under construction.

Post-completion, the project will enhance highway lanes to improve mobility and congestion, as well as complement the economic development and growth in the region.

AECOM’s stock grew 1.72% on Sep 14.

Solid Project Execution Aid the Business

AECOM is a leading solutions provider supporting professional, technical and management solutions for diverse industries across end markets like transportation, facilities, government and environmental, energy and water businesses.

Demand for AECOM’s technical, advisory and program management capabilities is increasing on the back of an improving funding environment, highlighted by the recent passing of the federal infrastructure bill in the United States as well as rising demand for ESG-related services. This underpins the company’s expectation for accelerating revenue growth in fiscal 2023 as well as continued margin, adjusted EBITDA and adjusted EPS growth.

AECOM is witnessing robust prospects across its segments. Its net service revenues or NSR — defined as revenues excluding subcontractor and other direct costs — have been benefiting from strength across core transportation, water and environment markets.

In the third quarter of fiscal 2023, NSR increased by 10%, marking the 10th consecutive quarter of accelerating organic growth. The contracted backlog in the said quarter was up 1.4% year over year. The total backlog increased to $41.63 billion (including 10% growth in the design business) from $41.13 billion in the prior-year quarter.

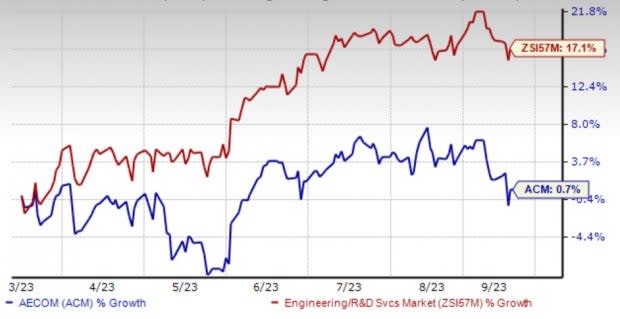

Image Source: Zacks Investment Research

Although shares of the company have underperformed the Zacks Engineering - R and D Services industry, earnings estimates for third-quarter fiscal 2023 have moved two cents north in the past 30 days to $1.02 per share from $1.00. This reflects 14.6% growth year over year. Its fiscal 2023 earnings also reflect 6.9% growth from the previous year.

Zacks Rank & Key Picks

AECOM currently carries a Zacks Rank #3 (Hold).

Some top-ranked stocks in the broader sector are PulteGroup Inc. PHM, Toll Brothers, Inc. TOL and Meritage Homes Corporation MTH, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PulteGroup: Based in Atlanta, GA, this homebuilder has been benefiting from a prudent land investment strategy, a focus on entry-level buyers and the return of more free cash flow to shareholders. PulteGroup’s annual land acquisition strategies have been resulting in improved volumes, revenues and profitability for quite some time now. The company has been reaping benefits from the successful execution of strategic initiatives to boost profitability, with a focus on entry-level homes. Its solid operating model, which strategically aligns the production of build-to-order and quick-move-in homes with applicable demand across consumer groups, has been a major tailwind.

The Zacks Consensus Estimate for PulteGroup's 2023 and 2024 earnings has been upwardly revised by 12.3% and 9%, respectively, over the past 60 days. Its earnings topped consensus estimates in three of the trailing four quarters and missed on one occasion, the average surprise being 19.5%.

Toll Brothers: Based in Horsham, PA, Toll Brothers is a leading builder of luxury homes. The company has been benefiting from its strategy of broadening its product lines, price points and geographies. Also, it has been gaining from the lack of competition in the luxury new home market, its build-to-order approach and its solid backlog level. This, combined with its focus on operational efficiency, has been helping TOL drive growth. Meanwhile, the company has been strategically adding more affordable luxury communities because of the current demographic trends and expanding its footprint and customer base. These communities are expected to be more capital-efficient.

Earnings estimates for fiscal 2023 have increased to $11.91 per share from $10.61 over the past 30 days. Toll Brothers' earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 31.4%.

Meritage Homes: Based in Scottsdale, AZ, Meritage Homes is one of the leading designers and builders of single-family homes. Its focus on entry-level LiVE.NOW homes has been a major driving factor. Although the combined effect of greater sales incentives and continued elevated direct costs has been impacting the company’s gross margins, MTH is particularly focused on increasing gross margins and maximizing profits on every sale. To this end, it is making homes out of speculations that promise faster delivery at a lower cost. Meritage Homes’ strategic shift to a pure-play entry-level and first-move-up builder is expected to yield higher absorptions, aided by an improving community count growth trajectory.

MTH has seen an upward estimate revision for 2023 and 2024 earnings by 25.2% and 22.6% over the past 60 days, respectively. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 24.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report