AECOM (ACM) Reports Robust First Quarter Fiscal 2024 Results

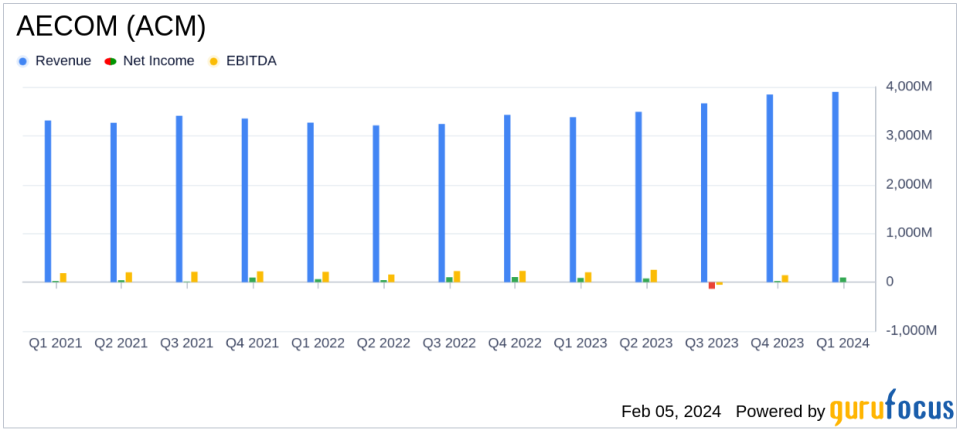

Revenue: Increased by 15% year-over-year to $3.9 billion.

Net Income: Grew by 11% year-over-year to $97 million.

EPS (Fully Diluted): Rose by 15% year-over-year to $0.71.

Operating Cash Flow: Improved by 19% year-over-year to $143 million.

Free Cash Flow: Increased by 4% year-over-year to $87 million.

Design Backlog: Reached a record $21.8 billion, up 9% year-over-year.

On February 5, 2024, AECOM (NYSE:ACM), a global leader in infrastructure consulting, announced its financial results for the first quarter of fiscal year 2024. The company reported a significant increase in revenue and net income, alongside a robust design backlog that signals a strong outlook for future growth. AECOM's 8-K filing details these results, reflecting the company's successful execution of its strategic priorities and its ability to capitalize on favorable market conditions.

AECOM, headquartered in Los Angeles, is one of the largest providers of design, engineering, construction, and management services globally. With operations in over 150 countries and a workforce of 51,000, AECOM generated $14.4 billion in sales and $847 million in adjusted operating income in fiscal 2023. The company serves a diverse set of end markets, including infrastructure, water, transportation, and energy, positioning it well to benefit from the ongoing global infrastructure investment megatrends.

Financial and Operational Highlights

The company's revenue for the quarter stood at $3.9 billion, a 15% increase from the previous year, driven by strong organic growth and high win rates in its design business. Net income saw an 11% year-over-year increase to $97 million, while diluted earnings per share (EPS) grew by 15% to $0.71. These improvements reflect AECOM's focus on high-value services and its ability to maintain operational efficiency.

Operating income rose by 7% to $163 million, and adjusted operating income increased by 17% to $223 million. The segment operating margin on net service revenue (NSR) improved by 100 basis points to 15.0%, indicating enhanced profitability. Free cash flow, a critical indicator of financial health for construction firms, increased by 4% to $87 million, providing AECOM with the liquidity to pursue strategic growth opportunities.

The company's design backlog, an indicator of future revenue potential, reached a new record of $21.8 billion, up 9% from the previous year. This backlog growth, combined with a near-record high win rate, provides substantial visibility into AECOM's future performance and underscores its competitive positioning in the market.

Management Commentary

Our strong first quarter performance reflects the strength of our strategy and culture, which is focused on winning what matters and collaborating to bring the best of our technical resources to our clients globally, said Troy Rudd, AECOMs chief executive officer. We delivered a record design backlog, strong organic NSR growth, record first quarter margins and strong free cash flow."

Through our Think and Act Globally strategy, we have created a competitive advantage at a time when investments are increasing across our largest and most profitable markets, said Lara Poloni, AECOMs president.

We have created an algorithm for superior shareholder value creation by focusing our time and capital on high-returning organic growth opportunities, investing in innovation, and executing on our disciplined returns-focused capital allocation policy, said Gaurav Kapoor, AECOMs chief financial and operations officer.

Segment Performance and Balance Sheet Strength

In the Americas, revenue reached $3.0 billion with NSR growth of 9% in the design business. Operating income in this segment increased by 7% to $175 million, with an adjusted operating margin on NSR of 18.3%. The International segment also performed strongly, with revenue of $861 million and an 8% increase in NSR. Operating income in this segment surged by 40% to $77 million, with a record adjusted operating margin on NSR of 10.6%.

AECOM's balance sheet remains solid, with $1.2 billion in cash and cash equivalents and a net leverage ratio of 0.9x. The effective tax rate was 19.5%, and on an adjusted basis, it was 22.0%.

Value investors may find AECOM's strong financial performance, strategic market positioning, and robust backlog particularly appealing. The company's focus on high-value segments and disciplined capital allocation strategy suggest a favorable outlook for sustainable growth and shareholder returns.

For a more detailed breakdown of AECOM's financial results and management's outlook, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from AECOM for further details.

This article first appeared on GuruFocus.