AECOM (ACM) Selected as Managing Partner for the CSRM Program

AECOM ACM, along with its other Norfolk Resilience Partners, Moffatt & Nichol and Volkert, were selected by City of Norfolk, VA, for the Coastal Storm Risk Management (CSRM) program. City of Norfolk is the local sponsor of this single-award contract with a valuation of $2.6 billion.

AECOM believes that the impact of the CSRM program on the Norfolk city’s future flood management and residents’ quality of life will position it as the model for resiliency programs along the Atlantic coast and even globally.

CSRM Program Deliverables

The Norfolk Resilience Partners joint venture is entitled to provide a range of comprehensive services comprising program and project management, engineering and design, real estate services, public engagement, environmental and cultural resources evaluations and other related services.

In the joint venture, AECOM will serve as a managing partner, indulging in handling a strong lineup of subject matter experts that will support a team of local, highly committed professionals. The set of experts are assembled to cushion Norfolk’s CSRM Program in every possible manner.

The Army Corps of Engineers (USACE) identified Norfolk to be highly vulnerable to flooding and other climatic mishaps. In regards to this, as an initiative of USACE, the program primarily aims to increase the resiliency of the city’s infrastructure along with protection from coastal flooding and significant storm events.

The project will be divided into five implementation phases. Herein four phases will be associated with four watershed areas comprising Downtown, Pretty Lake, Lafayette River and Broad Creek, and the fifth phase will be associated with providing non-structural solutions across the city, such as home elevations, basement fills, and floodproofing.

Image Source: Zacks Investment Research

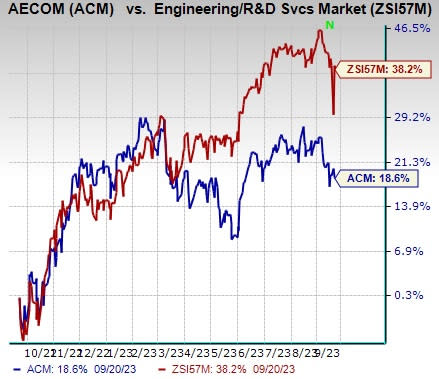

Shares of AECOM inched down 0.1% on Sep 20, during the trading session. Also, the stock has gained 18.6% in the past year compared with the Zacks Engineering - R and D Services industry’s 38.2% growth. Although the shares of the company have underperformed its industry, its ongoing contract wins position it well to gain momentum in the upcoming period.

Increased Global Infrastructure Spending to Boost Growth

AECOM is expecting its solid pipeline of opportunities to be up in the double digits in the Americas design business. This is backed by its clients' strengthening funding backdrop, including benefits from the $1.2 trillion infrastructure bill and the Jobs Act in the United States, which ensure the continued growth of the company’s backlog. This highlights the increased demand for AECOM’s technical, advisory and program management capabilities. Furthermore, the company has been benefiting from the industry-leading position in green building and green design, environmental compliance and remediation, energy efficiency and infrastructure resilience.

The company is also witnessing growth in its international infrastructure spending, owing to the improvement in the global economic scenario. It has been benefiting from solid infrastructure spending in the United Kingdom, Ireland, Australia, New Zealand, Hong Kong and the Middle East. Management remains confident to attain its goal of double-digit International margins by 2024.

The company’s solid backlog levels, which are a key indicator of future revenue growth, indicate significant opportunities in the forthcoming quarters. At the end of third-quarter fiscal 2023, AECOM’s total backlog increased to $41.63 billion (including 10% growth in the design business) from $41.13 billion in the prior-year quarter.

Zacks Rank

AECOM currently carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks from the Construction sector are EMCOR Group, Inc. EME, TopBuild Corp. BLD and Fluor Corporation FLR.

EMCOR currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

EME delivered a trailing four-quarter earnings surprise of 17.2%, on average. Shares of the company have risen 82.7% in the past year. The Zacks Consensus Estimate for EME’s 2023 sales and earnings per share (EPS) indicates growth of 11.7% and 36.2%, respectively, from the previous year’s reported levels.

TopBuild currently sports a Zacks Rank of 1. BLD delivered a trailing four-quarter earnings surprise of 14.1%, on average. Shares of the company have risen 59.5% in the past year.

The Zacks Consensus Estimate for BLD’s 2023 sales and EPS indicates growth of 3.3% and 8.4%, respectively, from the previous year’s reported levels.

Fluor currently sports a Zacks Rank of 1. FLR delivered a trailing four-quarter negative earnings surprise of 5.3%, on average. Shares of the company have gained 47% in the past year.

The Zacks Consensus Estimate for FLR’s 2023 sales and EPS indicates growth of 11.3% and 141.5%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report