AECOM (ACM) Selected as Technical Advisor for Hamilton's LRT

AECOM ACM, the infrastructure consulting firm, is set to play a pivotal role in transforming Hamilton, Ontario, with the Hamilton Light Rail Transit (“LRT”) project. Appointed as the technical advisor by Metrolinx, AECOM is poised to reshape the city's future.

This ambitious 14-kilometer transit line will be Hamilton's first light rail system, expertly designed to accommodate future growth, bolster connectivity, and fuel economic development in the rapidly expanding region. AECOM's integrated team will work closely with Metrolinx to oversee the delivery of this transformative infrastructure.

The Hamilton LRT will introduce new light rail vehicles on dedicated tracks, ensuring safety, reliability, and greater frequency of service. Furthermore, the project will focus on revitalizing critical utilities and essential infrastructure along the route, paving the way for sustainable growth and city-building.

Mark Southwell, chief executive of AECOM's global Transportation business, highlighted the importance of world-class transit in urban development. He expressed how this project will make Hamilton a standout leader in public transportation, preparing the city for a more livable, low-carbon future. This endeavor aligns seamlessly with AECOM's Sustainable Legacies strategy, enhancing social and environmental outcomes for communities.

As AECOM steers Hamilton toward a more connected, prosperous future, this project signals a major stride toward sustainable, smart cities, solidifying the company's reputation as a key player in the infrastructure consulting sector.

Image Source: Zacks Investment Research

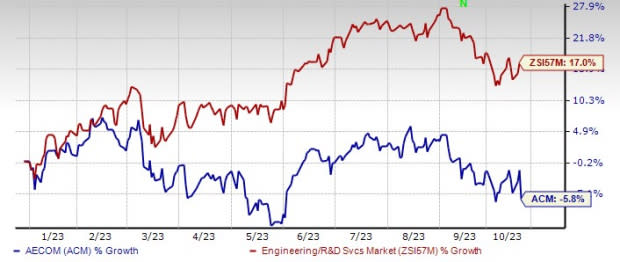

Shares of AECOM declined 4.5% during the trading session on Oct 18 but gained 2.1% during the after-hour trading session on the same day. Meanwhile, the stock has lost 5.8% so far this year against the Zacks Engineering - R and D Services industry’s 17% growth. Although shares of the company have underperformed its industry, its ongoing contract wins position it well to gain momentum in the upcoming period.

Booming Global Infrastructure Investment to Drive AECOM's Growth

AECOM is poised for robust expansion in its Americas design business, with expectations of double-digit growth in its project pipeline. This optimistic outlook is underpinned by the strengthening financial support from its clients, buoyed by the $1.2 trillion infrastructure bill and the Jobs Act in the United States. Moreover, AECOM's dominant position in green building and design, environmental compliance, energy efficiency, and infrastructure resilience has been a driving force behind its continued success.

Internationally, AECOM is witnessing growth in infrastructure spending, thanks to an improved global economic climate. Strong infrastructure investments in the United Kingdom, Ireland, Australia, New Zealand, Hong Kong, and the Middle East have further bolstered the company's position. AECOM's management is resolute in achieving its target of achieving double-digit international profit margins by 2024.

The company's substantial backlog, a pivotal gauge of future revenues, indicates a wealth of opportunities in the forthcoming quarters. As of the end of the third quarter of fiscal 2023, AECOM's total backlog has surged to $41.63 billion, reflecting 10% growth in the design business, compared with $41.13 billion in the prior-year quarter. This robust performance underscores AECOM's promising trajectory and its potential for continued success.

Zacks Rank

AECOM currently carries a Zacks Rank #5 (Strong Sell).

Key Picks

Some better-ranked stocks from the Construction sector are EMCOR Group, Inc. EME, TopBuild Corp. BLD and Fluor Corporation FLR.

EMCOR currently sports a Zacks Rank #1 (Strong Buy). Shares of the company have risen 32.6% year to date (YTD). You can see the complete list of today’s Zacks #1 Rank stocks here.

EME delivered a trailing four-quarter earnings surprise of 17.2%, on average. The Zacks Consensus Estimate for EME’s 2023 sales and earnings per share (EPS) indicates growth of 11.3% and 35.4%, respectively, from the previous year’s reported levels.

TopBuild currently carries a Zacks Rank of 2 (Buy). BLD delivered a trailing four-quarter earnings surprise of 14.1%, on average. Shares of the company have risen 46.8% YTD.

The Zacks Consensus Estimate for BLD’s 2023 sales and EPS indicates growth of 3.3% and 8.4%, respectively, from the previous year’s reported levels.

Fluor currently carries a Zacks Rank of 2. FLR delivered a trailing four-quarter negative earnings surprise of 5.3%, on average. Shares of the company have gained 3.3% YTD.

The Zacks Consensus Estimate for FLR’s 2023 sales and EPS indicates growth of 12.6% and 159.8%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report