AECOM (ACM) Selected for Uisce Eireann's Capital Works Program

AECOM ACM is solely selected by Ireland’s public water utility company, Uisce Eireann, for its new Capital Works PMO Framework.

For the capital works program, AECOM will deliver various services that include project and program management, design, stakeholder consultation and site supervision. The projects comprise construction and upgradation of water and wastewater treatment plants, water and sewerage networks, and dams and reservoirs infrastructure.

AECOM’s support of this program will take Uisce Eireann a step closer to its goal of transforming the delivery of water services along with supporting social and economic growth. The project, which is considered for five years, with a window of two years extension, replaces and combines several previous frameworks under one program.

The company shares optimistic views on this project win because it believes that its current market position makes it a good fit to deliver on its clients’ ambitions.

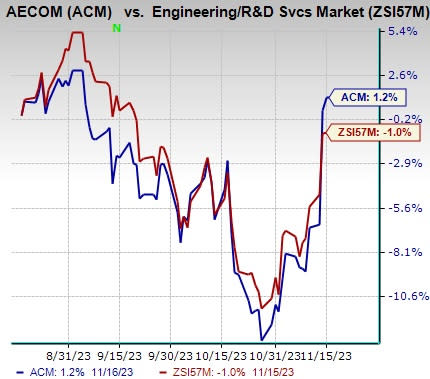

Image Source: Zacks Investment Research

Following the news break, shares of ACM inched up 0.8% during the trading hours on Nov 15. Furthermore, shares of the company have gained 1.2% in the past three months against the Zacks Engineering - R and D Services industry’s 1% decline.

Strong Backlog Driving Growth

AECOM is witnessing robust prospects in all its segments despite the ongoing market uncertainty. Its service offerings in diverse industries across end markets like transportation, facilities and government as well as those in environmental, energy and water businesses have aided it immensely. The diversity and its focus on efficient service delivery have aided its backlog growth.

At the end of fourth-quarter fiscal 2023, AECOM’s total backlog increased to $41.17 billion (including record 12.7% growth in the design business) from $40.18 billion in the prior-year quarter. Overall, the company’s performance demonstrates that it has been outgrowing the industry organically and capturing market share.

Moreover, the company currently has good visibility of a strong backlog and pipelines for the upcoming quarters. Its pipeline of opportunities is up in double digits in the Americas design business.

Zacks Rank & Key Picks

AECOM currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks that investors may consider from the Zacks Construction sector.

Acuity Brands, Inc. AYI currently sports a Zacks Rank #1 (Strong Buy). AYI delivered a trailing four-quarter earnings surprise of 12%, on average. The stock has 0.3% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AYI’s fiscal 2024 sales and earnings per share (EPS) indicates a decline of 3% and 4.7%, respectively, from a year ago.

M-tron Industries, Inc. MPTI currently sports a Zacks Rank of 1. MPTI delivered a trailing four-quarter earnings surprise of 35.6%, on average. It has surged 255.7% in the past year.

The Zacks Consensus Estimate for MPTI’s 2023 sales and EPS indicates growth of 30.6% and 156.7%, respectively, from the previous year.

Construction Partners, Inc. ROAD presently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 10.6%, on average. Shares of ROAD have rallied 34% in the past year.

The Zacks Consensus Estimate for ROAD’s fiscal 2024 sales and EPS indicates an improvement of 14.6% and 47.1%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

Construction Partners, Inc. (ROAD) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report