Aemetis Inc (AMTX) Reports Substantial Growth in India Biodiesel Sales Despite Overall Net Loss ...

Revenue Growth: India biodiesel segment revenue soared to $77.2 million, a 175% increase year-over-year.

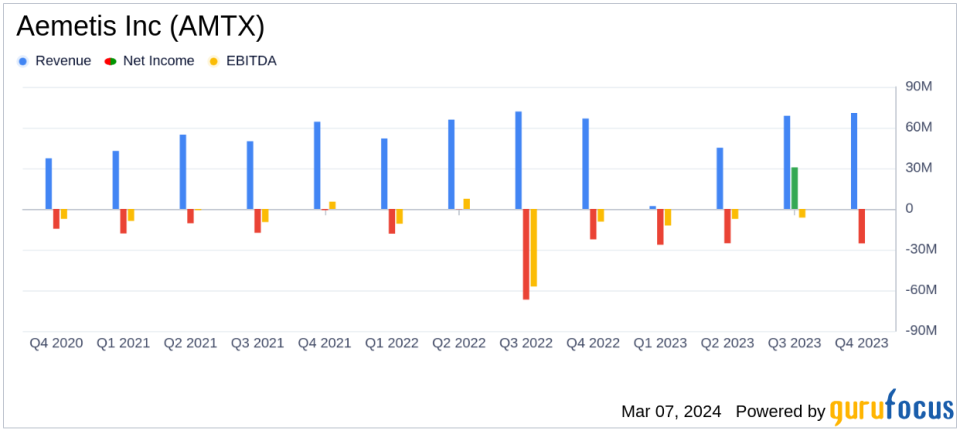

Net Loss: Despite revenue growth in certain segments, Aemetis Inc (NASDAQ:AMTX) reported a net loss of $46.4 million for 2023.

Operational Milestones: Achieved key operational milestones and secured $50 million in USDA-guaranteed funding for dairy digesters.

Capital Expenditures: Invested $33 million in carbon intensity reduction and production expansion projects.

Gross Profit: Gross profit turned positive at $2.0 million for 2023, compared to a gross loss in the previous year.

Cost of Goods Sold: Decreased to $185 million in 2023 from $262 million in 2022, reflecting efficiency improvements.

Stock Compensation: Selling, general and administrative expenses rose, partly due to $5.0 million in stock compensation.

Aemetis Inc (NASDAQ:AMTX) released its 8-K filing on March 7, 2024, detailing its financial results for the fourth quarter and the full year ended December 31, 2023. The company, known for its renewable natural gas and renewable fuels, reported a significant increase in sales within its India biodiesel segment, which reached $77.2 million, marking a 175% increase over the prior year. This growth was a highlight in a year where the company faced an overall net loss.

Financial Performance Overview

For the fourth quarter of 2023, Aemetis reported revenues of $70.8 million, a modest increase from $66.7 million in the same quarter of the previous year. The full-year revenues amounted to $186.7 million, with the India Biodiesel segment contributing $77.2 million and the California Renewable Natural Gas segment adding $5.5 million. Despite these increases, the company experienced a net loss of $25.4 million in the fourth quarter and $46.4 million for the full year.

The company's Cost of Goods Sold (COGS) saw a decrease, which, along with the revenue growth in the India segment, led to a gross profit of $2.0 million for the year, a positive shift from the gross loss reported in 2022. Selling, general, and administrative expenses increased to $39.3 million, influenced by stock compensation and reclassification of expenses during the Keyes plant maintenance cycle.

Operational and Financial Challenges

Operational challenges included an extended maintenance and upgrade cycle at the Keyes ethanol plant, which, while allowing for efficiency upgrades, also contributed to a decrease in revenue from the ethanol segment. The company also faced high natural gas prices in early 2023, which impacted operations.

Capital expenditures for 2023 totaled $33 million, reflecting the company's commitment to its Five Year Plan focusing on carbon intensity reduction and production expansion. Aemetis also secured new credit facilities and refinanced existing debt, providing long-term funding for its biogas projects.

Despite these strategic investments, the company's operating loss widened slightly to $37.4 million for the year, and interest expenses increased to $39.5 million, excluding accretion and other expenses. Cash at the end of 2023 was $2.7 million, down from $4.3 million at the end of 2022.

Strategic Developments and Future Outlook

Eric McAfee, Chairman and CEO of Aemetis, highlighted the company's operational milestones and the closure of a new credit facility, which is part of a strategic move to construct dairy digesters. Investors are encouraged to review the updated Aemetis Five Year Plan for more detailed insights into the company's future direction.

Aemetis remains focused on its mission to develop and commercialize innovative technologies that replace petroleum-based products and reduce greenhouse gas emissions. With its diverse portfolio, including a biogas digester network, ethanol production, and biodiesel facilities, Aemetis is positioning itself as a leader in the renewable energy sector.

For a more detailed analysis of Aemetis Inc (NASDAQ:AMTX)'s financial results, including the full income statement and balance sheet, please refer to the company's 8-K filing.

Value investors and potential GuruFocus.com members interested in the renewable energy sector and companies like Aemetis Inc (NASDAQ:AMTX) can find comprehensive financial data and analysis on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Aemetis Inc for further details.

This article first appeared on GuruFocus.