Aerie (AERI) to be Acquired by Alcon for $770M, Shares Up

Aerie Pharmaceuticals, Inc. AERI recently announced that it has entered into an agreement with Alcon ALC whereby the latter will acquire it for approximately $770 million.

The purchase price of $15.25 per share represents a premium of 37% to Aerie’s last closing price of $11.15 on Aug 22.

Consequently, shares are up in pre-market trading as investors are optimistic about the premium offered.

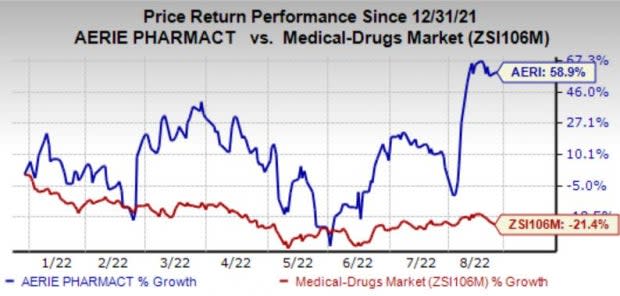

The company’s shares have surged 58.9% in the year so far against the industry’s decline of 21.4%.

Image Source: Zacks Investment Research

Aerie has two commercial products in its kitty — Rhopressa and Rocklatan. Rhopressa (netarsudil ophthalmic solution) 0.02% is a once-daily eye drop approved by the FDA to reduce elevated intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension. It was launched in the United States in April 2018.

Rocklatan (netarsudil and latanoprost ophthalmic solution) 0.02%/0.005% is a once-daily eye drop approved by the FDA for the reduction of elevated IOP in patients with open-angle glaucoma or ocular hypertension. It was launched in the United States in May 2019. It is a fixed-dose combination of Rhopressa and latanoprost ophthalmic solution (0.005%), a commonly prescribed drug for treating patients with open-angle glaucoma or ocular hypertension.

The addition of Aerie’s two drugs will broaden Alcon’s ophthalmology portfolio. The acquisition also adds a pipeline of preclinical ophthalmic pharmaceutical product candidates.

Alcon was the Swiss major Novartis’ NVS eye-care segment. Novartis spun off Alcon in 2019 to focus on its core business.

Following the spin-off, Alcon became a stand-alone, independent company.

Alcon’s recent expansion into the ophthalmology space includes acquisitions of the exclusive U.S. commercialization rights to Simbrinza from Novartis in April 2021 and of Eysuvis and Inveltys from Kala Pharmaceuticals, Inc. in May 2022.

Aerie generated product revenues of $63 million in the first half of 2022. Aerie expects total glaucoma franchise net product revenues of $130 million to $140 million, up 16% to 25% from 2021.

The acquisition is expected to be accretive to Alcon’s core earnings in 2024.

The transaction is anticipated to close in the fourth quarter of 2022.

Aerie currently carries a Zacks Rank #2 (Buy). Another top-ranked stock in the sector is Dynavax DVAX which carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dynavax’s earnings estimates have increased to $1.73 from $1.14 for 2022 over the past 60 days. Earnings of Dynavax have surpassed estimates in two of the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Alcon (ALC) : Free Stock Analysis Report

Aerie Pharmaceuticals, Inc. (AERI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research