Aerospace & Defense Aug 2 Earnings Roster: CW, TGI & SPR

Majority of the aerospace and defense stocks that are members of the prestigious S&P 500 cohort have beat on earnings as well as revenue estimates in the second-quarter reporting cycle, so far. Let’s see how some other players from this industry, namely Curtiss-Wright Corp. CW, Triumph Group TGI and Spirit AeroSystems SPR, might have performed. Their quarterly results are set to release tomorrow.

Factors That Influenced Aerospace & Defense Stocks

Per a recent report by the International Air Transport Association, industry-wide global revenue per kilometer increased 39.1% year over year in May 2023. This is indicative of the steadily growing air passenger traffic across the globe. This, in turn, is likely to significantly boost the second-quarter results of aerospace and defense stocks, particularly those engaged in commercial aviation.

Evidently, Boeing witnessed a solid year-over-year surge of 12.4% in its commercial shipments during the quarter to be reported. With BA being the nation’s largest jet maker, we expect the April-June quarter results of the remaining aerospace majors to reflect a similar improvement in delivery trends. Such solid deliveries might have boosted the overall top as well as bottom-line growth of the Aerospace sector, which houses all aerospace and defense stocks.

Stocks that are more focused on combat are also expected to have gained as a result of consistent government support. Notably, a steady order flow observed in the past couple of quarters, along with improving delivery trend in recent times, buoyed by recovering economic trends, is likely to have bolstered the aerospace and defense stocks’ second-quarter revenues.

However, persistent headwinds like supply-chain disruption, inflationary pressure, along with rising jet fuel prices as well as increasing policy rates by the Federal Reserve, might have adversely impacted the industry’s bottom-line performance.

Q2 Projections

The Aerospace sector’s earnings are expected to decline 4.1% from the prior-year quarter’s reported figure. Revenues are projected to improve 10.6%.

For more details on quarterly releases, you can go through the latest Earnings Preview.

Aerospace & Defense Stocks to Watch

Let's take a look at three defense companies that are scheduled to post their quarterly reports on Aug 2 and find out how things might have shaped up prior to the announcements.

Curtiss-Wright delivered a four-quarter average earnings surprise of 4.03%. The Zacks Consensus Estimate for second-quarter earnings is pegged at $1.97 per share, implying a 7.7% year-over-year improvement.

The consensus mark for the company’s second-quarter revenues is pegged at $648.8 million, indicating growth of 6.5% from the year-ago quarter’s reported figure.

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Curtiss-Wright has an Earnings ESP of +0.13% and a Zacks Rank #2 at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

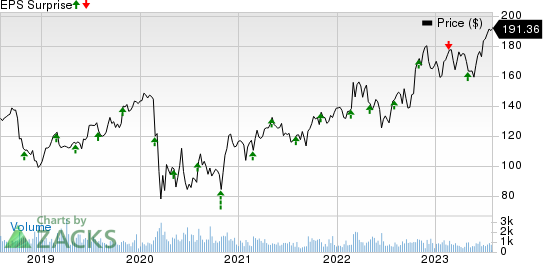

Curtiss-Wright Corporation Price and EPS Surprise

Curtiss-Wright Corporation price-eps-surprise | Curtiss-Wright Corporation Quote

Triumph Group delivered a four-quarter average earnings surprise of 94.58%. The bottom-line estimate for fiscal first-quarter 2024 is pinned at a loss of 5 cents per share, implying a deterioration from the year-ago quarter’s reported earnings of 12 cents per share.

The consensus mark for revenues is pegged at $324 million, indicating a 7.3% year-over-year decline.

Triumph Group has an Earnings ESP of -8.70% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Triumph Group, Inc. Price and EPS Surprise

Triumph Group, Inc. price-eps-surprise | Triumph Group, Inc. Quote

Spirit AeroSystems delivered a four-quarter average negative earnings surprise of 295.17%. The bottom-line estimate for the second quarter is pegged at a loss of 79 cents per share, implying an improvement from the year-ago quarter’s reported loss of $1.21.

The consensus mark for revenues is pinned at $1.27 billion, indicating a year-over-year improvement of 1%.

Spirit AeroSystems has an Earnings ESP of -86.71% and a Zacks Rank #5 (Strong Sell) at present.

Spirit Aerosystems Holdings, Inc. Price and EPS Surprise

Spirit Aerosystems Holdings, Inc. price-eps-surprise | Spirit Aerosystems Holdings, Inc. Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Triumph Group, Inc. (TGI) : Free Stock Analysis Report

Spirit Aerosystems Holdings, Inc. (SPR) : Free Stock Analysis Report

Curtiss-Wright Corporation (CW) : Free Stock Analysis Report