AeroVironment Inc (AVAV) Soars with Record Q3 Revenue and Raised FY2024 Guidance

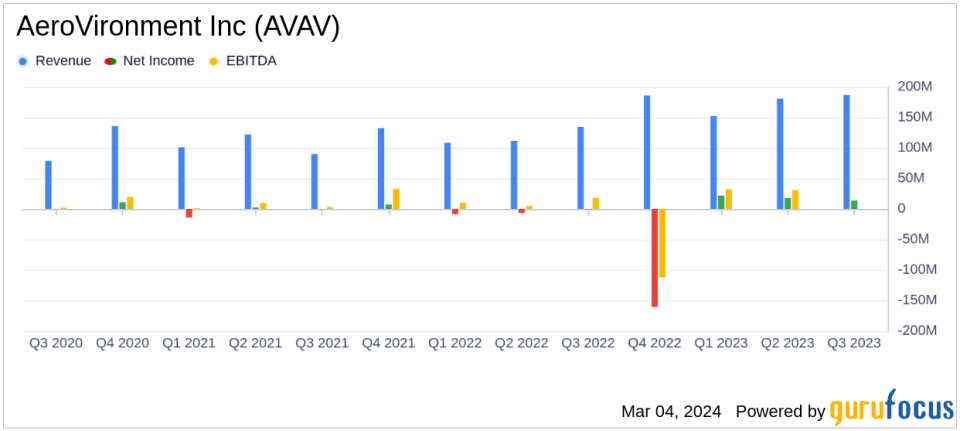

Revenue: Increased by 39% to $186.6 million in Q3 FY2024.

Net Income: Grew to $13.9 million, or $0.50 per diluted share.

Gross Margin: Improved to 36% from 34% in the same quarter last year.

Backlog: Funded backlog rose to $462.8 million as of January 27, 2024.

FY2024 Guidance: Revenue now expected to be between $700 million and $710 million.

On March 4, 2024, AeroVironment Inc (NASDAQ:AVAV) released its 8-K filing, announcing financial results for the fiscal third quarter ended January 27, 2024. The company, a leading provider of unmanned aircraft systems and tactical missile systems for the United States Department of Defense and allied international governments, reported a significant increase in revenue and net income, attributing the success to strong demand and solid operating execution.

Financial Highlights and Company Performance

AeroVironment Inc (NASDAQ:AVAV) achieved a record third quarter revenue of $186.6 million, marking a nearly 40% increase over the same period last fiscal year. This growth was driven by a 140% increase in revenue from the Loitering Munitions Systems segment and a 23% increase in Unmanned Systems, though partially offset by a decrease in MacCready Works.

The company's gross margin also saw a notable increase, rising to 36% from 34% in the prior year's quarter. This improvement was primarily due to a higher proportion of product revenue and a decrease in depreciation charges for in-service assets, despite an increase in intangible amortization expense and other related non-cash purchase accounting expenses.

Income from operations for the quarter stood at $14.3 million, a substantial improvement from $4.6 million in the third quarter of the previous fiscal year. This was mainly due to the higher gross margin, which offset increases in research and development and selling, general, and administrative expenses.

Net income attributable to AeroVironment for the third quarter was $13.9 million, or $0.50 per diluted share, compared to a net loss of $(0.7) million, or $(0.03) per diluted share, in the prior-year period. The company also reported a strong funded backlog of $462.8 million as of January 27, 2024, compared to $424.1 million as of April 30, 2023.

Looking Ahead

With the increased global demand for AeroVironment's solutions and a strong backlog, the company is optimistic about its growth prospects. As a result, it has raised and narrowed its fiscal year revenue guidance for 2024 to between $700 million and $710 million and anticipates double-digit revenue growth in fiscal year 2025.

"Once again, AeroVironment has delivered outstanding results, including a record for third quarter revenue thats nearly 40% above the same period last fiscal year," said Wahid Nawabi, AeroVironment chairman, president and chief executive officer. "Solid bottom-line results, fueled by record demand and strong operating execution, have us on track for our best year ever."

The company's financial achievements underscore its importance in the Aerospace & Defense industry, where technological innovation and reliable performance are critical. The growth in the Loitering Munition Systems segment, in particular, highlights the increasing reliance on unmanned systems for defense and security purposes.

Financial Statements Overview

AeroVironment Inc (NASDAQ:AVAV)'s balance sheet reflects a healthy financial position with total assets of $980.3 million as of January 27, 2024. The company's cash and cash equivalents stood at $107.7 million, and it has managed to maintain a robust equity base with total stockholders' equity of $812.9 million.

The income statement and cash flow statements further demonstrate the company's strong performance, with significant improvements in net income and cash provided by operating activities. These financial metrics are crucial for the company's ability to invest in new technologies, expand its product offerings, and maintain its competitive edge in the market.

In conclusion, AeroVironment Inc (NASDAQ:AVAV)'s latest earnings report reflects a company that is not only growing but also managing its finances effectively in a competitive and dynamic industry. The raised guidance for fiscal year 2024 is a testament to the company's positive outlook and strategic positioning for future growth.

For more detailed information and to listen to the earnings call, investors are encouraged to visit the Investor Relations page of AeroVironment, Inc.'s website at http://investor.avinc.com.

Explore the complete 8-K earnings release (here) from AeroVironment Inc for further details.

This article first appeared on GuruFocus.