Is The AES Corp (AES) Modestly Undervalued? A Comprehensive Analysis

On July 23, 2023, The AES Corp (NYSE:AES) recorded a 3.02% gain, with its stock price reaching $22.49. With a market cap of $15.1 billion, the company's GF Value stands at $25.88, suggesting that it's modestly undervalued. The AES Corp, a global power company, operates a diverse generation portfolio of over 32 gigawatts, including renewable energy, gas, coal, and oil. Serving 2.6 million customers through its six electric utilities, the company's sales reached $13 billion, despite a Loss Per Share of $-0.82.

Understanding the GF Value of The AES Corp (NYSE:AES)

The AES (NYSE:AES) stock appears to be modestly undervalued according to the GuruFocus Value calculation. The GF Value, which represents the fair value at which the stock should ideally be traded, is calculated based on historical trading multiples, an adjustment factor from GuruFocus, and estimates of future business performance. If a stock's price is significantly above the GF Value Line, it's overvalued and likely to deliver poor future returns. Conversely, if it's significantly below the GF Value Line, its future return will likely be higher. Given The AES's current price and market cap, the stock seems modestly undervalued.

Because The AES is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

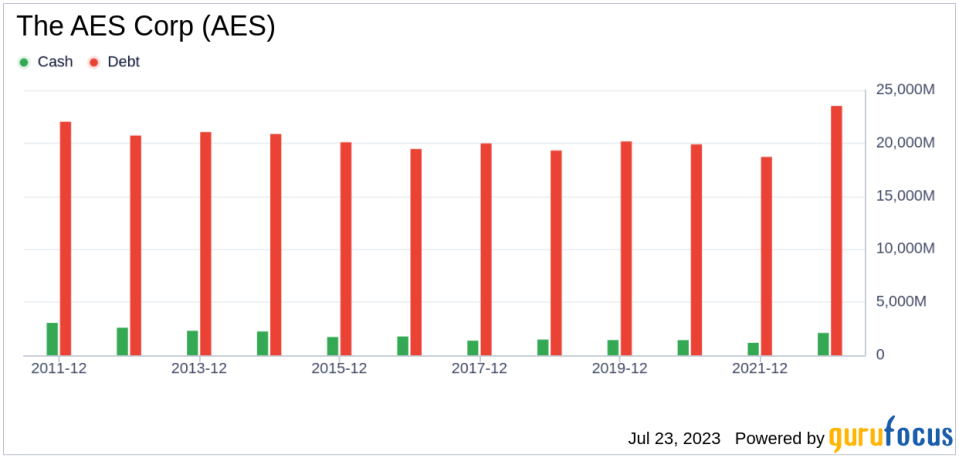

Financial Strength of The AES

Companies with poor financial strength pose a high risk of permanent capital loss. To avoid this, investors must research and review a companys financial strength before purchasing shares. Two key indicators of financial strength are the cash-to-debt ratio and interest coverage. The AES has a cash-to-debt ratio of 0.09, ranking worse than 74.85% of companies in the Utilities - Regulated industry. The overall financial strength of The AES is 3 out of 10, indicating that its financial strength is poor.

Profitability and Growth of The AES

Investing in profitable companies, especially those with consistent profitability over the long term, poses less risk. A company with high profit margins is also typically a safer investment than one with low profit margins. The AES has been profitable 6 times over the past 10 years. With a revenue of $13 billion and a Loss Per Share of $-0.82 over the past twelve months, its operating margin is 18.47%, ranking better than 68.2% of companies in the Utilities - Regulated industry. Overall, GuruFocus ranks the profitability of The AES at 6 out of 10, indicating fair profitability.

Growth is a key factor in the valuation of a company. Faster-growing companies create more value for shareholders, especially if the growth is profitable. The 3-year average annual revenue growth of The AES is 7.3%, ranking worse than 52.59% of companies in the Utilities - Regulated industry. The 3-year average EBITDA growth rate is -13.6%, ranking worse than 89.11% of companies in the same industry.

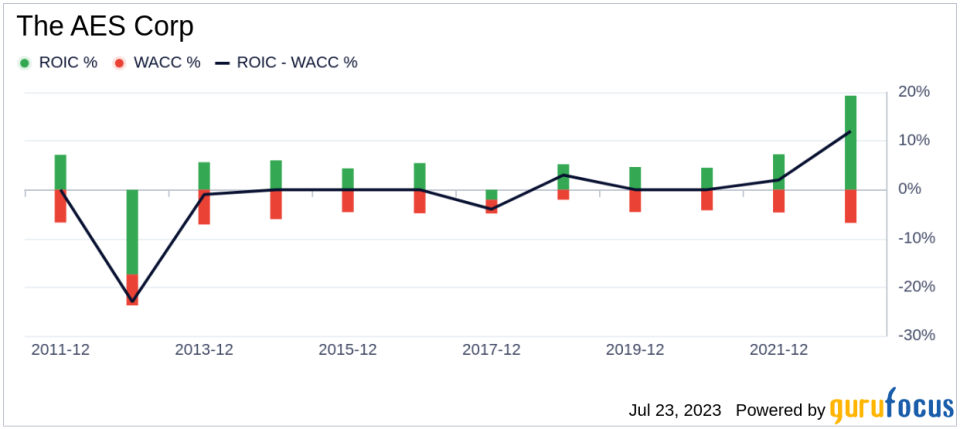

Comparing ROIC and WACC of The AES

Comparing a companys return on invested capital (ROIC) to its weighted cost of capital (WACC) is another way to evaluate its profitability. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, The AESs ROIC was 19.51, while its WACC came in at 7.19.

Conclusion

In conclusion, The AES Corp's (NYSE:AES) stock appears to be modestly undervalued. Despite its poor financial condition, the company's profitability is fair. However, its growth ranks worse than 89.11% of companies in the Utilities - Regulated industry. For more about The AES stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.