Aeva Technologies Inc (AEVA) Reports Steady Revenue and Shrinking Losses in 2023

Order Book: Aeva Technologies Inc (NYSE:AEVA) boasts a $1 billion order book with Daimler Truck.

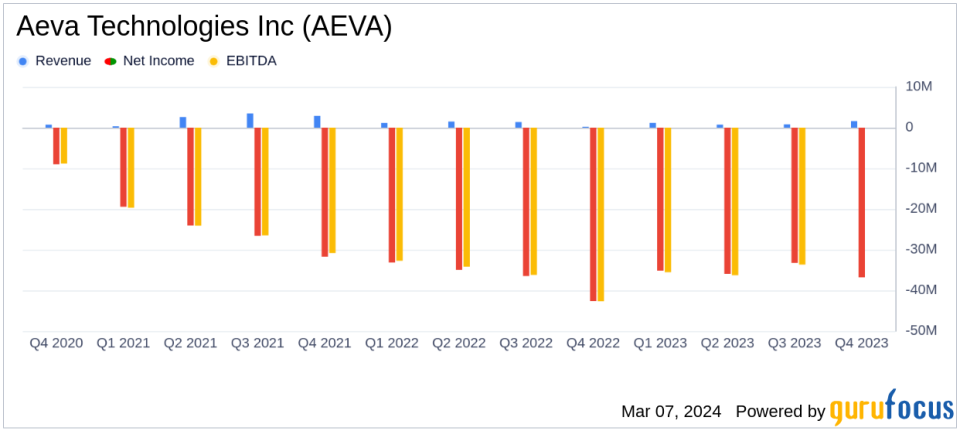

Revenue: Q4 2023 revenue increased to $1.6 million from $0.2 million in Q4 2022.

Full Year Revenue: Full year 2023 revenue slightly up at $4.3 million compared to $4.2 million in 2022.

Operating Loss: GAAP operating loss reduced to $36.8 million in Q4 2023 from $44.4 million in Q4 2022.

Net Loss Per Share: GAAP net loss per share improved to $0.18 in Q4 2023 from $0.20 in Q4 2022.

Liquidity: Cash, cash equivalents, and marketable securities stood at $221.0 million as of December 31, 2023.

On March 5, 2024, Aeva Technologies Inc (NYSE:AEVA), a pioneer in next-generation sensing and perception systems, released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. The company, known for its Frequency Modulated Continuous Wave (FMCW) sensing technology, designs a 4D LiDAR-on-chip that, along with its proprietary software applications, aims to enable the adoption of LiDAR across various applications from automated driving to consumer electronics, and more.

Financial Performance and Highlights

Aeva Technologies Inc (NYSE:AEVA) reported a significant milestone with Daimler Truck selecting the company to supply long and ultra-long range LiDARs and perception software for its series production vehicle program, contributing to an order book of $1 billion. The company also announced Aeva Atlas, the worlds first automotive-grade 4D LiDAR for mass production, and is on track for its first industrial program deployment with Nikon by the end of 2024.

For the fourth quarter of 2023, AEVA saw an increase in revenue to $1.6 million, up from $0.2 million in the same quarter of the previous year. The full year revenue also saw a slight increase to $4.3 million in 2023 from $4.2 million in 2022. The company's GAAP operating loss for Q4 2023 was $36.8 million, a reduction from a loss of $44.4 million in Q4 2022. The full year GAAP operating loss also decreased to $147.8 million in 2023 from $152.0 million in 2022. The GAAP net loss per share improved to $0.18 in Q4 2023, down from $0.20 in Q4 2022, and the full year GAAP net loss per share decreased to $0.66 in 2023 from $0.68 in 2022.

Balance Sheet and Cash Flow

The balance sheet of AEVA as of December 31, 2023, showed cash, cash equivalents, and marketable securities totaling $221.0 million, with an undrawn facility of $125.0 million. The company's cash flow statements indicate a net loss of $149.3 million for the year ended December 31, 2023, with net cash used in operating activities amounting to $118.8 million.

Management Commentary

2023 was a landmark year for Aeva, as we secured multiple production awards, including our first major automotive production win with Daimler Truck, one of the worlds largest commercial trucking OEMs, said Soroush Salehian, Co-Founder and CEO at Aeva. We believe this win is just the beginning of the growing consensus around FMCW as OEMs look to introduce highway speed autonomy at mass scale. The unique performance and maturity of Aevas 4D LiDAR, along with our financial strength, position us to lead this adoption, as we progress on multiple additional automotive RFQs anticipated to be awarded this year.

Outlook and Challenges

While AEVA has demonstrated a strong order book and technological advancements, the company faces the challenge of transitioning from a development stage to mass production. The ability to scale production and reduce costs will be critical to AEVA's success in the competitive automotive and industrial markets. Moreover, the company's continued operating losses highlight the need for careful financial management and the successful execution of its strategic partnerships and customer engagements.

AEVA's performance is pivotal as it reflects the company's potential to capitalize on the growing demand for advanced sensing technologies in the automotive industry and beyond. The company's financial achievements, such as the reduced operating losses and the maintained liquidity, are important indicators of its ability to sustain operations and invest in growth opportunities.

Investors and stakeholders will be watching closely as AEVA progresses towards its anticipated additional automotive RFQs awards and the deployment of its industrial program with Nikon. The company's strategic moves in 2024 will be crucial in determining its position in the market and its long-term financial health.

For further details on Aeva Technologies Inc's financial results and strategic initiatives, interested parties can join the conference call and live webcast hosted by the company.

For more in-depth analysis and up-to-date financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Aeva Technologies Inc for further details.

This article first appeared on GuruFocus.