Affiliated Managers Group Inc (AMG) Reports Mixed Results for Q4 and Full Year 2023

Assets Under Management (AUM): Increased to $672.7 billion by the end of 2023.

Net Income: Reported at $672.9 million for the full year, with a Q4 contribution of $196.2 million.

Earnings Per Share (EPS): Diluted EPS stood at $5.15 for Q4 and $17.42 for the full year.

Economic Earnings Per Share: Reached $6.86 in Q4 and $19.48 for 2023, reflecting strategic execution.

Share Repurchases: AMG repurchased approximately $574 million in common stock in 2023.

Strategic Investments: Completed investment in Ara Partners, enhancing exposure to industrial decarbonization.

On February 5, 2024, Affiliated Managers Group Inc (NYSE:AMG) released its 8-K filing, detailing its financial and operating results for the fourth quarter and the full year of 2023. AMG, a global partner to independent investment management firms, reported an increase in Assets Under Management (AUM) to $672.7 billion by year-end, up from $650.8 billion at the end of the previous year.

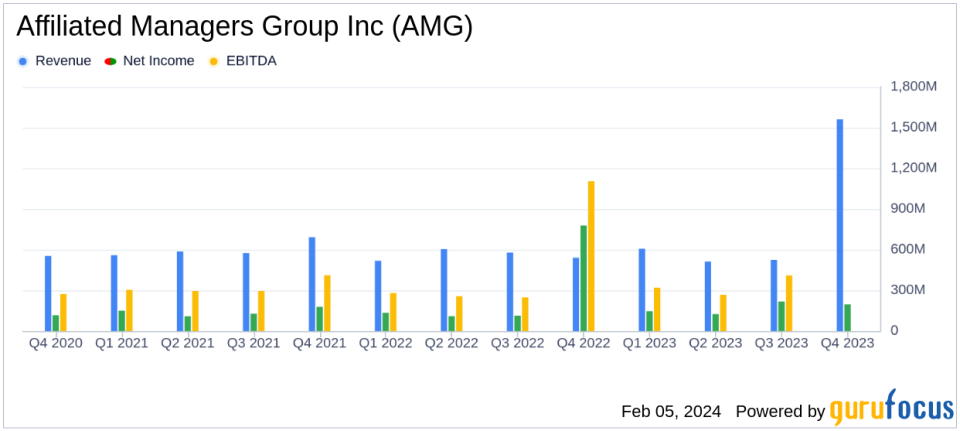

AMG's net income for the controlling interest was reported at $672.9 million for the full year, with a fourth-quarter contribution of $196.2 million. The diluted earnings per share (EPS) stood at $5.15 for the fourth quarter and $17.42 for the full year. The company also reported Economic Earnings per share of $19.48 for 2023, reflecting the disciplined execution of its strategy, including capital allocation to high-growth areas.

Financial Performance and Capital Management

The company's financial achievements are significant in the asset management industry, where the management of AUM and the ability to generate consistent earnings are critical. AMG's strategic investments, such as the one in Ara Partners, are important as they enhance the company's exposure to secular growth areas like industrial decarbonization. Additionally, the repurchase of approximately 10% of its shares outstanding demonstrates confidence in the company's value and a commitment to returning capital to shareholders.

AMG's President and CEO, Jay C. Horgen, commented on the company's performance, stating:

"AMG reported 2023 Economic Earnings per share of $19.48, reflecting the disciplined execution of our strategy, including allocating capital to the areas of highest growth and return. AMG's focus on investing in secular growth areas continued to diversify our business, further distinguishing our unique profile, which includes independent firms operating in private markets, liquid alternatives, and differentiated active equities."

Despite the positive aspects of AMG's performance, the company faced challenges, including net client cash outflows of $29.2 billion for the full year and $6.1 billion for the fourth quarter. These outflows can lead to concerns about the company's ability to attract and retain capital, which is essential for growth in the asset management industry.

Income Statement and Balance Sheet Highlights

AMG's income statement reflects a decrease in aggregate fees from $5.56 billion in the previous year to $5.07 billion in 2023. The balance sheet shows a robust capital position, with significant share repurchases signaling a strong liquidity position. The company's cash flow statement indicates active capital management, with share repurchases and dividend payments to shareholders.

Key metrics such as AUM, net income, EPS, and economic EPS are crucial for evaluating the company's performance. AUM indicates the scale of the business and its ability to generate fee revenue, while net income and EPS provide insights into profitability and shareholder value. Economic EPS, a non-GAAP measure, offers a view of the company's earnings that excludes certain non-cash and one-time items, providing a clearer picture of the company's operating performance.

In conclusion, AMG's 2023 performance demonstrates a strategic focus on growth areas and shareholder value, despite market challenges. The company's investment in new affiliates and share repurchase program underscore its commitment to long-term value creation. As AMG enters 2024, it aims to leverage its competitive advantages and partnership model to further enhance its position in the asset management industry.

For a more detailed analysis of AMG's financial results and strategic initiatives, investors and interested parties can join the conference call with AMG's management or access the presentation and replay information provided on AMG's website.

Explore the complete 8-K earnings release (here) from Affiliated Managers Group Inc for further details.

This article first appeared on GuruFocus.