Affirm (AFRM) Up 30% Since Earnings on Investors' Confidence

Affirm Holdings, Inc. AFRM shares have gained 30% since it reported better-than-expected fourth-quarter fiscal 2023 results on Aug 24, 2023. Increased active merchants, Gross Merchandise Volume (GMV), transactions and interest income benefited its results. The company also provided some encouraging outlook, which investors are liking, pushing the stock up, in turn.

AFRM reiterated its expectation to reach profitability in fiscal 2024 on an adjusted operating income basis, which will be a significant milestone. Its network growth as a result of disciplined performance in the past few quarters is a major tailwind. Rising transactions will likely continue aiding its performance.

The adjusted operating margin is anticipated to be more than 2% in fiscal 2024, indicating a massive improvement from negative 4.6% in fiscal 2023. As such, the Zacks Consensus Estimate for fiscal 2024 bottom line indicates a 10.5% year-over-year improvement. The company expects the weighted average shares outstanding to be 313 million in fiscal 2024.

Affirm forecasts fiscal 2024 GMV of more than $24 billion, up from the fiscal 2023 level of $20.2 billion. Revenues, as a percentage of GMV, are expected to be similar to the fiscal 2023 level of 7.9%. This means that revenues will see a definite increase in fiscal 2024. The Zacks Consensus Estimate for fiscal 2024 revenues is pegged at more than $1.8 billion, suggesting a 15.7% year-over-year increase.

Despite the upsides, investors are keeping an eye on some factors and rightfully so. The stock is currently trading at 2.78X forward 12-month sales, which is higher than 1.63X of the Zacks Business Services industry, marking it overvalued.

As the company is including consumers’ student loan balances in underwriting decisions, when loan repayments resume (Oct 1, 2023), it is expected to bring a modest headwind to AFRM’s GMV level.

The rising costs trend is also standing in the way for the company to reach its potential profit growth level. Total operating expenses rose 26% year over year in fiscal 2023, primarily due to higher funding costs and processing and servicing costs. The metric also witnessed a 77% jump in fiscal 2022. Nevertheless, decreasing loss on loan purchase commitment can provide an impetus.

Surprise History

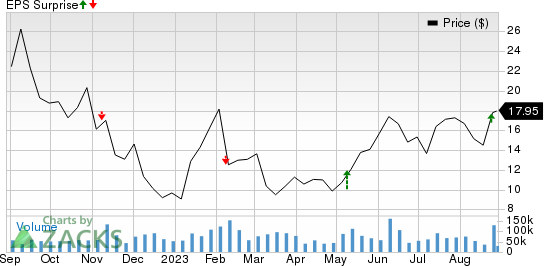

Affirm beat earnings estimates in two of the past four quarters and missed on the other occasions, with an average surprise of 7.5%. This is depicted in the graph below.

Affirm Holdings, Inc. Price and EPS Surprise

Affirm Holdings, Inc. price-eps-surprise | Affirm Holdings, Inc. Quote

Zacks Rank & Key Picks

Affirm currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Business Services sector are Paysafe Limited PSFE, FirstCash Holdings, Inc. FCFS and PagSeguro Digital Ltd. PAGS. While Paysafe currently sports a Zacks Rank #1 (Strong Buy), FirstCash and PagSeguro carry a Zacks Rank #2 (Buy), each, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Paysafe’s current year bottom line suggests 1.3% year-over-year growth. Headquartered in London, PSFE beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 154%.

The Zacks Consensus Estimate for FirstCash’s current year earnings indicates a 6.4% year-over-year increase. Fort Worth, TX-based FCFS beat earnings estimates in all the past four quarters, with an average surprise of 7.3%.

The Zacks Consensus Estimate for PagSeguro’s current year bottom line suggests 13% year-over-year growth. Based in Sao Paulo, Brazil, PAGS beat earnings estimates in all the past four quarters, with an average surprise of 9.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstCash Holdings, Inc. (FCFS) : Free Stock Analysis Report

PagSeguro Digital Ltd. (PAGS) : Free Stock Analysis Report

Affirm Holdings, Inc. (AFRM) : Free Stock Analysis Report

Paysafe Limited (PSFE) : Free Stock Analysis Report