Affirm (AFRM) to Offer Pay Over Time Options to Evolve Customers

Affirm Holdings, Inc. AFRM recently disclosed that it has partnered with Evolve to offer its pay over time options to its customers. Affirm, as a payment company, aims to provide flexible payment options to customers via its buy now pay later feature. Evolve, being a vacation rental hospitality company, will be able to offer travelers with AFRM’s pay over time options, thus improving their top line.

The deal comes at an opportune time for AFRM as demand for flexible payment options related to travel is rapidly increasing. As people are trying to make up for their missed vacations during the pandemic by planning to travel despite rising costs, this offering is an attractive one for travelers.

Eligible travelers will be able to book vacation rentals with AFRM’s pay over time options without any fear of hidden fees. Evolve customers can divide the total cost of their booking over $500 into monthly installments for 0% APR. The transparent nature of Affirm’s solutions enables customers to get a clear understanding of the total purchase cost at the time of checkout.

Per a recent Affirm research, more than 90% of Americans plan to undertake traveling in 2024. This implies the attractiveness of AFRM’s transparent payment options in times of rising inflation.This partnership adds Evolve to Affirm’s network of more than 266,000 merchants. The massive network includes merchants like Great Wolf Lodge, American Airlines, CheapOair and many others. Increased active merchants, gross merchandise volume and transactions are aiding AFRM’s results.

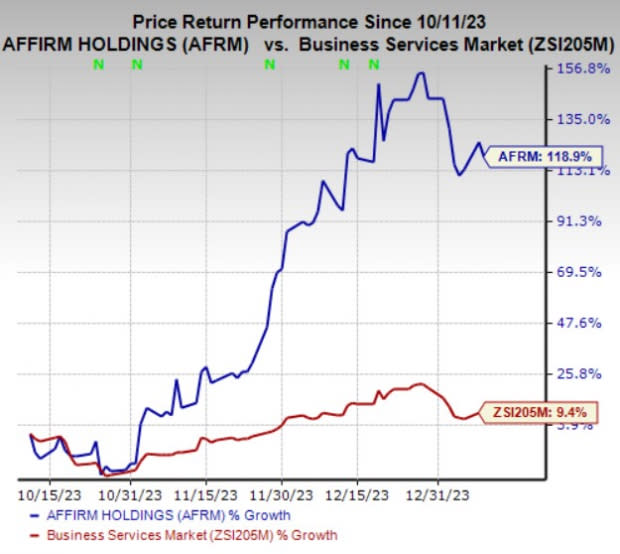

Shares of Affirm have surged 118.9% in the past three months compared with the industry’s 9.4% growth. AFRM currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader Business Services space are Shift4 Payments, Inc. FOUR, Envestnet, Inc. ENV and FirstCash Holdings, Inc. FCFS. While Shift4 Payments and Envestnet currently sport a Zacks Rank #1 (Strong Buy), FirstCash Holdings carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Shift4 Payments’ current-year earnings is pegged at $2.92 per share, which indicates 110.1% year-over-year growth. Allentown, PA-based FOUR beat earnings estimates in all the past four quarters, with an average surprise of 25%.

The Zacks Consensus Estimate for Envestnet’s current-year bottom line suggests 7.5% year-over-year growth. Based in Berwyn, PA, ENV beat earnings estimates in three of the past four quarters, missing once, with an average surprise of 3.2%.

The Zacks Consensus Estimate for FirstCash’s current-year bottom line indicates 13.1% year-over-year growth. Headquartered in Fort Worth, TX, FCFS beat earnings estimates in all the past four quarters, with an average surprise of 7.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstCash Holdings, Inc. (FCFS) : Free Stock Analysis Report

Envestnet, Inc (ENV) : Free Stock Analysis Report

Shift4 Payments, Inc. (FOUR) : Free Stock Analysis Report

Affirm Holdings, Inc. (AFRM) : Free Stock Analysis Report