Affirm Holdings Inc (AFRM) Reports Accelerated Growth and Improved Profitability in Q2 2024

Gross Merchandise Volume (GMV): Increased by 32% year-over-year to $7.5 billion.

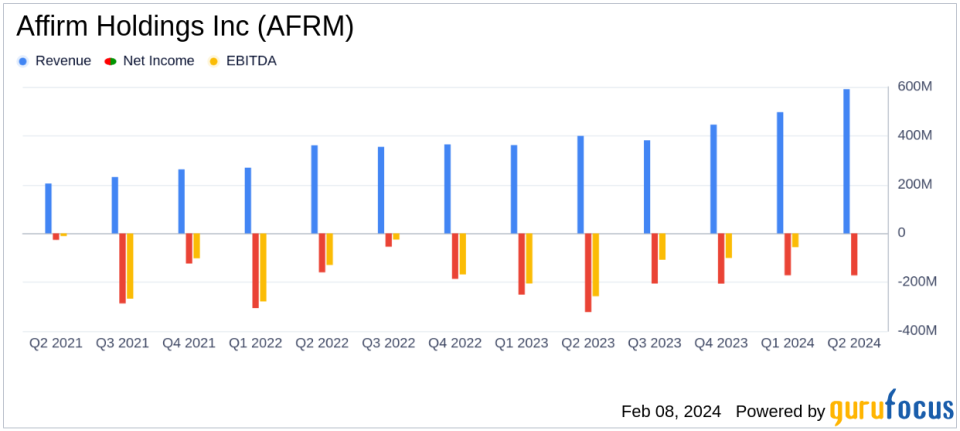

Revenue: Grew by 48% year-over-year to $591 million.

Revenue Less Transaction Costs (RLTC): Jumped by 68% year-over-year to $242 million.

Adjusted Operating Income: Improved significantly to $93 million compared to a loss of $62 million in FQ223.

Active Consumers: Grew by 13% year-over-year to 17.6 million.

Active Merchants: Increased by 15% year-over-year to 279,000.

Outlook for Fiscal Year 2024: GMV projected to exceed $25.25 billion with an Adjusted Operating Margin of over 11%.

On February 8, 2024, Affirm Holdings Inc (NASDAQ:AFRM) released its 8-K filing, showcasing a quarter marked by significant growth and improved profitability. The company, known for its digital and mobile-first commerce platform, has continued to expand its merchant network and enhance its product offerings, including the popular Affirm Card.

Financial Performance Highlights

Affirm's financial achievements this quarter are particularly noteworthy given the backdrop of a challenging economic environment. The company's GMV growth, which has accelerated for the third consecutive quarter, is a testament to the strength and appeal of its platform among both consumers and merchants. The substantial increase in revenue and RLTC indicates that Affirm is not only growing its user base but also managing to monetize its services more effectively.

The impressive turnaround to a $93 million Adjusted Operating Income from a significant loss in the previous year highlights the company's successful efforts in building operating leverage and maintaining credit performance. This is crucial for Affirm as it seeks to reassure investors of its path to sustained profitability.

Strategic and Operational Developments

Affirm's strategic focus on disciplined execution and operational efficiency has paid dividends, as evidenced by the robust growth in its direct-to-consumer business and the scaling of the Affirm Card. The card's GMV of approximately $397 million, driven by over 700 thousand active consumers, underscores the product's growing popularity and the company's potential to tap into the offline retail market.

The company's active consumer base has expanded to 17.6 million, a 13% increase year-over-year, while active merchants have grown to 279,000. This expansion of Affirm's network is a critical component of its growth strategy, as it allows for greater diversification and resilience against economic fluctuations.

Challenges and Outlook

Despite the positive results, Affirm faces challenges, including the need to manage transaction costs, which increased by $94 million year-over-year, and the impact of a higher interest rate environment on funding costs. However, the company's proactive capital management and strong credit performance position it well to navigate these headwinds.

Looking ahead, Affirm's financial outlook for fiscal year 2024 is optimistic, with expectations for GMV to surpass $25.25 billion and an Adjusted Operating Margin of more than 11%. This forward-looking perspective, combined with the company's strategic initiatives, suggests a continued trajectory of growth and profitability.

Value investors may find Affirm's latest earnings report indicative of the company's potential for long-term value creation, given its strong performance metrics, strategic growth initiatives, and focus on operational efficiency.

For a more detailed analysis of Affirm Holdings Inc (NASDAQ:AFRM)'s financial performance and strategic direction, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Affirm Holdings Inc for further details.

This article first appeared on GuruFocus.