Affirm Stock: Buy, Sell, or Hold?

The introduction of buy now, pay later (BNPL) services has sparked fresh conversations about how young consumers borrow money. While it's hard to see credit cards disappearing completely, there's also a convincing argument that BNPL has enough staying power to draw investor interest.

Affirm (NASDAQ: AFRM) is one of the companies vying for dominance in a crowded BNPL field. Investors don't like hearing about competition, but all young industries are full of it. It's also an opportunity to examine companies before they grow into household names.

This company's unique traits help it stand out among the BNPLs, and they position the business and investors for success over the coming years.

Here are four reasons to buy and hold this BNPL player today.

1. Affirm does things differently

The buy now, pay later concept is quite simple. Consumers can borrow funds to pay for purchases, paying it back in various ways. That may be four interest-free installments or a short-term, (sometimes) interest-bearing loan of up to 36 months in some cases. The significant difference between BNPL and credit cards is this: Credit cards are revolving debt that works up a balance that becomes hard to pay down. BNPL treats each purchase as a new loan. It gives consumers more transparency into precisely what they're borrowing.

Now, Affirm goes an extra step by not charging any fees. It may charge interest on loans, but it doesn't charge fees for installments or late fees if you're late. It often makes money on merchants, charging them a percentage of the transaction. Affirm's business model can be a bit complex because it has multiple buckets of revenue pouring into the top line, including merchant fees, interest, and investment income.

However, overall, Affirm aims to be the most consumer-friendly financial product on the market. It emphasizes transparency and its no-fee approach. That has led to solid growth. Affirm has over 17.1 million active consumers using it and works with over 279,000 active merchants.

2. Elite strategic positioning for online and offline growth

What separates Affirm from many competitors, like Afterpay and Klarna, are Affirm's strategic relationships with some of the most prominent U.S. retailers. Affirm has partnerships with Amazon, Walmart, and Shopify, giving it tremendous exposure to online shopping. Amazon alone has a 38% market share of e-commerce in the United States.

Affirm is smartly trying to take its business offline with its Affirm Card. A smart debit card lets shoppers use it for daily purchases by linking it to a bank account. Users can then retroactively go into their Affirm app and parse purchases into BNPL installments.

The card has been widely available for about a year and has roughly 800,000 users. Those with the card are four times more engaged on Affirm than non-cardholders. It's a significant engagement catalyst to watch over the long term.

3. The BNPL industry could be huge

According to a study by eMarketer, approximately 37% of Generation Z and 32% of millennials have recently used a BNPL product. The number of consumers using BNPL could surpass 100 million by next year. That tremendous momentum could mean putting at least a dent in credit card usage as young consumers gravitate toward this new way to borrow.

Translating that to dollars, the global BNPL market was an estimated $6.1 billion in 2022 and could grow by an average of 26% annually to over $37 billion by 2030, according to Research and Markets.

That means steadily strong growth for the major players, and it's hard not to see Affirm factoring into that with its current momentum. Users grew 16% year over year in the company's second quarter of fiscal year 2024.

4. Managing risk successfully

The biggest concern I've seen around BNPL is that consumers default on loans. That's a risk with any lender, but the numbers show Affirm is doing a good job underwriting its loans. The company benefits from primarily offering short-term loans, which means it can respond swiftly to changes in economic conditions.

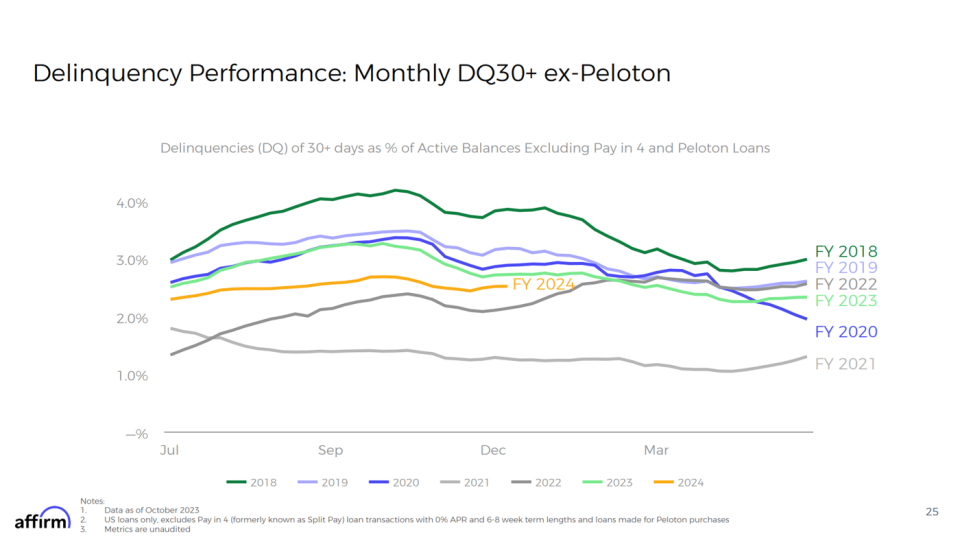

According to Affirms data, its delinquency rate (excluding Peloton) through two quarters of fiscal year 2024 is about 2.5% -- below 2018 levels but above the stimulus-fueled 2021. It's below 2023; in other words, things are stable.

Here's the bottom line

The company could someday be a prominent fintech business with many millions of customers. Today, shares are worth a market cap of $11 billion. PayPal was worth hundreds of billions at one point. Affirm may never reach that pinnacle, but there's room for growth.

This stock still has much to prove, but Affirm has done well in a challenging environment as interest rates rose. Consider buying and holding Affirm in a long-term portfolio and letting it blossom into its full potential as a high-risk, high-reward investment.

Should you invest $1,000 in Affirm right now?

Before you buy stock in Affirm, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Affirm wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Justin Pope has positions in Affirm. The Motley Fool has positions in and recommends Amazon, PayPal, Peloton Interactive, Shopify, and Walmart. The Motley Fool recommends the following options: short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

Affirm Stock: Buy, Sell, or Hold? was originally published by The Motley Fool