AG Mortgage Investment Trust Inc CEO Acquires 50,000 Shares

Thomas Durkin, CEO and President of AG Mortgage Investment Trust Inc (NYSE:MITT), has made a significant purchase of company stock, according to a recent SEC filing. On February 23, 2024, the insider acquired 50,000 shares of the real estate investment trust, which specializes in residential mortgage assets, other real estate-related securities, and financial assets. The transaction is notable as it reflects the insider's commitment to the company's future.

AG Mortgage Investment Trust Inc operates as a real estate investment trust (REIT) that focuses on investing in, acquiring, and managing a diversified portfolio of residential mortgage assets, other real estate-related securities, and financial assets. The company is externally managed by AG REIT Management, LLC, a subsidiary of Angelo, Gordon & Co., L.P., a leading alternative investment firm.

Insider transactions are closely monitored by investors as they can provide insights into a company's internal perspective. An insider buy, such as the one executed by Thomas Durkin, can suggest confidence in the company's prospects and often signals a positive outlook from those who are most familiar with the business.

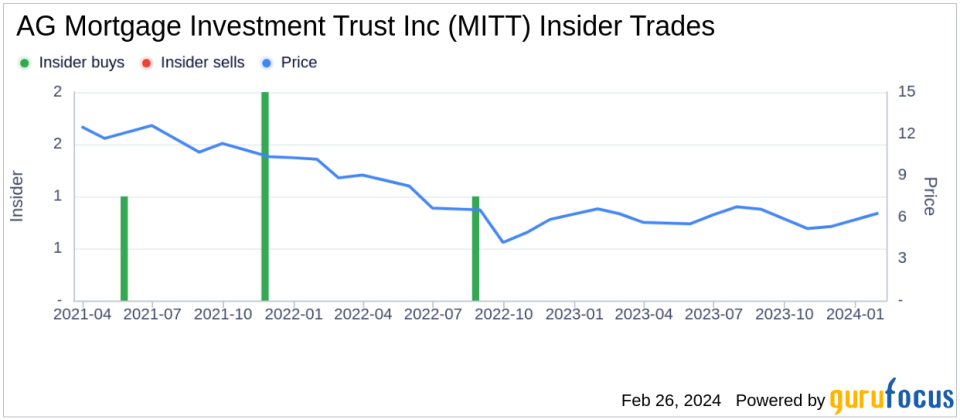

Over the past year, Thomas Durkin has purchased a total of 50,000 shares and has not sold any shares, indicating a bullish stance on the company's trajectory. The overall insider transaction history for AG Mortgage Investment Trust Inc shows a pattern of more insider buying than selling, with 1 insider buy and 0 insider sells over the past year.

On the day of the insider's recent purchase, shares of AG Mortgage Investment Trust Inc were trading at $6.12, resulting in a market cap of $184.274 million. The price-earnings ratio of the stock stood at 11.38, which is below the industry median of 16.95, suggesting a potentially undervalued position relative to its peers.

Furthermore, with a share price of $6.12 and a GuruFocus Value of $7.85, AG Mortgage Investment Trust Inc has a price-to-GF-Value ratio of 0.78. This indicates that the stock is considered Modestly Undervalued according to the GF Value metric. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The insider's recent acquisition aligns with the current valuation indicators, suggesting that the insider perceives the stock's current price as an attractive entry point. Investors often look to insider buying trends as a signal for potential value in a stock, and Thomas Durkin's purchase may be interpreted as a positive sign for AG Mortgage Investment Trust Inc's future performance.

For more detailed information on insider transactions and stock performance, investors are encouraged to review the full SEC filings and consider the broader market context.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.