AGCO Corp (AGCO) Benefits From Pricing Actions Amid High Costs

AGCO Corporation AGCO has been gaining from increased sales across most of its businesses due to strong demand. Recent investments are also aiding the company’s growth. However, AGCO is exposed to headwinds like inflation in material and logistic costs, high production costs, and increased operating expenses.

These obstacles will be offset by higher sales volume and pricing. Moreover, improving farm income will drive order growth.

Higher Sales & Positive Pricing Actions Drive Results

AGCO will gain on demand across all the major global markets in the upcoming quarters, owing to favorable farm economics. Healthy farm income across most major agricultural production regions, with elevated crop prices, bodes well for the company. This will also help the company offset the impacts of higher fuel, fertilizer and other input costs.

The company has been experiencing strong demand for its Precision Agriculture Business , technology-rich Fendt full lineup of equipment and replacement parts. AGCO will further benefit from growth in the Precision Planting business and the Fuse suite of products as farmers see the benefit of these high-tech solutions.

AGCO Corp expects 2023 net sales of $14.7 billion, whereas it reported $12.6 billion in 2022. The company expects improved sales volumes and positive pricing to aid the 2023 results. The gross and operating margins are expected to be higher than the 2022 reported levels, owing to rising sales and production volumes, as well as the company’s pricing actions to mitigate material and labor cost inflation.

The improved profitability is likely to support incremental investments in engineering and other technology to advance AGCO’s precision agriculture and digital initiatives. Considering these, management projects an EPS of $15.75 for 2023, up from the previously disclosed $15.25.

Strategic Investments Support Margins

AGCO continues to invest in products, premium technology and sustainable smart farming solutions to improve distribution, enhance digital capabilities, expand product lines and improve factory productivity in order to drive margins and strengthen product offerings.

These improvements will support AGCO’s investments in precision agriculture and digital initiatives, driving higher sales growth and margin. The company is expanding its capability by increasing engineering expenses, while investing in acquisitions.

In May 2022, AGCO acquired JCA Industries, which specializes in electronic systems and software development to automate and control agricultural equipment. JCA will support AGCO’s endeavor to deliver machine automation and autonomous systems that improve farmer productivity.

AGCO is focused on investing in Fuse OEM Precision Agriculture solutions, as farmers are looking to capture increased yields and cover the expensive input costs of fertilizer and diesel. The company is poised to benefit from the Precision Planting business, growth scopes from a new product pipeline, and its retrofit approach.

Positive Farm Fundamentals to Aid Growth

The USDA (U.S. Department of Agriculture) projects net farm income at $141.3 billion for 2023, which is 23% lower than that reported in 2022. The decline is mainly due to lower direct government payments. Nevertheless, despite this decline, net farm income in 2023 will be higher than the 2003-2022 average.

This will continue to support AGCO’s margin. The farm size has been on the rise in the United States, which requires more laborers. Given the escalation in labor costs every year, farmers are resorting to farming equipment to replace labor.

The U.S. agricultural machinery market is projected to reach $52.73 billion by 2027, seeing a CAGR of 3.3% over 2021-2027.

Low Smaller Tractor Sales & Higher Costs Act as Woes

In North America, industry unit retail sales of utility and high horsepower tractors for the first nine months of 2023 were down, driven by lower sales of smaller tractors. Increased interest rates and overall economic conditions have hampered the demand for smaller tractors.

Tractor industry unit retail sales in South America decreased in the first nine months of 2023 from the same time in 2022, owing to lower industry unit retail sales. If this trend continues, it might dent the company's top line.

If commodity prices decline again, farmers will adopt a cautious stance regarding their spending on equipment, which will hurt AGCO’s top-line performance. Also, farmers are witnessing higher production costs, particularly feed costs. This might impede their purchasing power if commodity prices decline again.

Price Performance

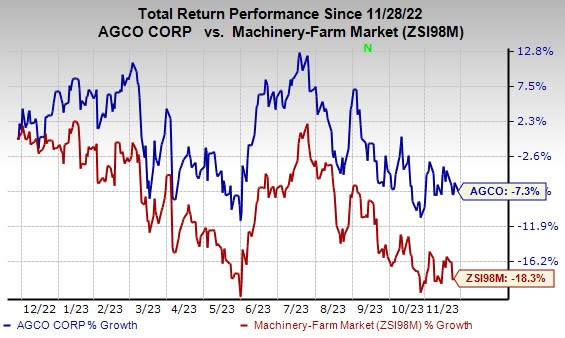

AGCO Corp’s shares have lost 7.3% in the past year compared with the industry’s decline of 18.3%.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

AGCO currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Brady BRC, Applied Industrial Technologies AIT and A. O. Smith Corporation AOS.

BRC currently sports a Zacks Rank #1 (Strong Buy), and AIT and AOS each carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Brady’s 2023 earnings per share is pegged at $4.00. The consensus estimate for 2023 earnings has moved 13% north in the past 60 days and suggests year-over-year growth of 9.9%. The company has a trailing four-quarter average earnings surprise of 7.2%. Shares of BRC have rallied 16.4% in a year.

Applied Industrial has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have moved up 4% in the past 60 days. The company’s shares have gained 27.2% in a year.

The Zacks Consensus Estimate for A. O. Smith’s 2023 earnings is pegged at $3.77 per share. The consensus estimate for 2023 earnings has moved 5% north in the past 60 days and suggests year-over-year growth of 20.1%. The company has a trailing four-quarter average earnings surprise of 14%. AOS shares have gained 29.4% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AGCO Corporation (AGCO) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report