Agenus (AGEN) to Focus on BOT/BAL Candidate, Stock Falls 7%

Agenus Inc. AGEN announced its strategic reprioritization initiative to focus its resources on the accelerated development of its flagship botensilimab/balstilimab (BOT/BAL) program to treat solid tumor cancers. To accomplish the same, AGEN will temporarily postpone all preclinical and clinical programs unrelated to BOT/BAL.

Furthermore, AGEN will cut its workforce by approximately 25%, which is slated to deliver the company about $40 million in savings by the end of 2023.

The company expects the above plan of action to reduce its operating expenses by concentrating its quality, manufacturing, clinical, regulatory and research and development resources on the BOT/BAL program, thereby driving commercial readiness.

However, shares of Agenus lost about 7.3% on Aug 23, 2023. The investors did not cheer the decision to streamline its operations, as this move by the company essentially puts all its eggs in one basket. If its BOT/BAL program fails, it will cause catastrophic repercussions on AGEN’s stock and set the pipeline back significantly, as the development of other pipeline candidates will have temporarily been halted.

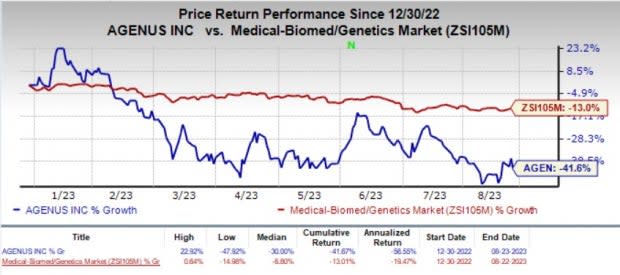

Year to date, shares of the company have plummeted 41.6% compared with the industry’s 13% fall.

Image Source: Zacks Investment Research

Botensilimab is AGEN’ proprietary, novel and multifunctional CTLA-4 investigational antibody to treat cold tumors that have not historically responded to standard-of-care or investigational therapies.

Per Agenus, approximately 600 patients have been treated in phase I and phase II studies, either alone or in combination with Agenus’ PD-1 antibody, balstilimab. It displayed clinical responses in nine, previously intestinal obstruction unresponsive, solid tumor cancers.

AGEN is conducting a global phase II study of botensilimab in combination with balstilimab compared with the standard of care in non-MSI-H colorectal cancer patients. Per data presented by the company at a medical conference, during the second quarter, treatment with the BOT/BAL combo demonstrated a median overall survival of 20.9 months and a 23% overall response rate. Both of these achieved statistics beat data reported for the standard of care in third-line non-MSI-H colorectal cancer in patients without active liver metastases.

Based on these upbeat results, management firmly believes in the game-changing potential of the combination pipeline drug and expects to file for regulatory approval in 2024. The strategic move to concentrate on the BOT/BAL program is anticipated to expedite regulatory approval and availability, thereby quenching the high unmet medical need.

Agenus’ BOT/BAL program also enjoys the FDA’s Fast Track Designation in the United States.

Agenus Inc. Price and Consensus

Agenus Inc. price-consensus-chart | Agenus Inc. Quote

Zacks Rank and Stock to Consider

Agenus currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the pharma/biotech sector are J&J JNJ, Corcept Therapeutics CORT and Dynavax Technologies DVAX, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for J&J’s 2023 earnings per share has increased from $10.73 to $10.75. During the same period, the estimate for JNJ’s 2024 earnings per share has increased from $11.28 to $11.30. Year to date, shares of JNJ have lost 6.9%.

JNJ beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 5.58%.

In the past 30 days, the Zacks Consensus Estimate for Corcept’s 2023 earnings per share has gone up from 62 cents to 78 cents. The estimate for Corcept’s 2024 earnings per share has also improved from 61 cents to 83 cents. Year to date, shares of CORT have climbed 56.6% in the past month.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

In the past 30 days, the Zacks Consensus Estimate for Dynavax’s 2023 loss per share has narrowed from 51 cents to 24 cents. The estimate for Dynavax’s 2024 earnings per share is currently pegged at 2 cents. Year to date, shares of DVAX have risen by 40.9%.

DVAX’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 25.78%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Agenus Inc. (AGEN) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report