Agilent (A) Boosts DGG Offerings With PD-L1 IHC 22C3 Approval

Agilent Technologies A is leaving no stone unturned to bolster diagnostic tool offerings in a bid to strengthen its Diagnostics and Genomics Group (DGG) segment.

Notably, Agilent received FDA approval for its PD-L1 IHC 22C3 pharmDx diagnostic tool, which helps in Gastric or Gastroesophageal Junction Adenocarcinoma diagnosis.

Further, it identifies patients’ eligibility for treatment with KEYTRUDA, an anti-programmed cell death (PD1) therapy, along with chemotherapy, trastuzumab and fluoropyrimidine.

Additionally, PD-L1 IHC 22C3 pharmDx aids in identifying patients with non-small cell lung, esophageal, cervical, head and neck and triple-negative breast cancer who may be eligible for KEYTRUDA treatment.

We note that this approval would benefit cancer patients whose tumors express programmed cell death ligand 1 (PD-L1).

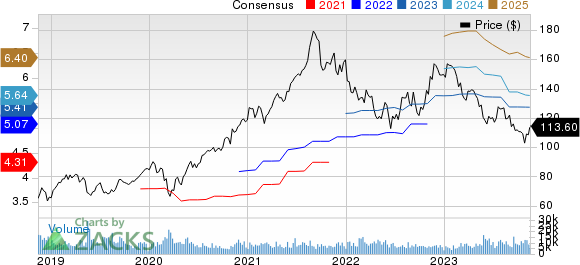

Agilent Technologies, Inc. Price and Consensus

Agilent Technologies, Inc. price-consensus-chart | Agilent Technologies, Inc. Quote

Growth Prospects

The latest announcement bodes well for the company’s deepening focus to strengthen its footprint in the PD-1 and PD-L1 inhibitors market. This, in turn, will aid Agilent to solidify its footing in the global cancer diagnostics market.

Per a Mordor Intelligence report, the global PD-1 and PD-L1 inhibitors market is expected to hit $45.8 billion in 2023 and reach $104.6 billion by 2028, witnessing a CAGR of 18% between 2023 and 2028.

A Future Market Insights report indicates that the global cancer diagnostics market will reach $126 billion by 2033, exhibiting a CAGR of 8.5% during the forecast period of 2023-2033.

We believe the company’s solid prospects in these promising markets are expected to instill investor optimism in the stock.

However, it has been suffering from macroeconomic uncertainties, weak momentum in China, rising inflationary pressure and geo-political tensions.

Agilent has lost 24.1% in the year-to-date period, underperforming the industry’s decline of 4.6%.

Expanding DGG Segment

Apart from the latest move, Agilent released the enhanced xCELLigence RTCA Software Pro Version 2.8, a software package for real-time cell analysis in GMP-regulated facilities, ensuring data authenticity and compliance.

Further, Agilent launched the Agilent SureSelect Cancer CGP Assay, a pan-cancer assay designed for somatic variant profiling of solid tumor types, utilizing an NGS panel of 679 genes.

We note that all the above-mentioned endeavors will likely act as a catalyst for its customer base expansion.

Notably, Agilent signed a Research Collaboration Agreement with the National Cancer Centre Singapore to expedite translational cancer research on Asian-prevalent cancer genomics over two years.

Further, the agreement involves the provision of an Agilent Magnis NGS Preparation System for investigating specific details in Asian cancer cohorts, where tissue samples are limited locally and regionally.

Moreover, Agilent signed a Memorandum of Understanding with Advanced Cell Therapy and Research Institute, Singapore, to install and operate its xCELLigence real-time cell analyzer, aiming to advance cell and gene therapy over the next three years.

All these endeavors are likely to aid the performance of the DGG segment in the days ahead.

For third-quarter fiscal 2023, revenues in the underlined segment increased 3% from the prior-year fiscal quarter’s figure on a reported as well as a core basis to $349 million.

Our model estimate for DGG revenues for fiscal 2023 is pegged at $1.41 billion, indicating growth of 1.5% from the 2022 level. The same for fiscal 2024 and fiscal 2025 stands at $1.48 billion and $1.58 billion, suggesting year-over-year growth of 5% and 7%, respectively.

Zacks Rank & Stocks to Consider

Currently, Agilent carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are Badger Meter BMI, Arista Networks ANET and Salesforce CRM. While Badger Meter sports a Zacks Rank #1 (Strong Buy), Arista Networks and Salesforce carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Badger Meter shares have gained 35.9% in the year-to-date period. BMI’s long-term earnings growth rate is currently projected at 20.39%.

Arista Networks shares have gained 71.2% in the year-to-date period. The long-term earnings growth rate for ANET is currently projected at 20.4%

Salesforce shares have gained 65.5% in the year-to-date period. CRM’s long-term earnings growth rate is currently projected at 22.54%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report