Agilent (A) Boosts DGG Segment With ProteoAnalyzer System

To boost capabilities in protein analysis, Agilent Technologies A announced the launch of the Agilent ProteoAnalyzer system.

The Agilent ProteoAnalyzer system is a new automated parallel capillary electrophoresis system for protein analysis that brings more efficiency, versatility and reliability in protein QC workflows by automating the separation, data processing and simplifying sample preparation steps.

This way, it analyzes complex protein mixtures seamlessly.

It is designed to analyze different sizes and types of proteins in a single run without compromising the accuracy of the results.

Agilent is expected to gain strong momentum across the pharma, biotech, food analysis and academia sectors on the back of its latest move, as the ProteoAnalyzer system can help companies reduce training and labor costs with the aforementioned features.

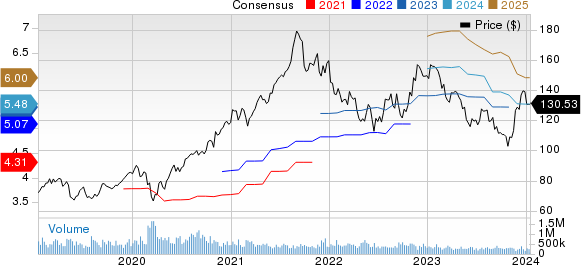

Agilent Technologies, Inc. Price and Consensus

Agilent Technologies, Inc. price-consensus-chart | Agilent Technologies, Inc. Quote

Strengthening DGG Segment

The latest move bodes well for Agilent’s growing efforts to expand its Diagnostics and Genomics Group segment.

Apart from the ProteoAnalyzer system, Agilent’s introduction of the enhanced xCELLigence RTCA Software Pro Version 2.8, a software package for real-time cell analysis in GMP-regulated facilities, remains noteworthy.

The latest FDA approval for its PD-L1 IHC 22C3 pharmDx diagnostic tool, which helps in Gastric or Gastroesophageal Junction Adenocarcinoma diagnosis, remains positive.

The launch of the Agilent SureSelect Cancer CGP Assay, a pan-cancer assay designed for somatic variant profiling of solid tumor types utilizing an NGS panel of 679 genes, is another positive.

We note that all the above-mentioned endeavors are expected to drive the company’s customer base within the underlined segment.

Agilent signed a Research Collaboration Agreement with the National Cancer Centre Singapore to expedite translational cancer research on Asian-prevalent cancer genomics over two years.

The agreement involves the provision of an Agilent Magnis NGS Preparation System for investigating specific details in Asian cancer cohorts, where tissue samples are limited locally and regionally.

Agilent signed a Memorandum of Understanding with Advanced Cell Therapy and Research Institute, Singapore, to install and operate its xCELLigence real-time cell analyzer, aiming to advance cell and gene therapy over the next three years.

An expanding customer base is expected to aid the performance of the DGG segment in the coming days. This, in turn, will benefit the company’s overall financial performance.

However, Agilent is currently suffering from macroeconomic uncertainties and sluggish capital spending. Softness in the genomics business remains a concern. Also, weakness across pharma, diagnostics and clinical markets is a headwind.

Agilent has lost 14.7% over a year against the industry’s growth of 0.4%.

For fiscal 2024, the Zacks Consensus Estimate for revenues is pegged at $6.74 billion, indicating a decline of 1.4% from fiscal 2023.

The same for earnings stands at $5.48 per share, indicating growth of 0.7% from the reported figure in fiscal 2023.

Zacks Rank & Stocks to Consider

Currently, Agilent carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are Itron ITRI, Vertiv VRT and AMETEK AME. While Itron sports a Zacks Rank #1 (Strong Buy), Vertiv and AMETEK each carries a Zacks Rank #2 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Itron have returned 24.9% in the past year. The long-term earnings growth rate for ITRI is pegged at 23%.

Shares of Vertiv have lost 10.7% in the past year. The long-term earnings growth rate for VRT is currently projected at 53.9%.

AMETEK has returned 16.4% in the past year. The long-term earnings growth rate for AME is currently projected at 9.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Itron, Inc. (ITRI) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report