Agilent Technologies Inc (A) Faces Headwinds: Q1 Fiscal 2024 Earnings Analysis

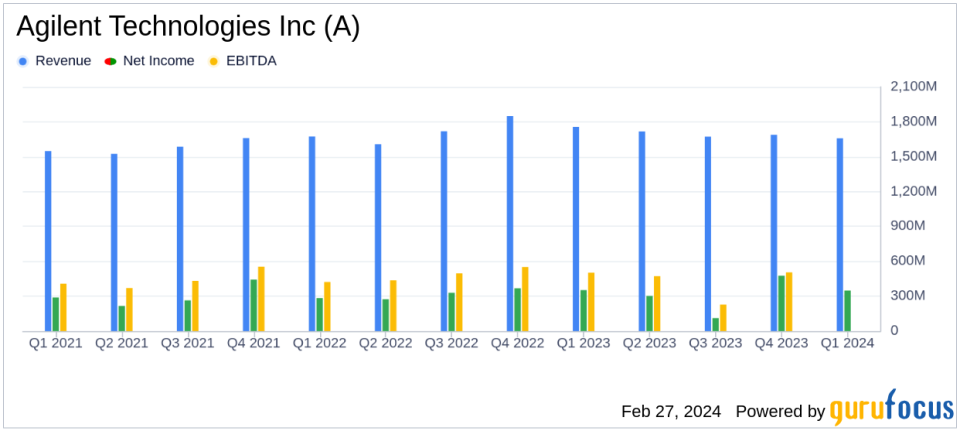

Revenue: $1.66 billion, a decrease of 5.6% year-over-year.

GAAP Net Income: $348 million, slightly down from $352 million in Q1 2023.

Non-GAAP Net Income: $380 million, a 6% decrease from the previous year.

Earnings Per Share (EPS): GAAP EPS at $1.18, Non-GAAP EPS at $1.29.

Full-Year Outlook: Revenue forecast maintained at $6.710 to $6.810 billion, with Non-GAAP EPS guidance of $5.44 to $5.55.

On February 27, 2024, Agilent Technologies Inc (NYSE:A) released its 8-K filing, detailing the financial results for the first quarter of the fiscal year 2024. The company, a global leader in life sciences, diagnostics, and applied chemical markets, reported a revenue of $1.66 billion, marking a 5.6% decrease compared to the first quarter of 2023. Despite the decline, Agilent's revenue and earnings exceeded the Q1 guidance, and the company has maintained its full-year revenue outlook.

Agilent Technologies Inc (NYSE:A), which originated from Hewlett-Packard in 1999, has grown into a prominent entity within the life sciences and diagnostics sector. The company's measurement technologies cater to a diverse customer base across biopharmaceutical, chemical, and advanced materials end markets, as well as clinical labs, environmental, forensics, food, academic, and government organizations. With significant operations in the U.S. and China, Agilent's global presence is a testament to its expansive reach.

Segment Performance and Financial Highlights

Agilent's Life Sciences and Applied Markets Group (LSAG) experienced a revenue decline of 10% year-over-year, with an operating margin of 27.9%. The Agilent CrossLab Group (ACG) saw a revenue increase of 6%, and an impressive operating margin of 30.2%. Meanwhile, the Diagnostics and Genomics Group (DGG) reported a 6% decrease in revenue, with an operating margin of 17.3%.

Agilent's President and CEO, Mike McMullen, commented on the results, stating,

The Agilent team continued its strong execution in the first quarter, delivering better-than-expected revenue and earnings. We are well positioned for long-term growth driven by our diversified business and multiple growth drivers. While near term market challenges remain, I continue to be optimistic about our future."

The company's financial achievements, particularly in maintaining a steady EPS and a robust full-year outlook amidst market challenges, underscore its resilience and strategic positioning in the Medical Diagnostics & Research industry. These results are significant as they demonstrate Agilent's ability to navigate a complex market landscape while continuing to deliver value to its shareholders.

Income Statement and Balance Sheet Synopsis

Agilent's GAAP net income for the quarter stood at $348 million, with a diluted EPS of $1.18. The Non-GAAP net income was reported at $380 million, with a Non-GAAP EPS of $1.29. The company's balance sheet reflects a strong liquidity position, with cash and cash equivalents totaling $1.748 billion as of January 31, 2024.

From an operational standpoint, Agilent generated a net cash provided by operating activities of $485 million, a significant increase from the $296 million reported in the same period last year. This robust cash flow performance is indicative of the company's efficient operations and effective capital management.

Outlook and Investor Considerations

Looking ahead, Agilent maintains its full-year revenue outlook at $6.710 billion to $6.810 billion, with a Non-GAAP EPS guidance range of $5.44 to $5.55. The second-quarter revenue is expected to be between $1.560 billion and $1.590 billion, with a Non-GAAP EPS forecast of $1.17 to $1.20.

While Agilent faces near-term market challenges, the company's diversified business model and multiple growth drivers position it for long-term success. Investors and potential GuruFocus.com members should consider Agilent's consistent performance, strategic market positioning, and the potential for continued growth as they evaluate the company's investment prospects.

For a more detailed analysis of Agilent Technologies Inc (NYSE:A)'s financial performance and future outlook, investors are encouraged to review the full earnings report and listen to the earnings conference call. These resources provide valuable insights into the company's strategic initiatives and market opportunities.

Explore the complete 8-K earnings release (here) from Agilent Technologies Inc for further details.

This article first appeared on GuruFocus.