Agilent Technologies Inc's CEO Michael McMullen Sells 62,467 Shares

Michael McMullen, the CEO and President of Agilent Technologies Inc, has recently made a significant change in his holdings of the company's stock. On December 7, 2023, the insider sold a total of 62,467 shares of Agilent Technologies Inc (NYSE:A), a notable transaction that has caught the attention of investors and market analysts alike.

Who is Michael McMullen?

Michael McMullen has been serving as the CEO and President of Agilent Technologies Inc since March 2015. Under his leadership, the company has continued to grow and expand its presence in the life sciences, diagnostics, and applied chemical markets. McMullen has been instrumental in steering the company through strategic initiatives and has a deep understanding of the operational aspects of the business, having held various senior positions within Agilent since joining the company in 1999.

Agilent Technologies Inc's Business Description

Agilent Technologies Inc is a global leader in the life sciences, diagnostics, and applied chemical markets. The company provides laboratories worldwide with instruments, services, consumables, applications, and expertise, enabling customers to gain the insights they seek. Agilent's expertise and trusted collaboration give them the highest confidence in their solutions. The company's key focus areas include food, environmental and forensics, pharmaceutical, diagnostics, chemical and energy, and research.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions can provide valuable insights into a company's financial health and future prospects. When insiders buy shares, it often indicates their confidence in the company's future performance. Conversely, when insiders sell, it can raise questions about their outlook on the company's stock price or may simply reflect personal financial management decisions.

According to the data provided, over the past year, Michael McMullen has sold a total of 63,411 shares and has not made any purchases. This pattern of selling without corresponding buys could suggest that the insider is taking profits or reallocating personal investment portfolios rather than reflecting a negative outlook on the company's future.

It is also important to consider the overall insider transaction history for Agilent Technologies Inc. There have been 2 insider buys and 6 insider sells over the past year. This trend shows more insider selling than buying, which could be interpreted in various ways. However, without additional context, it is difficult to draw definitive conclusions from these transactions alone.

On the day of McMullen's recent sale, shares of Agilent Technologies Inc were trading at $130, giving the company a market cap of $37.158 billion. The price-earnings ratio of 30.21 is higher than the industry median but lower than the company's historical median, suggesting a mixed valuation picture.

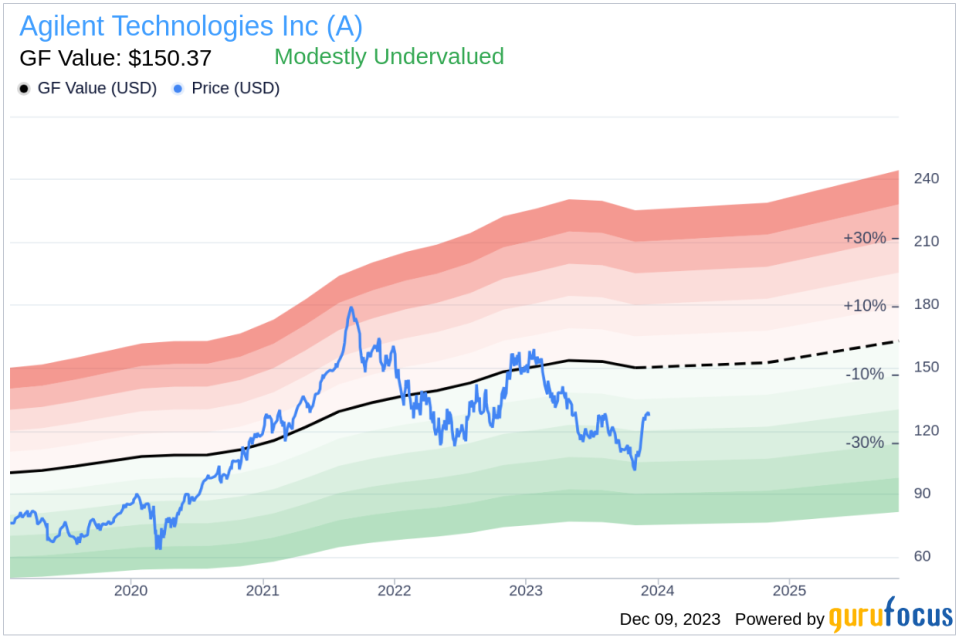

When considering the price-to-GF-Value ratio of 0.86, with a GF Value of $150.37, Agilent Technologies Inc appears to be modestly undervalued. This could indicate that despite the insider selling, the stock may still have room for growth based on its intrinsic value estimate.

The GF Value is determined by historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This comprehensive approach to valuation suggests that Agilent Technologies Inc's stock might be an attractive investment despite the recent insider selling activity.

The insider trend image above provides a visual representation of the buying and selling patterns of insiders at Agilent Technologies Inc. This can help investors understand the sentiment of those with the most intimate knowledge of the company.

The GF Value image further illustrates the stock's valuation relative to its intrinsic value, supporting the notion that Agilent Technologies Inc may be undervalued at its current price.

Conclusion

While insider selling can sometimes raise concerns among investors, it is essential to consider the broader context of the company's valuation and market performance. In the case of Agilent Technologies Inc, the modestly undervalued status based on the GF Value, combined with a solid market cap and a reasonable price-earnings ratio, suggests that the company's stock may still be a sound investment. Investors should always conduct their due diligence and consider insider transactions as one of many factors in their investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.