Agiliti Inc (AGTI) Reports Mixed 2023 Financial Results Amidst Upcoming Privatization

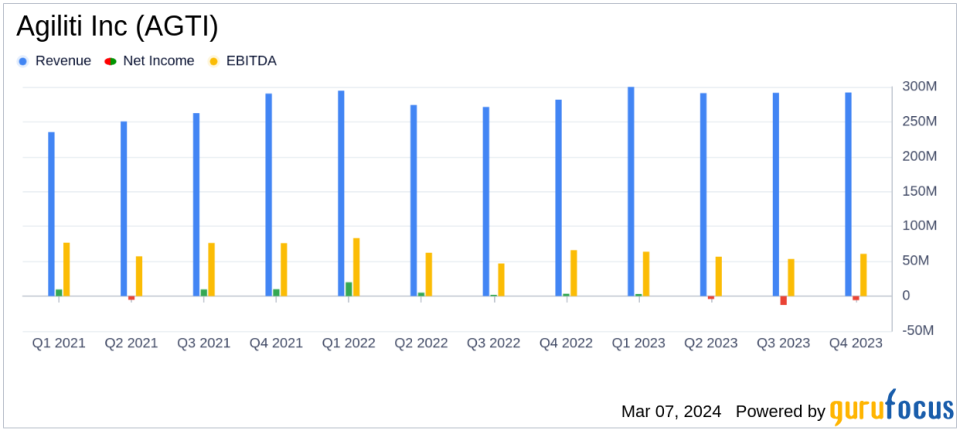

Revenue Growth: Agiliti Inc (NYSE:AGTI) reported a 5% year-over-year increase in annual revenue, reaching $1.17 billion in 2023.

Net Income: The company experienced a net loss of $19.4 million for the full year, a significant downturn from the $30.2 million net income in 2022.

Adjusted EBITDA: Adjusted EBITDA decreased by 10% to $266.9 million for the year, reflecting operational challenges.

Debt and Leverage: Total debt stood at $1.08 billion with a net leverage ratio of 3.97x as of December 31, 2023.

Privatization Plan: Agiliti is set to be acquired by THL Partners for $10.00 per share, transitioning to a private entity in the first half of 2024.

On March 5, 2024, Agiliti Inc (NYSE:AGTI), a leading provider of healthcare technology management and service solutions in the United States, released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company reported a modest revenue increase but faced a net loss for both the quarter and the full year, contrasting with the net income achieved in the previous year.

Company Overview

Agiliti Inc (NYSE:AGTI) specializes in a range of services including clinical engineering, equipment rental, imaging services, and onsite management, exclusively operating within the U.S. healthcare sector. The company's solutions are designed to support a more efficient, safe, and sustainable healthcare delivery system, serving over 10,000 healthcare providers nationwide.

Financial Performance and Challenges

The company's revenue growth, while positive, was tempered by a net loss of $19.4 million for the year, a stark contrast to the net income of $30.2 million reported in the prior year. This downturn is primarily attributed to increased costs of revenue and significant interest expenses. Adjusted EBITDA also saw a decline, which is a critical metric for assessing the company's operational efficiency and ability to generate cash flow from its core business operations.

Financial Achievements and Industry Importance

Despite the challenges, the revenue growth signifies Agiliti's ability to expand its market presence and maintain demand for its services within the healthcare industry. The company's management of healthcare technology is crucial for healthcare providers to optimize patient outcomes and manage costs effectively.

Key Financial Metrics

The following are essential details from Agiliti's financial statements:

Financial Aspect | 2023 | 2022 |

|---|---|---|

Total Revenue | $1.17 billion | $1.12 billion |

Net Loss | $(19.4 million) | $30.2 million |

Adjusted EBITDA | $266.9 million | $296.6 million |

Total Debt | $1.08 billion | |

Net Leverage Ratio | 3.97x |

These metrics are vital for investors as they provide insight into the company's profitability, debt management, and operational efficiency.

Privatization and Future Outlook

Agiliti's announcement of its acquisition by THL Partners marks a significant transition for the company. The $2.5 billion deal will take Agiliti private, which may lead to strategic shifts that could impact its financial trajectory. As the company will no longer be publicly traded, this move underscores the importance of the current financial results as a benchmark for the company's performance pre-acquisition.

For more detailed information and analysis, investors and interested parties are encouraged to review Agiliti's full financial statements and accompanying notes.

As Agiliti Inc (NYSE:AGTI) navigates through its financial challenges and impending privatization, investors and stakeholders will closely monitor the company's performance and strategic decisions. The healthcare industry's reliance on technology management and service solutions underscores the importance of Agiliti's role in the market, making its financial health a matter of significant interest.

Explore the complete 8-K earnings release (here) from Agiliti Inc for further details.

This article first appeared on GuruFocus.