Agiliti (NYSE:AGTI) shareholder returns have been stellar, earning 140% in 3 years

Agiliti, Inc. (NYSE:AGTI) shareholders might understandably be very concerned that the share price has dropped 65% in the last quarter. But that doesn't change the fact that the returns over the last three years have been very strong. In fact, the share price is up a full 140% compared to three years ago. After a run like that some may not be surprised to see prices moderate. If the business can perform well for years to come, then the recent drop could be an opportunity.

Since the stock has added US$99m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Agiliti

We don't think that Agiliti's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last three years Agiliti has grown its revenue at 18% annually. That's pretty nice growth. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 34% per year over three years. The business has made good progress on the top line, but the market is extrapolating the growth. It would be worth thinking about when profits will flow, since that milestone will attract more attention.

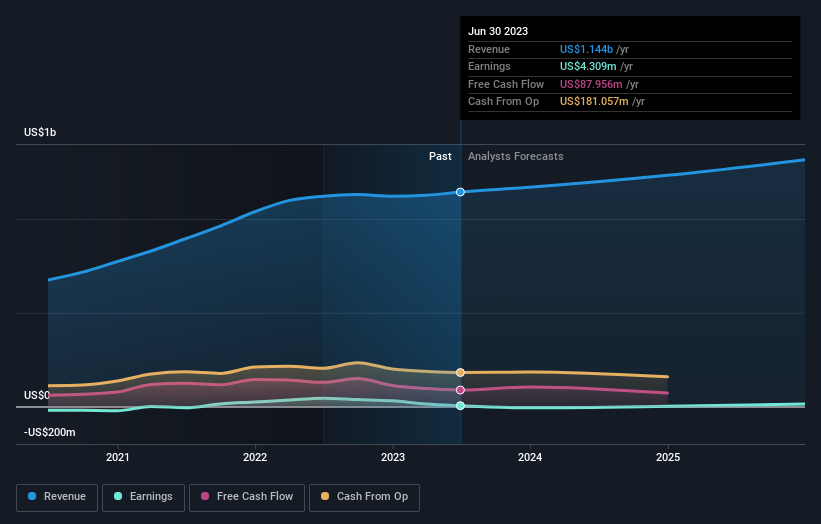

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Agiliti has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Agiliti shareholders are down 66% for the year, but the market itself is up 16%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Agiliti better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Agiliti (including 1 which is a bit concerning) .

We will like Agiliti better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.