Agilon Health Inc (AGL) Faces Headwinds Despite Revenue Surge in Q4 2023

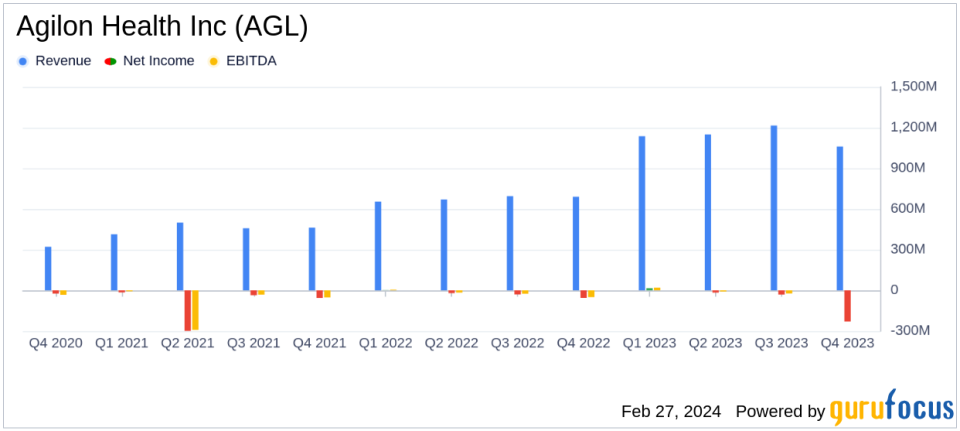

Revenue Growth: Q4 revenue increased by 72% year-over-year to $1.06 billion.

Membership Expansion: Medicare Advantage membership grew by 68%, reaching 388,400 members.

Net Loss Widens: Q4 net loss expanded to $230 million from $57 million in the prior year.

Medical Margin Pressure: Medical Margin turned negative in Q4, reflecting higher medical costs.

Adjusted EBITDA: Adjusted EBITDA loss worsened to $137 million in Q4 from a loss of $32 million year-over-year.

Guidance Revised: 2024 guidance adjusted to account for continued higher medical cost trends.

On February 27, 2024, Agilon Health Inc (NYSE:AGL) released its 8-K filing, detailing the fourth quarter and full-year financial results for the period ending December 31, 2023. Agilon Health, a company dedicated to transforming healthcare for seniors by empowering community-based physicians, reported significant growth in revenue and Medicare Advantage membership. However, the company faced challenges due to an acceleration in medical costs, which impacted profitability and led to a wider net loss compared to the previous year.

Financial Performance Overview

Agilon Health's revenue for the fourth quarter soared to $1.06 billion, a 72% increase from the same period in 2022. This growth was driven by a substantial 68% rise in Medicare Advantage membership, which now totals 388,400 members. Despite this impressive expansion, the company's gross profit turned negative at $95 million in Q4, compared to a positive $16 million in the prior year. The net loss also widened significantly to $230 million from a loss of $57 million in Q4 2022.

The company's Medical Margin, a key metric reflecting the profitability of medical services after expenses, was negatively impacted by higher medical costs, including prior period development from previous quarters. This resulted in a negative Medical Margin of $102 million for the quarter, a stark contrast to the $63 million positive margin in the same quarter of the previous year.

Challenges and Strategic Response

Agilon Health's performance was notably affected by macroeconomic dynamics, leading to higher medical costs. CEO Steve Sell acknowledged the challenging environment and emphasized the company's commitment to mitigating its impact and strengthening reserves. The company has initiated a targeted action plan aimed at measured growth and operational efficiency improvements, which includes expanding support for primary care physicians and refining payer partnerships.

The Class of 2025 is expected to add at least 60,000 Medicare Advantage members across five physician groups, indicating continued growth potential. However, the company has revised its 2024 guidance to assume a continuation of the higher medical cost trends experienced in 2023.

Capital Position and Outlook

As of December 31, 2023, Agilon Health reported a solid balance sheet with $495 million in cash, cash equivalents, and marketable securities, and total debt of $39 million. The company's updated guidance for fiscal year 2024 reflects a cautious approach, with a medical cost trend assumption of 6.6% for Year 2+ markets, which is higher than previous expectations.

Agilon Health's performance in the fourth quarter of 2023 and the full year reflects a company experiencing robust growth in membership and revenue, yet facing significant challenges due to rising medical costs. The company's strategic actions and revised guidance demonstrate a commitment to navigating these headwinds and positioning itself for sustainable long-term success.

For more detailed information and analysis, investors and interested parties are encouraged to access the full earnings report and join the webcast and conference call hosted by Agilon Health.

Explore the complete 8-K earnings release (here) from Agilon Health Inc for further details.

This article first appeared on GuruFocus.