Agilysys (NASDAQ:AGYS) Surprises With Q2 Sales, Stock Jumps 21.7%

Hospitality industry software provider Agilysys (NASDAQ:AGYS) announced better-than-expected results in Q2 FY2024, with revenue up 22.8% year on year to $58.6 million. Turning to EPS, Agilysys made a GAAP profit of $0.16 per share, improving from its profit of $0.12 per share in the same quarter last year.

Is now the time to buy Agilysys? Find out by accessing our full research report, it's free.

Agilysys (AGYS) Q2 FY2024 Highlights:

Revenue: $58.6 million vs analyst estimates of $56.8 million (3.13% beat)

EPS (non-GAAP): $0.25 vs analyst estimates of $0.19 (29.9% beat)

The company lifted its revenue guidance for the full year from $232.5 million to $236.5 million at the midpoint, a 1.72% increase

Free Cash Flow of $2.51 million is up from -$3.04 million in the previous quarter

Gross Margin (GAAP): 59.9%, down from 61.5% in the same quarter last year

Ramesh Srinivasan, President and CEO of Agilysys, commented, “Our implementation efficiency continues to improve as the re-engineered core products and newly developed experience enhancer add-on software modules are performing well in the field and creating considerable value for customers. Excellent selling success momentum highlighted by one of our best sales quarters and the best ever first half of fiscal year April to September sales measured in annual contract value terms drove aggregate recurring revenue, product and services backlog to a near record level."

Originally a subsidiary of Pioneer-Standard Electronics that distributed electronic components, Agilysys (NASDAQ:AGYS) offers a software-as-service platform that helps hotels, resorts, restaurants, and other hospitality businesses manage their operations and workflows.

Hospitality & Restaurant Software

Enterprise resource planning (ERP) and customer relationship management (CRM) are two of the largest software categories dominated by the likes of Microsoft, Oracle, and Salesforce.com. Today, the secular trend of mass customization is driving vertical software that customizes ERP and CRM functions for specific industry requirements. Restaurants are a prime example where a set of customized software providers have sprung up in recent years to create unique operating systems that blend tax and accounting software, order management and delivery, along with supply chain management. Hotels and other hospitality providers are another example.

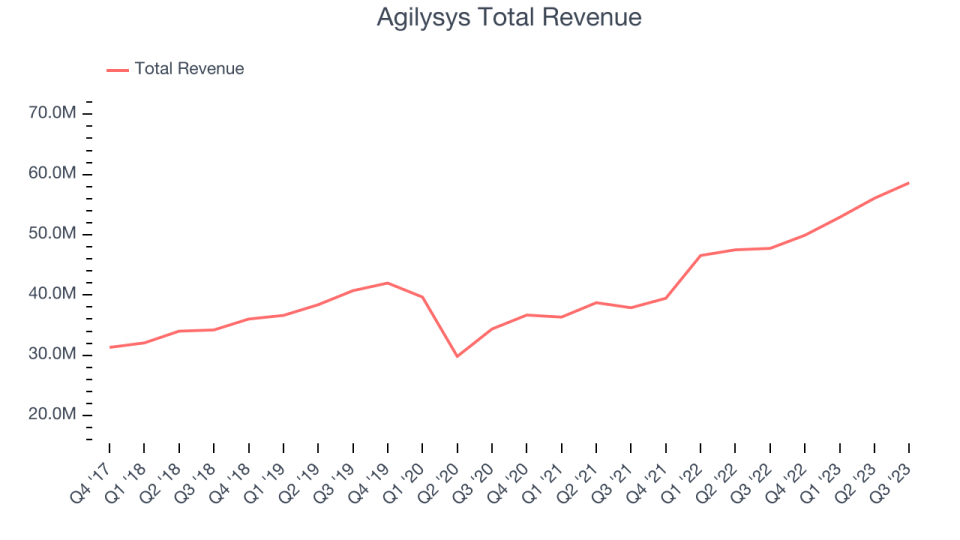

Sales Growth

As you can see below, Agilysys's revenue growth has been strong over the last two years, growing from $37.9 million in Q2 FY2022 to $58.6 million this quarter.

This quarter, Agilysys's quarterly revenue was once again up a very solid 22.8% year on year. However, its growth did slow down a little compared to last quarter as the company increased revenue by $2.56 million in Q2 compared to $3.16 million in Q1 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Looking ahead, analysts covering the company were expecting sales to grow 16.7% over the next 12 months before the earnings results announcement.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

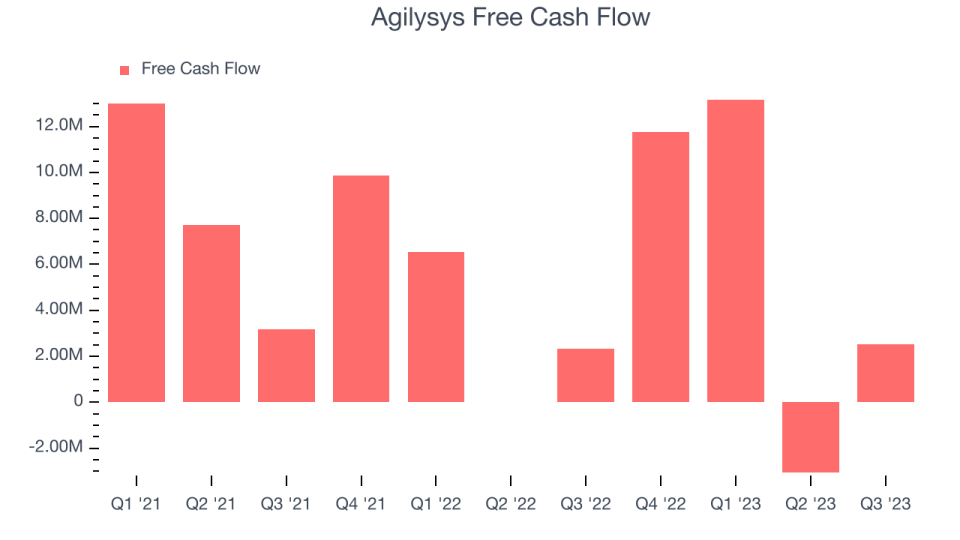

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Agilysys's free cash flow came in at $2.51 million in Q2, up 8.37% year on year.

Agilysys has generated $24.4 million in free cash flow over the last 12 months, a solid 11.8% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from Agilysys's Q2 Results

With a market capitalization of $1.6 billion, Agilysys is among smaller companies, but its $107.4 million cash balance and positive free cash flow over the last 12 months give us confidence that it has the resources needed to pursue a high-growth business strategy.

It was great to see Agilysys beat analysts' revenue expectations this quarter, driven by better-than-expected subscription revenue growth of 29.1%. Furthermore, its adjusted EBITDA margin of 13.7% (which also beat estimates) was particularly impressive as the company is managing through a phase of increased investment requirements. These investments are expected to take a few years to pay off, and investors were glad to see that Agilysys isn't trading off profitability for growth. As a result of this momentum, the company is raising its revenue and adjusted EBITDA guidance for the full year. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 21.7% after reporting and currently trades at $77.75 per share.

So should you invest in Agilysys right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.