Agios (AGIO) Reports Narrower-Than-Expected Q3 Loss, Lags Sales

Agios Pharmaceuticals, Inc. AGIO reported a loss per share of $1.64 in third-quarter 2023, narrower than the Zacks Consensus Estimate of a loss of $1.69. In the year-ago quarter, the company posted a loss of $1.49 per share.

The company reported revenues of $7.4 million, which missed the Zacks Consensus Estimate of $7.7 million. In the year-ago quarter, the company recorded total revenues of $3.5 million.

Quarter in Detail

In the reported quarter, revenues were generated entirely from product revenues of Agios’ only marketed drug, Pyrukynd (mitapivat), which the FDA approved for treating hemolytic anemia in adults with pyruvate kinase (PK) deficiency in February 2022.

Pyrukynd revenues in the United States were up 110% year over year and 10% sequentially. The top line missed our model estimate of $7.8 million.

Given the ultra-rare nature of the disease and long lead times associated with initiating patients on therapy, management expects slow and steady growth, with quarter-to-quarter variability.

Research & development expenses totaled $81.8 million, up 25% year over year. The upside was due to the $17.5 million upfront payment to Alnylam Pharmaceuticals ALNY for the TMPRSS6 asset.

Selling, general and administrative expenses declined 11% year over year to $25.8 million due to lower stock-based compensation expenses and reduced professional fees.

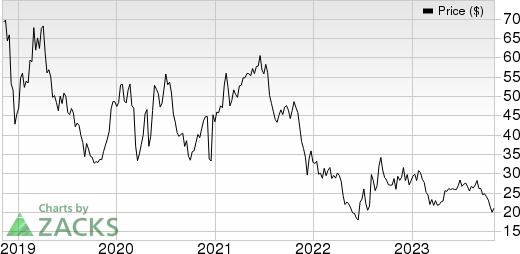

Year to date, shares of Agios have declined 25.2% compared with the industry’s 11.6% fall.

Image Source: Zacks Investment Research

As of Sep 30, 2023, cash, cash equivalents and marketable securities totaled $872.4 million compared with $946.9 million as of Jun 30, 2023. Management expects this cash balance to fund its operations and meet capital expenditure requirements at least into 2026.

Pipeline Updates

In August, Agios and Alnylam announced an exclusive worldwide license agreement. The agreement grants Agios the right to develop and market Alnylam’s preclinical siRNA targeting TMPRSS6 as a potential disease-modifying therapy for patients with polycythemia vera, a rare and potentially fatal hematologic disease. Other than the upfront payment, Alnylam is eligible to receive potential milestone payments of up to $130 million and tiered royalties.

Agios has two ongoing phase III studies, namely ACTIVATE-kids and ACTIVATE-kidsT, which are evaluating Pyrukynd for PK deficiency in pediatric patients who are not and are regularly transfused, respectively. While the company has completed enrolment in the ACTIVATE-kidsT study, it has achieved more than 50% enrolment in the ACTIVATE-kids study.

Apart from PK deficiency, the company is evaluating Pyrukynd for thalassemia. Management recently completed patient enrollment in the phase III studies — ENERGIZE and ENERGIZE-T — evaluating Pyrukynd in adults with thalassemia. Data from both studies are anticipated in 2024.

Agios is conducting the phase II/III RISE UP study evaluating Pyrukynd for sickle cell disease (SCD). Recently, management started dosing study participants in the phase III portion of the RISE UP study.

Management expects to report topline data from a phase IIa study evaluating its PKR activator candidate AG-946 for lower-risk myelodysplastic syndrome (LR-MDS) before year-end. It plans to file an investigational new drug (IND) application with the FDA for a phenylalanine hydroxylase (PAH) stabilizer for treating phenylketonuria (PKU) by the end of the year.

Agios Pharmaceuticals, Inc. Price

Agios Pharmaceuticals, Inc. price | Agios Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

Currently, Agios has a Zacks Rank #3 (Hold). Some other top-ranked stocks in the overall healthcare sector include Acadia Pharmaceuticals ACAD, Alkermes (ALKS) and Puma Biotechnology PBYI. While Puma Biotechnology sports a Zacks Rank #1 (Strong Buy) at present, Acadia and Alkermes carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Puma Biotechnology’s earnings estimates for 2024 have increased from 55 cents to 56 cents per share in the past 30 days. Year to date, Puma Biotechnology’s stock has lost 41.1%.

Puma Biotechnology beat earnings estimates in three of the last four quarters while missing the mark on one occasion. On average, the company’s earnings witnessed a negative earnings surprise of 95.94%. In the last reported quarter, PBYI delivered an earnings surprise of 42.86%.

In the past 30 days, estimates for Acadia’s 2023 loss per share have narrowed from 41 cents to 37 cents. During the same period, the earnings estimates per share for 2024 have risen from 60 cents to 68 cents. Shares of ACAD are up 44.4% in the year-to-date period.

Earnings of Acadia beat estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing an average earnings surprise of 20.33%. In the last reported quarter, Acadia’s earnings beat estimates by 108.33%.

In the past 30 days, the estimate for Alkermes’ 2023 and 2024 EPS have increased from $1.61 to $1.63 and $1.93 to $2.14, respectively. Shares of ALKS are down 6.1% in the year-to-date period.

Earnings of Alkermes beat estimates in each of the last four quarters, witnessing an average earnings surprise of 93.34%. Alkermes’ earnings beat estimates by 45.45%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alnylam Pharmaceuticals, Inc. (ALNY) : Free Stock Analysis Report

Agios Pharmaceuticals, Inc. (AGIO) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report