AGNC Investment (AGNC) Beats on Q2 Net Spread and Dollar Roll

AGNC Investment Corp.’s AGNC second-quarter 2023 net spread and dollar roll income per common share (excluding estimated "catch-up" premium amortization costs) of 67 cents beat the Zacks Consensus Estimate of 58 cents. However, the bottom line declined 19.3% from the prior-year quarter.

Adjusted net interest and dollar roll income (excluding estimated "catch-up" premium amortization costs) of $493 million remained flat from the quarter-ago levels.

The company reported second-quarter comprehensive income per common share of 32 cents against the prior-year quarter’s loss of $1.34.

Inside the Headlines

Net interest income was negative $69 million against $315 million in the year-ago quarter. The Zacks Consensus Estimate was pegged at $342 million.

AGNC Investment's average asset yield on its portfolio was 3.72 % in the second quarter, up from 3.09% in the prior-year quarter.

The combined weighted average cost of funds, inclusive of interest rate swap, was 0.63% compared with 0.14% in the year-ago quarter.

The average net interest spread (excluding estimated "catch-up" premium amortization costs) was 3.26%, up from 2.74% reported in the year-earlier quarter.

As of Jun 30, 2023, AGNC’s average tangible net book value "at risk" leverage ratio was 7.2 compared with 7.8 in the prior-year quarter.

In the second quarter, the company's investment portfolio bore an average actual constant prepayment rate of 6.6%, down from 12.4% in the previous-year quarter.

As of Jun 30, 2023, tangible net book value per commonshare (BVPS) was $9.39, down from $11.43 as of Jun 30, 2022.

The economic return on tangible common equity was 3.6%. This included a dividend per share of 36 cents and a decrease of 2 centsin tangible net BVPS.

As of Jun 30, 2023, the company’s investment portfolio aggregated $58 billion. This included $46.7 billion of Agency mortgage-backed securities, $10.2 million of net to-be-announced mortgage position, and $1.1 billion of credit risk transfer and non-Agency securities.

As of Jun 30, 2023, AGNC Investment’s cash and cash equivalents totaled $716 million, down from $975 million as of Mar 31, 2023.

Dividend Update

In the second quarter, AGNC Investment announced a dividend of 12 cents per share each for April, May and June. Notably, management declared $12.4 billion in common stock dividends or $46.48 per common share since its initial public offering in May 2008 through second-quarter 2023.

Conclusion

In the second quarter, increasing asset yields supported the results. In a bid to navigate the monetary policy transition, the company has defensively positioned itself with prudent asset-selection efforts and timely portfolio adjustment. Going forward, investments in agency MBS will drive attractive risk-adjusted returns.

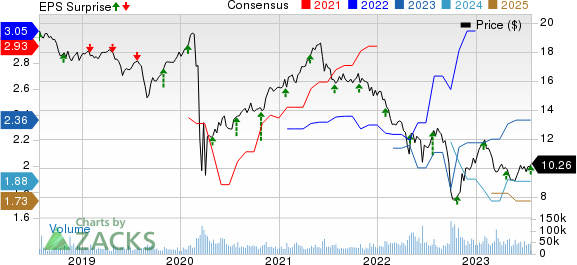

AGNC Investment Corp. Price, Consensus and EPS Surprise

AGNC Investment Corp. price-consensus-eps-surprise-chart | AGNC Investment Corp. Quote

AGNC Investment currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases Dates of Other REITs

We now look forward to the earnings releases of Annaly Capital Management, Inc. NLY and Invesco Mortgage Capital Inc. IVR.

NLY is scheduled to report quarterly figures on Jul 26. Over the past month, the Zacks Consensus Estimate for NLY’s quarterly earnings has remained unchanged at 66 cents per share, implying a 45% fall from the prior-year reported number.

IVR is slated to post quarterly results on Aug 3. Over the past month, the Zacks Consensus Estimate for IVR’s quarterly earnings has been unchanged at $1.07 per share, suggesting a 23.6% decline from the prior-year reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AGNC Investment Corp. (AGNC) : Free Stock Analysis Report

INVESCO MORTGAGE CAPITAL INC (IVR) : Free Stock Analysis Report

Annaly Capital Management Inc (NLY) : Free Stock Analysis Report