Agree Realty Corp (ADC) Reports Steady Growth Amidst Economic Headwinds

Net Income: Q4 unchanged at $0.44 per share, full-year down 7% to $1.70 per share.

Core FFO: Q4 up 3.4% to $0.99 per share, full-year up 1.6% to $3.93 per share.

AFFO: Q4 up 5.2% to $1.00 per share, full-year up 3.1% to $3.95 per share.

Dividends: Increased to $2.919 per share for the full year, up 4.1%.

Investments: Over $1.34 billion committed to 319 retail net lease properties in 2023.

Liquidity: Exceeds $1.0 billion, including credit facility availability and forward equity.

Debt to EBITDA: Proforma net debt to recurring EBITDA at 4.3 times.

On February 13, 2024, Agree Realty Corp (NYSE:ADC) released its 8-K filing, detailing the fourth quarter and full year results for 2023. As a fully integrated real estate investment trust, ADC focuses on the acquisition, development, and management of retail properties net leased to leading tenants. The company's portfolio includes prominent names like Walmart, 7-Eleven, and Wawa.

Financial Performance

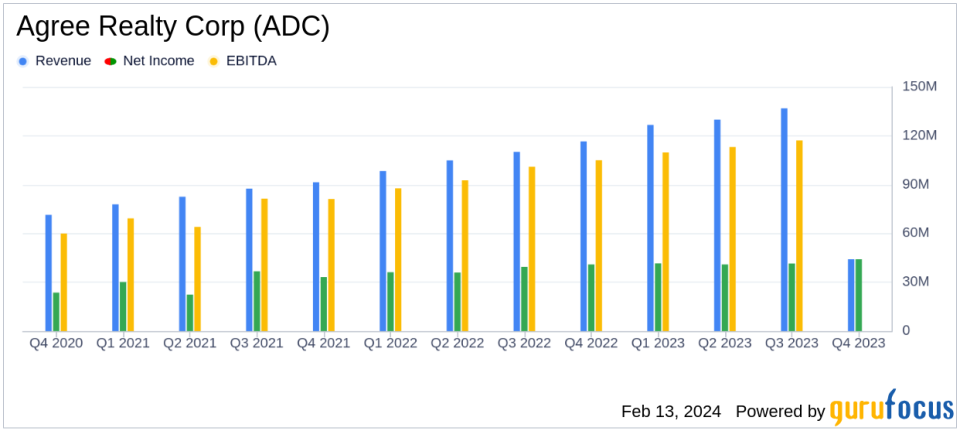

ADC's fourth quarter saw investments of approximately $199 million across 70 retail net lease properties and the completion of four development projects. Despite economic challenges, ADC maintained a steady Net Income per share at $0.44, unchanged year-over-year. Core Funds from Operations (Core FFO) per share and Adjusted Funds from Operations (AFFO) per share experienced growth, indicating ADC's ability to generate consistent and reliable cash flowsa critical metric for REIT investors.

For the full year, ADC invested or committed a substantial $1.34 billion in 319 retail net lease properties, showcasing the company's aggressive growth strategy. However, Net Income per share attributable to common stockholders declined by 7.0% to $1.70, reflecting the competitive and changing landscape of the retail real estate market.

Strategic Investments and Portfolio Expansion

ADC's strategic investments throughout the year have fortified its portfolio, which now consists of 2,135 properties across 49 states. The company's ground lease portfolio also expanded, with seven new acquisitions in the fourth quarter. The portfolio's occupancy rate stood at 99.8%, with a weighted-average remaining lease term of 8.4 years, and 69.1% of annualized base rents generated from investment-grade retail tenants.

ADC's acquisition strategy focused on properties with a weighted-average capitalization rate of 7.2%, while dispositions were executed at a rate of 6.0%. The company's development and Developer Funding Platform (DFP) projects continued to add value, with 37 projects completed or under construction by year-end.

Capital Markets and Liquidity

In the capital markets, ADC demonstrated financial prudence by raising over $370 million through its ATM program and closing on a $350 million unsecured term loan. The company's balance sheet remains robust, with a proforma net debt to recurring EBITDA of 4.3 times and total liquidity exceeding $1.0 billion.

CEO's Outlook

We are pleased with our performance in 2023 as we invested over $1.3 billion for the fourth consecutive year while adhering to our stringent investment criteria and further improving our leading portfolio, said Joey Agree, President and Chief Executive Officer. Looking ahead, our balance sheet is well positioned with more than $1 billion of total liquidity including over $235 million of forward equity raised late last year. We remain intently focused on prudently allocating capital to drive sustainable AFFO per share growth above our previously discussed base case of over 3% growth in 2024.

Conclusion

ADC's earnings report reflects a company that is navigating the complexities of the retail real estate market with a clear strategy and disciplined financial management. The company's ability to maintain stable income and grow its FFO and AFFO metrics, despite a challenging economic environment, positions it as a potentially attractive investment for value investors seeking steady returns in the REIT sector.

For a more detailed analysis of Agree Realty Corp's financial results and strategic initiatives, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Agree Realty Corp for further details.

This article first appeared on GuruFocus.